Chainlink Weekly Integration Report - June 2025

Chainlink Weekly Integration Report - June 2025

🔗 8 New Chains Join Forces

Chainlink reports 8 new integrations across 6 blockchain networks this week:

- Networks: Arbitrum, Base, BNB Chain, Ethereum, Optimism, and Sonic

- Notable integrations: Coinbase, Mux Protocol, Silo Finance, and Solv Protocol

- GetYieldFi and xSwap also joined the ecosystem

This follows significant growth in May, where Chainlink's Total Value Secured (TVS) increased by 50% to $65B+, driven by major protocol adoptions including TRON and Jupiter Exchange.

Key protocols continue leveraging Chainlink for cross-chain transfers and price feeds, strengthening the network's position in DeFi infrastructure.

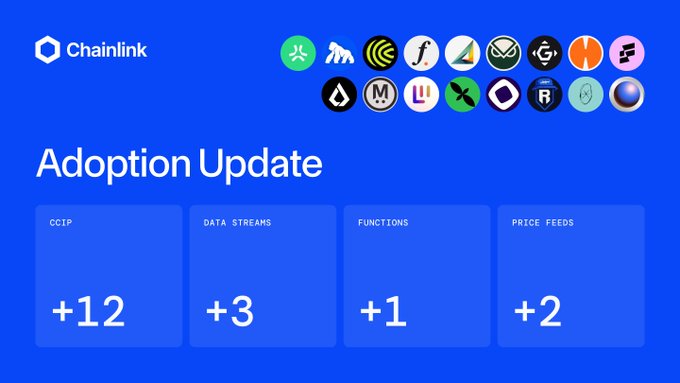

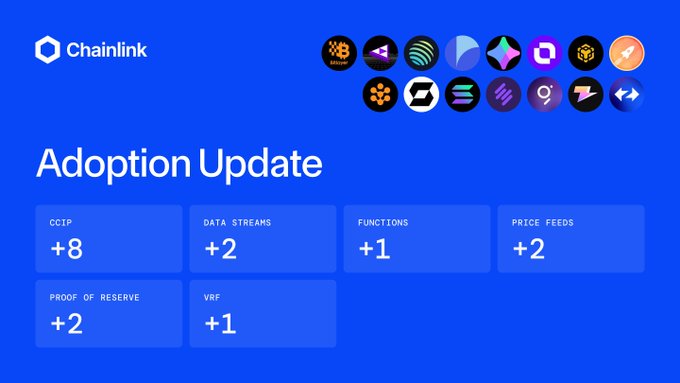

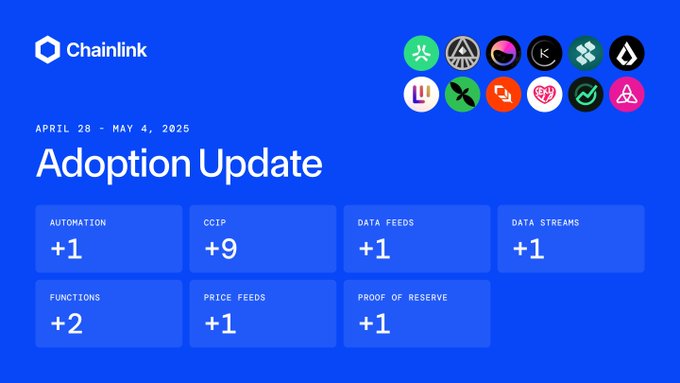

⬡ Chainlink Adoption Update ⬡ There were 18 integrations of the Chainlink standard across 4 services and 20 different chains: Abstract, ApeChain, Avalanche, Base, BNB Chain, Celo, Ethereum, Gnosis Chain, Hemi, Lisk, MegaETH, Metal L2, Mint, Monad, Optimism, Polygon, Ronin,

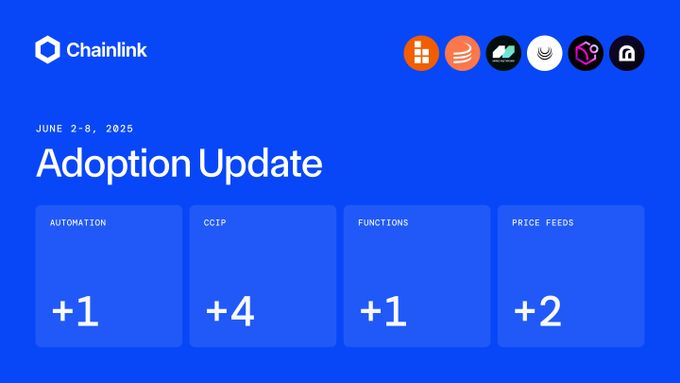

⬡ Chainlink Adoption Update ⬡ This week, there were 12 integrations of the Chainlink standard across 6 services and 8 different chains: Gravity Alpha, Monad, Polygon, Ronin, Rootstock, Superseed, Taiko, and Zora. New integrations include @GravityChain, @monad_xyz,

