Beefy Announces Rome Meetup as TVL Hits $260M Milestone

Beefy Announces Rome Meetup as TVL Hits $260M Milestone

🐮 Rome Wasn't Built in a Day

Beefy Finance continues its growth with several key developments:

- Rome Meetup: Community gathering scheduled for March 27th at Urbe Hub

- TVL Milestone: Platform now manages $260M across 1200 yield strategies

- Berachain Success: Network reaches $20M TVL

- New Content: Latest BeefyPOD episode features Monad Crypto, exploring faster DeFi and EVM technology

Platform shows consistent growth from previous week's metrics, expanding both its strategy count and total value locked.

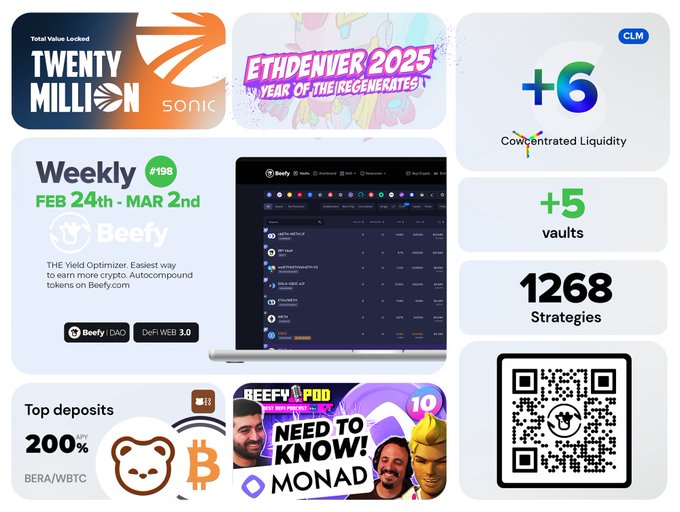

Beefy Weekly Highlights #198 • ETHDenver Wrapped & Octav Events 🔄 • Sonic TVL over 20 million 📈 • 11 new yield strategies! 🛠️

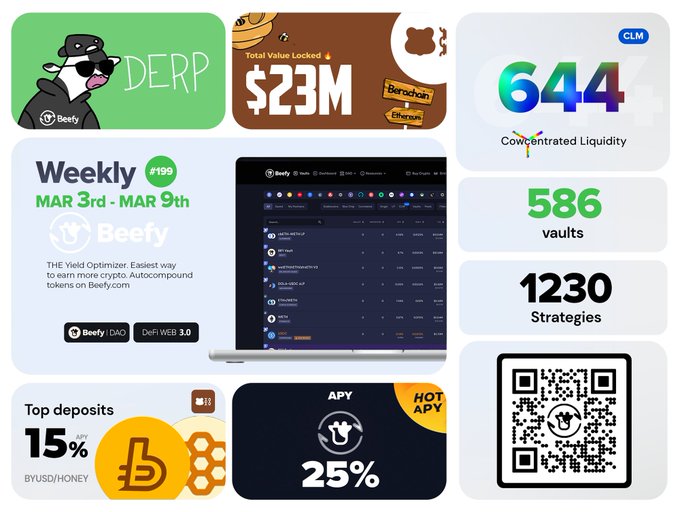

Beefy Weekly Highlights #199 • Beefy Meat-up on March 27th at Urbe Hub in Rome 🥳 • Berachain TVL over 20 million 📈 • New #BeefyPOD: Monad Crypto: Faster DeFi & EVM Explained 🎙️ • Derp • Over $260M Assets managed by 1200 strategies 📊

🚀 Buenos Aires Breakthrough

**Ethereum's biggest gathering ever** hit Buenos Aires with 14,500 attendees at Devconnect's first Ethereum Worlds Fair. **Major announcements dropped:** - Vitalik unveiled **Kohaku privacy wallets** - Pushed for **100x L1 gas limit increase** - **Bhutan launched national digital ID** on Ethereum - New **Ethereum Interoperability Layer (EIL)** unified all L2s **Real-world demos showcased:** - Tokenized S&P 500 shares - Biometric payments - Stablecoin remittances for everyday use From Aave Horizon to Centrifuge RWAs and Chainlink ACE, the week proved **Ethereum is evolving beyond crypto** into the global settlement layer for money, identity, and governance. Beefy shared how their yield architecture is adapting for the next wave of interoperability. *The question remains: Will ETH price catch up before quantum computing threatens elliptic curve cryptography?*

BIFI Token Offers 15% APY Through Platform Fee Sharing

**BIFI token holders can earn approximately 15% APY** by staking their tokens to receive a share of Beefy Finance platform fees. **Key Benefits:** - Revenue sharing from platform fees averaging 15% annual returns - Fixed supply of only 80,000 tokens total - Governance rights in DAO decisions and $6M treasury management - Indirect exposure to hundreds of DeFi strategies and protocols **Token Economics:** As Beefy's total value locked (TVL) and yields increase, BIFI holder rewards grow proportionally due to the limited token supply. **Governance Participation:** Stakers can participate in decentralized autonomous organization decisions and help govern the platform's $6M treasury. The revenue-sharing model provides holders with performance-based rewards tied to the platform's success across multiple DeFi protocols and yield strategies.

Klima Protocol Launches kVCM Token for Carbon Credit Yield Generation

**Klima Protocol introduces kVCM**, a new token that allows users to earn yield on carbon credits through their updated system. **How kVCM works:** - Functions as an **index token** representing the protocol's entire carbon portfolio - Automatically mints or burns tokens when carbon credits enter or exit the system - Each token represents a **weighted slice** of all carbon credit classes held **Key mechanics:** - Token supply adjusts based on portfolio holdings and voter-assigned importance weights - Market cap directly tied to the **Net Asset Value** of underlying carbon credits - Maintains system balance while providing exposure to carbon markets **Investment opportunity:** - Offers yield generation on carbon credits through a tokenized approach - Provides diversified exposure across different carbon credit classes - Appeals to users seeking alternative yield strategies in environmental assets This represents Klima's evolution into **Klima 2.0**, positioning kVCM as both a portfolio management tool and yield-generating asset for the carbon credit market.

🏦 $140T Fixed-Income Market

**Pendle is targeting the massive $140 trillion fixed-income market** by bringing traditional yield infrastructure on-chain. - Market projected to reach $200 trillion by 2030 - Aims to democratize fixed income beyond institutional access - Beefy now offers 24 Pendle single-asset vaults - **Up to 23% APY with autocompounding** The integration represents a shift from crypto-only yield to broader financial market access. Pendle has already settled $69.8 billion in yield transactions. [Read full article](https://markets.businessinsider.com/news/currencies/pendle-settles-69-8-billion-in-yield-bridging-the-140t-fixed-income-market-to-crypto-1035405834) *Explore yield opportunities through simplified vault access.*

Beefy Maxis Strategy Purchases 3,163 BIFI Tokens Worth $1.07M

**Beefy's automated treasury strategy** made significant moves in 2024, acquiring 3,163 BIFI tokens valued at $1.07 million. The yield optimizer platform expanded its offerings with: - **11 new yield strategies** for users - **5 additional boosts** to enhance returns - New **Linea CLM strategies** for concentrated liquidity management This treasury purchase demonstrates Beefy's commitment to its native token while the platform continues growing its DeFi yield optimization services.