Spot Bitcoin ETFs Saw Largest Weekly Net Outflows Since January 2024

Spot Bitcoin ETFs Saw Largest Weekly Net Outflows Since January 2024

💸 Massive Bitcoin ETF Exodus...

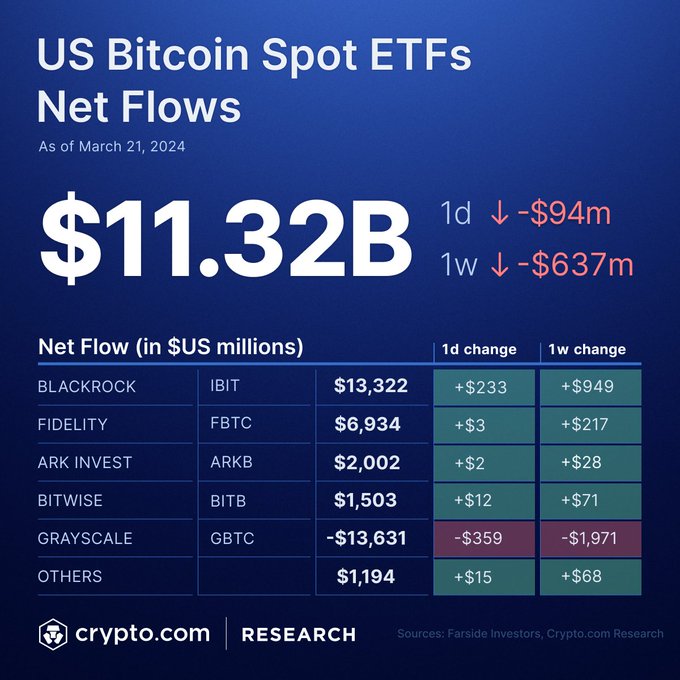

According to the latest data, US spot Bitcoin exchange-traded funds (ETFs) experienced weekly net outflows of -US$888 million last week, marking the largest outflow since January 2024. Despite this significant outflow, these ETFs still maintain a total net inflow of $11.27 billion as of March 22nd. Previous reports indicated a total net inflow of $11.32 billion on March 22nd, with a daily outflow of -$94 million on March 21st.

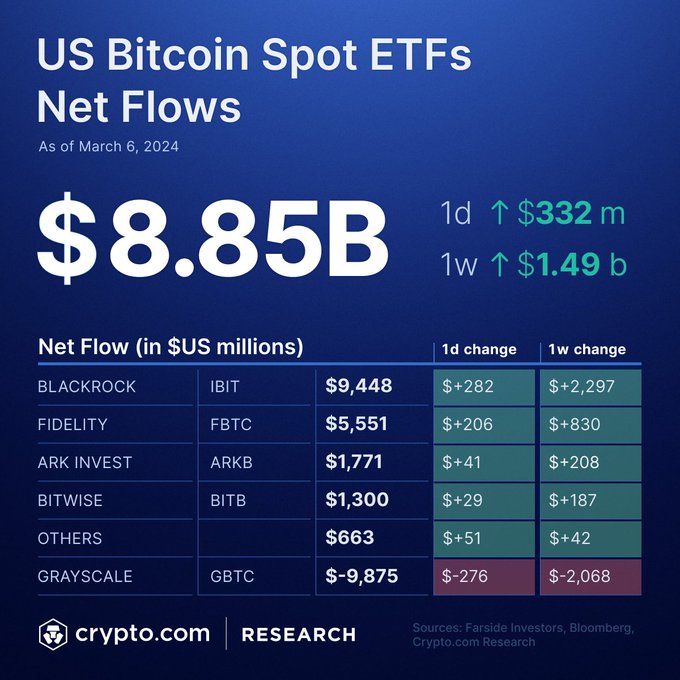

🔎 Latest data shows US Spot #Bitcoin ETFs with a total net inflow of US$8.85B, with US$332M inflow on 6 March.