As leading financial institutions adopt digital assets, the need for a cash leg to settle onchain transactions has become increasingly important. Discover how Chainlink is enabling the secure exchange of a Hong Kong CBDC and an Australian dollar stablecoin ↓

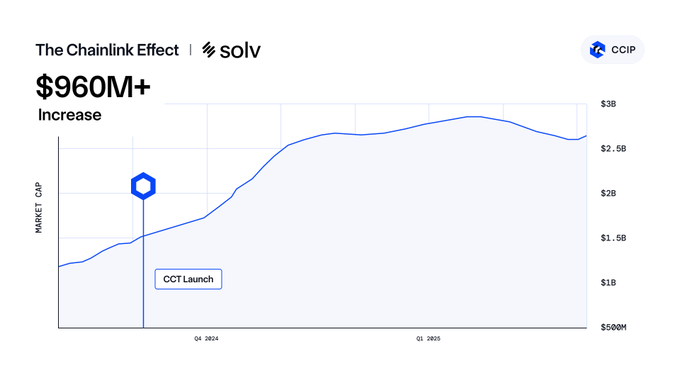

After @SolvProtocol adopted the Cross-Chain Token (CCT) standard, the Bitcoin staking protocol surged to $2.5B+ TVL—with $1.16B+ in cross-chain transfers via CCIP. Cross-chain by Chainlink → a catalyst for growth uniquely enabled by CCIP and a thriving community.

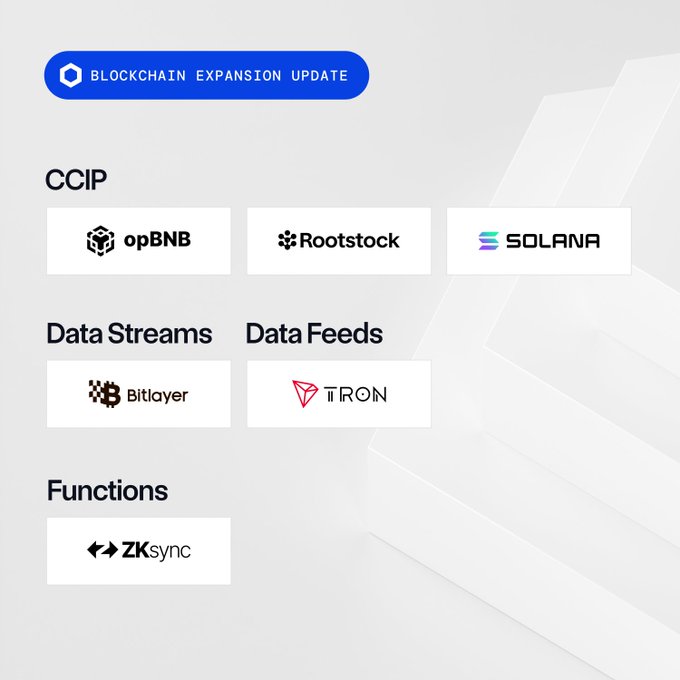

BLOCKCHAIN EXPANSION UPDATE Recently, Chainlink services expanded across the following blockchains: CCIP • opBNB • Rootstock • Solana Data Streams • Bitlayer Data Feeds • TRON Functions • ZKsync

Onchain asset manager @maplefinance ($1.9B AUM) has upgraded to Chainlink CCIP by adopting the Cross-Chain Token (CCT) standard to make $500M+ of syrupUSDC natively transferable across @Ethereum and @Solana. Users can also natively mint the yield-bearing stablecoin on Solana,

syrupUSDC is live on Solana. With DeFi use cases on day one and up to $500K in incentives. Launched in collaboration with @chainlink, @KaminoFinance, @Paxos, @jito_sol and @orca_so. Maple’s liquid yielding dollar is bringing consistent high yield to the ecosystem. Details

“The capital that can flow into Solana over CCIP will initially be the DeFi community’s capital … and then there will also be a very large category of institutional users.” Sergey Nazarov explores the impact of bringing Chainlink CCIP to @solana ↓

The Graph (@graphprotocol), a blockchain data platform that has served over 1.2 trillion requests, is adopting Chainlink CCIP and making its native token GRT a Cross-Chain Token (CCT). Users will be able to transfer the $1B+ market cap token across @arbitrum, @base, and @solana.

