Sonic TVL Surpasses $1 Million as Beefy Adds 20 New Strategies

Sonic TVL Surpasses $1 Million as Beefy Adds 20 New Strategies

🚀 $1M and Still Climbing

Beefy kicks off 2025 with significant developments:

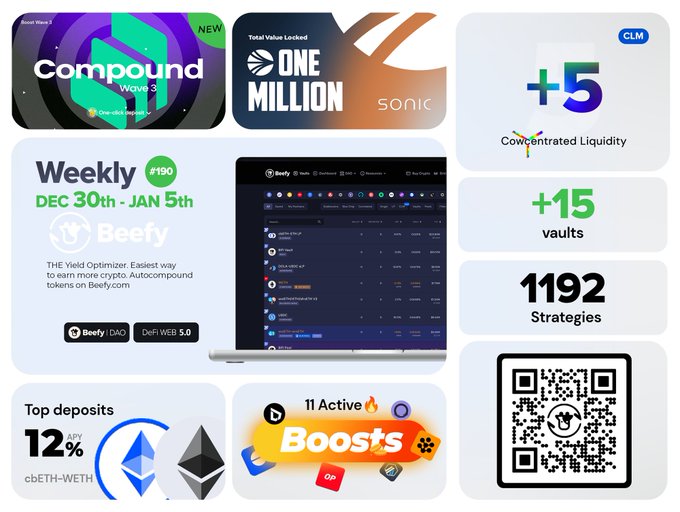

- Sonic protocol integration reaches $1M+ Total Value Locked

- Launch of Compound Wave 3 rewards program

- Addition of 20 new yield strategies

This expansion follows December's integration with SonicLabs and brings Beefy's total active yield strategies to over 1,200. The platform maintains 33 active boost incentives across various networks.

Want to maximize your DeFi yields? Explore the new strategies on Beefy.

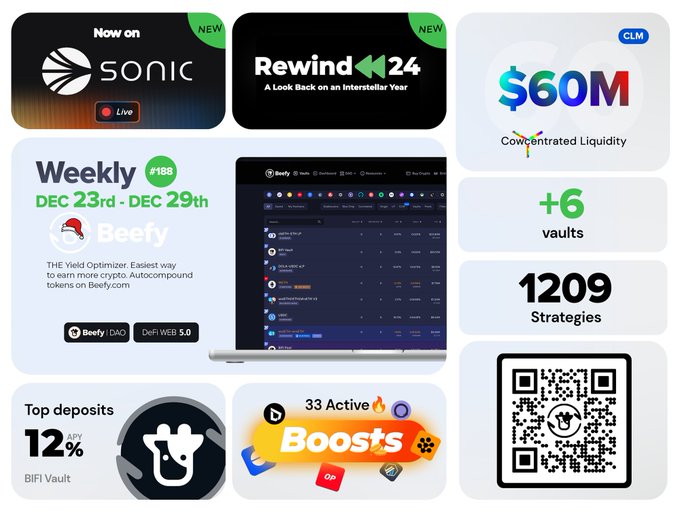

Beefy Weekly Highlights #189 • Merry Christmas 🎅 • Now on @SonicLabs ⛓️ • 6 New Yield Strategies! 🛠️ • 33 Active Boosts 🔥 • 1209 Active Yield Strategies ♻️

Beefy Weekly Highlights #190 • Happy New Year 🎉 • Sonic TVL over 1 million 📈 • Compound Wave 3 Rewards🔥 • 20 new yield strategies! 🛠️

X Integrates Grok AI to Rank Following Timelines

**X (formerly Twitter) has launched a major update** that uses Grok AI to rank content in users' Following timelines. The update represents a significant shift in how social media feeds are curated, moving from chronological or basic algorithmic sorting to **AI-powered content ranking**. - Grok will analyze and prioritize posts in Following feeds - The change affects how users see content from accounts they follow - Implementation appears to be rolling out across the platform This development marks another step in X's integration of AI technology into its core features, potentially changing how users discover and engage with content from their network.

Beefy Partners with StakeDAO for Double-Digit Yield Opportunities

**Beefy Finance** has partnered with **StakeDAO** to offer competitive yield farming opportunities across multiple token pairs. **Current APY rates include:** - $msETH - $WETH: **13% APY** - $sUSD - $sUSDe: **11% APY** - $MIM / $DAI / $USDC / $USDT: **11% APY** These rates represent solid returns for DeFi users looking to maximize their crypto holdings through automated yield optimization strategies. The partnership combines Beefy's yield optimization platform with StakeDAO's liquid staking solutions.

🚀 Monad Yields Hit 370%

**Monad network** is offering **370% APY** on bluechip token pairs through concentrated liquidity management (CLM). The yield opportunity focuses on: - USDC-WETH trading pairs - Automated liquidity optimization - High returns on established tokens Access the vault: [Beefy Finance CLM](https://app.beefy.com/vault/uniswap-cow-monad-usdc-weth-rp) *Consider risks before investing in high-yield DeFi protocols.*

📉 Market Bleeds Red, But DeFi Keeps Delivering

**Market took a beating** with BTC dropping under $81K, but **DeFi stayed strong**. **Beefy's weekly performance:** - $394K in yield distributed - 9.2% average APY maintained - Consistent returns despite market volatility **Key developments:** - Team presented at Multichain Day during Devconnect - Panel discussion: "The DeFi Stack: Data, Chains, and Yield" - **WalletConnect Certified** status achieved - Beefy users now eligible for AethonSwap airdrop on Monad **The takeaway:** While crypto markets bled red, yield farming infrastructure proved its resilience. Beefy's steady 9.2% APY shows that **consistent DeFi strategies can weather market storms**. Real yield doesn't stop for bear markets.

🚀 Buenos Aires Breakthrough

**Ethereum's biggest gathering ever** hit Buenos Aires with 14,500 attendees at Devconnect's first Ethereum Worlds Fair. **Major announcements dropped:** - Vitalik unveiled **Kohaku privacy wallets** - Pushed for **100x L1 gas limit increase** - **Bhutan launched national digital ID** on Ethereum - New **Ethereum Interoperability Layer (EIL)** unified all L2s **Real-world demos showcased:** - Tokenized S&P 500 shares - Biometric payments - Stablecoin remittances for everyday use From Aave Horizon to Centrifuge RWAs and Chainlink ACE, the week proved **Ethereum is evolving beyond crypto** into the global settlement layer for money, identity, and governance. Beefy shared how their yield architecture is adapting for the next wave of interoperability. *The question remains: Will ETH price catch up before quantum computing threatens elliptic curve cryptography?*