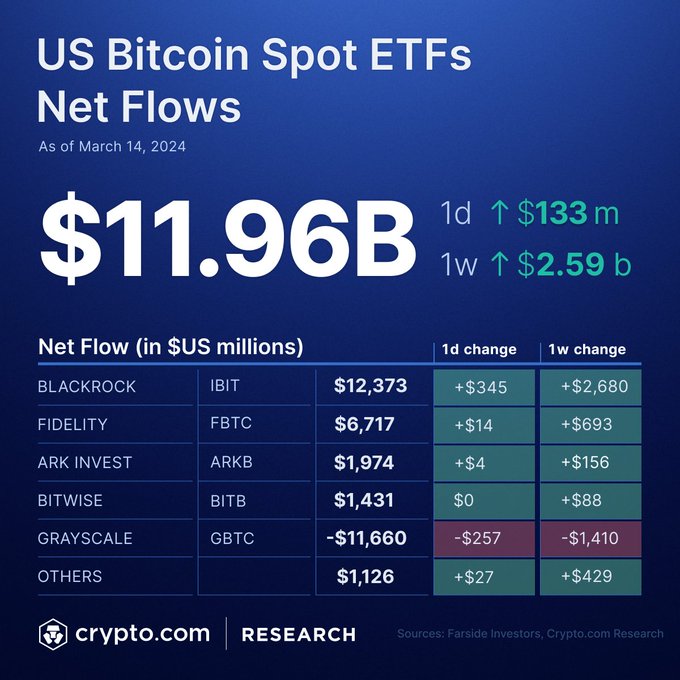

💸 Latest data shows US Spot #Bitcoin ETFs with a total net inflow of US$11.96B, with a daily inflow of US$133M on 14 March.

💸 Spot #Bitcoin ETFs saw weekly net outflows of -US$888M last week, the largest since Jan 2024. Now they have a total net inflow of $11.27B as of 22 March.

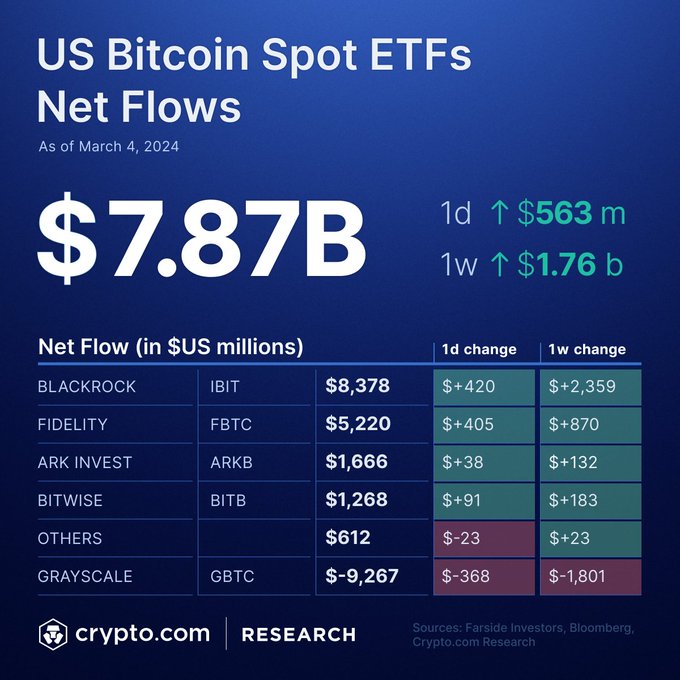

🔎 Latest data shows US Spot #Bitcoin ETFs with a total net inflow of US$7.87B, with US$563M inflow on 4 March