Coinbase is utilizing Chainlink Proof of Reserve to increase the transparency of $4.6B+ worth of cbBTC reserves. Proof of Reserve helps @coinbase ensure cbBTC reserves are verifiable onchain, with data published on @base & @ethereum. BTCFi scales with Chainlink.

Proof of Reserves empowers users to confidently integrate cbBTC across the DeFi ecosystem. Utilizing @chainlink Proof of Reserves on @base and @ethereum provides independent, transparent onchain verifications that cbBTC reserves are backed 1:1 by BTC.

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 4 services and 4 different chains: Base, BOB, Ethereum, and Solana. New integrations include @build_on_bob, @maplefinance, @mindnetwork_xyz, @NuraLabs, @SpaceandTimeDB, and

USD1—an institutional-grade stablecoin from @worldlibertyfi—is officially going cross-chain with Chainlink CCIP. prnewswire.com/news-releases/… Already the fastest-growing stablecoin from zero to $2B, USD1 is now expanding into new blockchain markets to increase its utility for

USD1 just got a major upgrade. Chainlink CCIP is live – enabling secure, cross-chain transfers and bringing true interoperability to DeFi. 🦅 prnewswire.com/news-releases/…

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 5 services and 6 different chains: Arbitrum, Base, BNB Chain, Ethereum, Optimism, and Sonic. New integrations include @BasedChadHQ, @coinbase, @muxprotocol, @SiloFinance,

BLOCKCHAIN EXPANSION UPDATE This week, Chainlink services expanded across the following blockchains: CCIP • Rootstock (testnet) • Superseed • Taiko • Zora Data Streams • Gravity Alpha • Polygon Data Feeds • Monad (testnet) VRF • Ronin

The below report, supported by @Accenture & @RWA_xyz, examines the state of blockchain adoption in financial services. Learn why prioritizing cross-chain is a competitive advantage and how CCIP uniquely solves interoperability hurdles for institutions. pages.chain.link/hubfs/e/liquid…

