Stability DAO Launches USDC Vault on Silo Finance

Stability DAO Launches USDC Vault on Silo Finance

🏗️ USDC Beast Unleashed

Stability DAO has launched a new USDC vault built on top of Silo Finance, offering automated yield optimization for users.

The vault provides:

- Up to 13% APY on USDC deposits

- 7% sGEM1 APR additional rewards

- Auto-compounding functionality powered by Silo V2 farm strategy

Additional Benefits:

- Sonic Airdrop eligibility for USDC depositors

- Stability points and GEMS for future $S airdrops

- Partnership integration with Silo Finance's lending protocol

The vault aims to simplify yield optimization while maximizing returns for USDC holders through automated farming strategies.

We've built a USDC beast on top of @SiloFinance

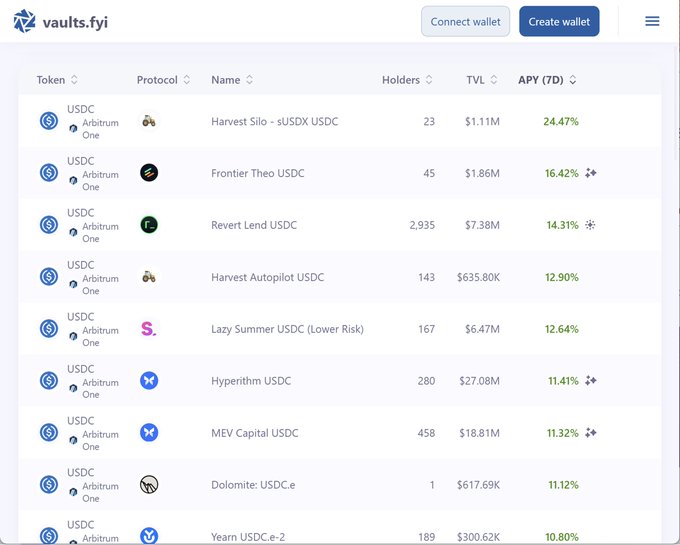

500+ AI Agent Wallets Now Farming Yield Through Harvest Protocol

**AI Agents Embrace DeFi Yield Farming** Harvest Finance has seen over 500 AI agent wallets connect to its vaults in 2026 to automatically source yield. The protocol's autocompounder has become the top destination for onchain AI agents seeking returns. **Key Developments:** - Harvest's integration with 40acres Finance Autocompounder now ranks #1 on the All Vaults list - AI agents are autonomously plugging into yield strategies without human intervention - The protocol is actively seeking builders working at the intersection of AI and DeFi yield **Why It Matters:** This represents a practical use case for AI agents in DeFi - automated yield optimization. Rather than manual farming, AI wallets can now autonomously allocate capital to the highest-yielding strategies through Harvest's infrastructure. The trend suggests AI agents are moving beyond simple transactions to more complex DeFi operations like yield farming and portfolio management.

Harvest Launches First USD1 Autocompounder with Automated WLFI Claims

Harvest has launched the industry's first USD1 autocompounder, powered by Dolomite. The new feature offers: - **One-click automation** for WLFI token claiming - **Optimized performance** through automated compounding - **USD1 Points exposure** alongside yield generation The autocompounder simplifies the process of managing USD1 positions while automatically claiming WLFI rewards, eliminating the need for manual intervention. Users can now maximize their returns through automated compounding strategies while maintaining exposure to the USD1 ecosystem. This integration with Dolomite represents a new approach to yield optimization in the World Liberty Financial ecosystem.

40acres Finance Autocompounder Doubles User Base to 648 Wallets in One Week

**40acres Finance** sees explosive growth as their **Autocompounder reaches 648 wallets** - a **100% increase** in just one week. The USDC-based farming tool on **Base network** has doubled from 300+ users, showing strong adoption momentum. - Platform offers **auto-harvested OP Rewards** - Built on Base blockchain for USDC farming - Growth accelerated from previous week's milestone The rapid user acquisition suggests growing interest in **automated yield farming** solutions as DeFi users seek passive income strategies.

Harvest Finance Completes Receipt Token Distribution for Silo Liquidity Crisis

**Harvest Finance has completed distributing receipt tokens** to users affected by the November 2025 liquidity crisis involving Silo, Stream Finance, and StablesLabs. **Key developments:** - Users now hold **bUSDC-127** and **Varlamore USDC Growth** tokens directly in their wallets - Tokens are visible in portfolio trackers like **DeBank** under the Silo section - Receipt tokens represent users' share of underlying USDC positions on Silo protocol **Two recovery paths available:** 1. **Direct control** - Users can manage positions directly through Silo once liquidity improves 2. **Registry inclusion** - Harvest vault contracts are listed in [Silo Labs' official registry](https://silofinance.medium.com/registry-of-lenders-impacted-by-stream-and-stable-labs-incidents-19c6b1f13a5b) If Stream Finance or Stable Labs provide restitution through the registry, **proceeds will be distributed to users** according to Harvest's [published framework](https://github.com/harvestfi/silo-share-distributions/blob/main/harvest-silo-share-distributions.pdf). **Distribution transactions** were executed in batches for both Harvest vault users and Autopilot users, with all transaction links provided for transparency. Harvest continues monitoring official communications from affected protocols and will share verified updates as they become available.

Harvest Finance Partners with PistachioFi for Permissionless Yield Integration

**Harvest Finance announces partnership with PistachioFi** to expand yield sourcing capabilities through their Autopilot platform. **Key developments:** - New platforms can now plug into Harvest's Autopilots without permission - Integration provides **instant liquidity** with no cross-chain delays - Strategies remain native to Base network for smooth user experience **Technical advantages:** - No bridging or cross-chain complexity - Instant exit feasibility for users - Top yields available on Base network **For developers:** - Plug-and-play integration available - Custom fee structures possible - Support available via Discord or DM The partnership reflects growing demand from platforms and AI agents seeking to integrate yield farming capabilities for their users while maintaining seamless user experience.