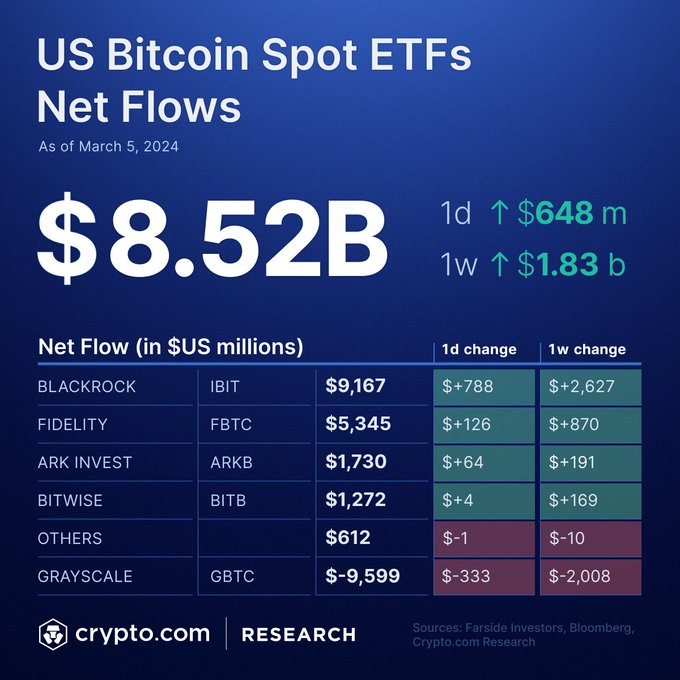

🔎 Latest data shows US Spot #Bitcoin ETFs with a total net inflow of US$8.52B, with US$648M inflow on 5 March. BlackRock (IBIT) recorded its highest daily inflow of US$788M.

💸 Latest data shows US Spot #Bitcoin ETFs with a total net inflow of $11.32B, with a daily outflow of -$94M on 21 March.

💸 Latest data shows US Spot #Bitcoin ETFs with a total net inflow of US$11.8B, with a daily inflow of US$684M on 13 March.

ATOM Flash Rewards Launch Offers 22% Annual Returns

**ATOM Flash Rewards** has launched on Crypto Earn, offering **22% annual percentage yield** for ATOM token holders. This marks the latest addition to the platform's Flash Rewards program, which has recently expanded to include: - AXL tokens at 10% APY - STX tokens at 12% APY - TON tokens at 8% APY The ATOM offering provides the **highest yield** among the recently launched Flash Rewards options. [Join the ATOM Flash Rewards program](https://crypto.onelink.me/ADTi/qorf6ifm)

📈 Fed Signals December Rate Cut

**Fed Officials Signal December Rate Cut Support** Two Federal Reserve officials have indicated support for potential interest rate cuts at the upcoming December 9-10 meetings. **Market Response:** - Markets rallied following the Fed signals - Various sectors showing positive reactions - Rate cut speculation gaining momentum **Key Details:** - Next Fed meeting: December 9-10 - Officials keeping rate cut option open - Market participants monitoring sector performance [Browse equities](https://crypto.com/en/stocks) to see how different sectors are responding to the news.

Crypto Exchange Launches BTC Campaign with $20,000 ETH Prize Pool

A cryptocurrency exchange has launched a **BTC App Campaign** offering users a chance to win from a **$20,000 ETH prize pool**. **Campaign Details:** - Minimum requirement: Buy or deposit at least **$50 worth of BTC** - Top 2,000 participants ranked by BTC deposits and purchases each earn **$10 in ETH** - Campaign runs until **December 10th** This follows a similar **SOL campaign** that concluded December 3rd with the same prize structure. Participants can access full terms and conditions through the provided campaign link.

Crypto.com App Launches Enhanced Chart Insights Feature for Better Trading Decisions

**Crypto.com has upgraded its mobile app with new Chart Insights functionality** designed to improve trading decision-making. The enhanced charting tools offer two key features: - **Historical tracking**: View your past entry and exit points to analyze trading patterns - **Side-by-side comparison**: Compare token prices directly for more informed decisions The rebuilt charts aim to provide traders with sharper insights before executing trades. Users can access the new Chart Insights feature through the updated Crypto.com mobile application. [Try Chart Insights now](https://crypto.onelink.me/ADTi/1bwmyr9c)

Nasdaq Posts Biggest One-Day Gain Since May 2025

The **Nasdaq** recorded its largest single-day increase this week since May 2025, signaling a strong market rebound. **Tech sectors** are driving the recovery as major indices bounce back from recent market volatility. This surge reflects renewed investor confidence in technology-linked companies. The rebound comes after a period of market uncertainty, with tech stocks leading the charge in restoring market stability. - Major indices showing signs of recovery - Technology sectors outperforming other market segments - Market volatility appears to be subsiding Investors can explore equity opportunities through [Crypto.com's stock platform](https://crypto.com/en/stocks).