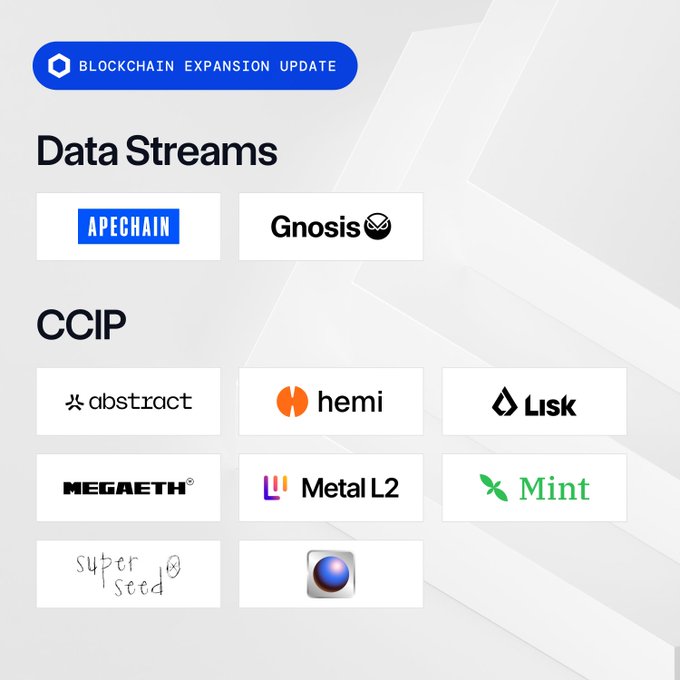

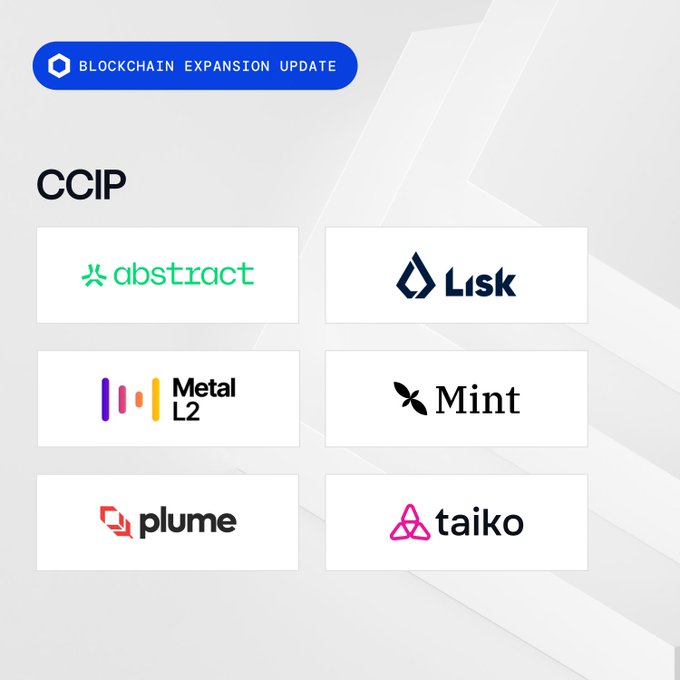

BLOCKCHAIN EXPANSION UPDATE Recently, Chainlink services expanded across the following blockchains: Data Streams • ApeChain • Gnosis Chain CCIP • Abstract (testnet) • Hemi • Lisk (testnet) • MegaETH (testnet) • Metal L2 (testnet) • Mint (testnet) • Superseed (testnet)

NEW REPORT: Explore insights from @GLEIF on how standards for organizational identity and automated compliance can “increase the trust and integrity of financial markets globally.” chain.link/resources/digi… Since 2008, the introduction of global identity standards has

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 5 services and 6 different chains: Arbitrum, Base, Berachain, BNB Chain, Ethereum, and TRON. New integrations include @BasisOS, @Dolomite_io, @0xfluid, @multisynq, @ThenaFi_,

Chainlink TradFi Use Cases Purchasing tokenized real estate in fiat using existing offchain payment networks. Made possible by Chainlink.

Chainlink CCIP is the universal adapter for blockchains. One plug. Every chain. Unified liquidity.

Kings College London (@KingsCollegeLon) published a new working paper by Dr. Rhys Bidder, Deputy Director at the Qatar Centre for Global Banking and Finance, exploring the path forward for stablecoins to fulfill their global potential. Chainlink is highlighted for its

⬡ Chainlink Adoption Update ⬡ There were 16 integrations of the Chainlink standard across 6 services and 16 different chains: Arbitrum, Avalanche, Base, Bitlayer, BNB Chain, Celo, Ethereum, opBNB, Optimism, Polygon, Ronin, Rootstock, Scroll, Solana, Sonic, and ZKsync. New

BTCFi platform with over $2B TVL @SolvProtocol has adopted Chainlink CCIP across @BNBChain, @ethereum, and @solana. In addition, Solv Protocol has adopted the Cross-Chain Token (CCT) standard for SolvBTC.Jup. BTCFi scales with Chainlink.

Investment funds today share the same identity data with multiple counterparties across fragmented, siloed systems. Blockchain turns that into a single, verifiable source of truth accessible to all, significantly increasing efficiency. Learn how ↓ chain.link/resources/digi…

BLOCKCHAIN EXPANSION UPDATE This week, Chainlink services expanded across the following blockchains: CCIP • Abstract • Lisk • Metal L2 • Mint • Plume • Taiko Hekla (testnet)

“The industry needs a common identity language—one that bridges traditional finance and digital assets.” @marketsmedia explores why onchain verifiable identity is critical to digital assets, and how @GLEIF and Chainlink are helping make it possible ↓

Silo, a leading lending protocol on Sonic with $506M+ TVL, is going cross-chain. @SiloFinance has adopted Chainlink CCIP and the Cross-Chain Token (CCT) standard to enable secure transfers of its SILO token across @arbitrum, @ethereum, and @SonicLabs.

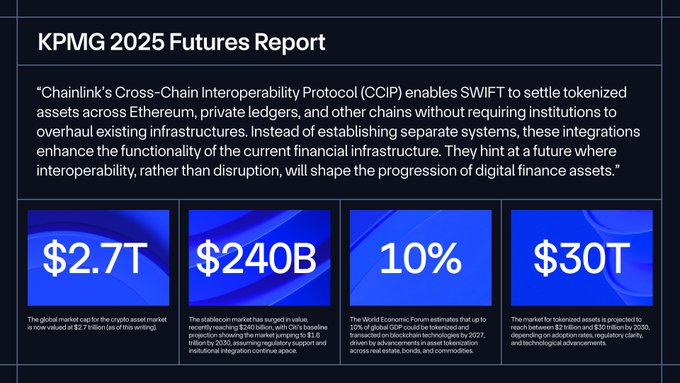

.@KPMG, a global professional services network and "Big Four" accounting firm, published its 2025 Futures Report, highlighting Chainlink's role in connecting traditional finance with decentralized protocols:

