srUSD Maintains Top Yield Position with 11% APY

srUSD Maintains Top Yield Position with 11% APY

🏆 Top Stablecoin Yield Alert

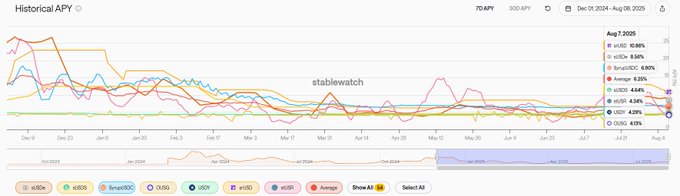

Reservoir's srUSD stablecoin continues to lead yield performance metrics:

- Maintains #1 position for 7-day APY over 8-month period

- Offers approximately 11% APY plus additional Reservoir points

- Features include:

- Multicollateral backing

- Proof of reserves system

- 1:1 USDC mint/redeem capability

- Instant liquidity access

- Over $1M in yield distributions (30-day period)

Currently ranks 9th among all stablecoins for yield payments.

RM to the srUSD holders srUSD is 1st in yield on a 7D APY basis over the last 8 months ~11% apy + reservoir points srUSD holders will love what comes next Just choose Reservoir

IPOR Reservoir Vaults Expand to Four Options with Double-Digit Looping Yields

**IPOR's Reservoir vaults now offer four different options for earning double-digit yields through automated looping strategies.** The platform has expanded its vault offerings to include: - rUSD - wETH - wBTC - USDC Users can access these vaults through IPOR's Fusion interface with a simple one-click loop mechanism. The vaults are designed to provide automated yield optimization without requiring manual management. The Reservoir vaults continue to position themselves as offering competitive looping yields in the DeFi space. [Access the vaults](https://app.ipor.io/fusion?chains=&assets=&atomists=Reservoir&a)

Steakhouse Finance Extends Reward Boost on Morpho Reservoir Vault

Steakhouse Finance has activated a **5-day reward boost** on its Reservoir Ecosystem Vault on Morpho, currently the platform's highest-yielding vault. **Key Features:** - Non-leveraged yields with full liquidity - Enhanced rewards following a recent top-up campaign - Curated by Steakhouse Finance for the Reservoir ecosystem The vault offers users the ability to lend and borrow while earning boosted returns through the temporary incentive program. This marks the second reward enhancement in recent weeks, with the previous campaign already delivering increased yields. [Access the vault on Morpho](https://app.morpho.org/ethereum/vault/0xBEeFF047C03714965a54b671A37C18beF6b96210/steakhouse-reservoir-usdc)

Reservoir Borrow Rates Drop Below 5% on Morpho

Reservoir has announced that borrow rates on Morpho across both Ethereum and Arbitrum networks have fallen below 5%. **Key Features:** - Low-cost borrowing opportunities - Enhanced loop strategies available - Competitive yield generation Users can explore current yield opportunities through Reservoir's dedicated yield page at [app.reservoir.xyz/yield](https://app.reservoir.xyz/yield). This follows recent ARB rewards on Morpho for the wsrUSD/USDC market on Arbitrum, continuing Reservoir's focus on combining affordable borrowing with high-yield options.

Curvance Launches New wsrUSD Market with 8%+ APY on Morpho

Curvance has introduced a new pristine market featuring wsrUSD, offering enhanced yields and incentives for users. **Key Features:** - Over 8% APY available through the Reservoir Ecosystem vault on Morpho - Pristine underlying collateral backing - Additional incentives for participants - Curated by Steakhouse Financial The platform continues expanding its DeFi offerings with quality collateral options and competitive returns for liquidity providers.

wsrUSD Integration Goes Live on Dolomite

**wsrUSD is now available on Dolomite**, enabling users to lend, borrow, and loop the stablecoin efficiently on the platform. **Key features:** - Full lending and borrowing functionality for wsrUSD - Efficient looping capabilities - Part of DoloVoir's continued expansion This integration follows Dolomite's previous support for srUSD looping strategies, which offered over 32% APY when paired with assets like USDC, USDT, and Ethena's USDe. The addition of wsrUSD expands DeFi users' options for yield optimization on the Dolomite protocol.