"Our industry is going through the next stage of institutional adoption." At @solana Accelerate, @SergeyNazarov joined @FintechTvGlobal to discuss the impact of asset management moving onchain, CCIP on Solana, & greater U.S. regulatory clarity. 📺 ↓ fintech.tv/unlocking-inst…

$2B+ TVL BTCFi protocol @SolvProtocol has deepened its integration with Chainlink Proof of Reserve (PoR). PoR now provides real-time transparency into the backing of SolvBTC, xSolvBTC, and Solv's entire protocol TVL. solvprotocol.medium.com/solv-integrate…

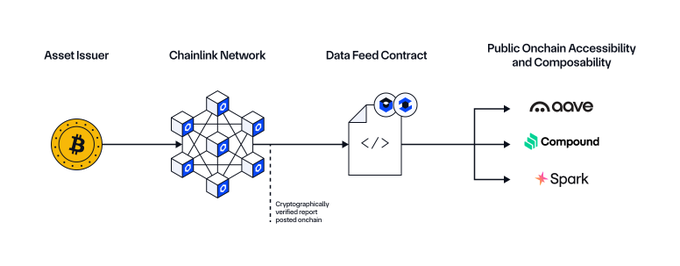

Chainlink enables asset issuers to do more. Data Feeds supply critical pricing information so tokenized Bitcoin can be used across top DeFi lending protocols. BTCFi scales with Chainlink.

“Chainlink is absolutely critical to merging traditional finance with decentralized finance.” At @consensus2025, @worldlibertyfi Co-Founder Zak Folkman announces they’re making USD1 accessible cross-chain using CCIP and discusses how Chainlink powers the onchain economy.

Sergey Nazarov and @paulbarron recently discussed: • The impact of Chainlink CCIP going live on Solana • Why cross-chain infra is driving institutional adoption • How regulation is unlocking liquidity for tokenized assets Watch on the Paul Barron Network ↓

Rocket Pool (@Rocket_Pool), a leading liquid staking protocol with 660K+ ETH staked and $1.6B+ in TVL, now supports rETH cross-chain token transfers between @Ronin_Network and @ethereum via an integration with Chainlink CCIP. Powered by the Cross-Chain Token (CCT) standard, this

BTCFi scales with Chainlink. Zeus Network (@ZeusNetworkHQ), a permissionless multichain layer that connects Bitcoin and other leading blockchains to the Solana ecosystem, has adopted Chainlink CCIP and Proof of Reserve. CCIP enables highly secure transfers of zBTC across @base,

Solana-Native Bitcoin $zBTC is Now Interoperable Through @Chainlink Zeus Network adopts Chainlink Proof of Reserve and CCIP to enhance transparency and cross-chain compatibility for Bitcoin on Solana and other chains. What’s the impact (1/6)👇

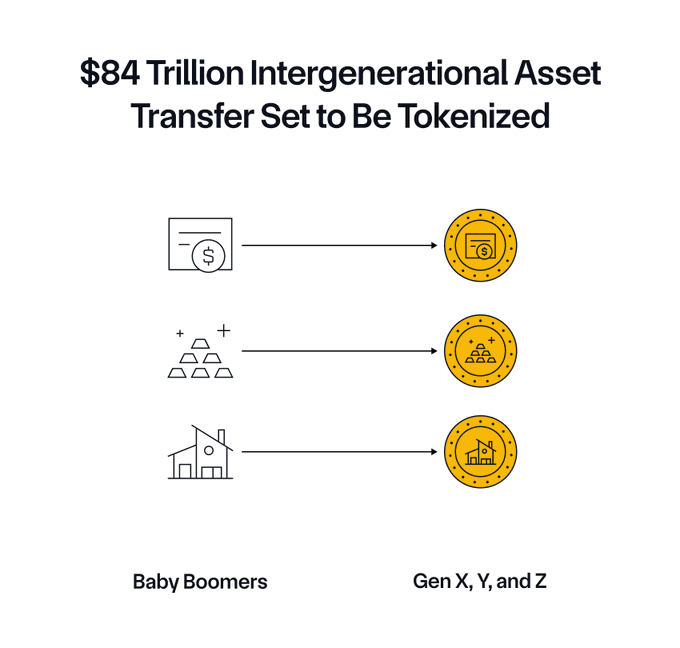

An $84 trillion wealth transfer is underway. Discover how Chainlink’s essential infrastructure for tokenized assets helps DeFi and TradFi capitalize on this generational opportunity: marketsmedia.com/fund-tokenizat…

Chainlink Total Value Secured (TVS) is experiencing significant growth, according to data from @DefiLlama. In May alone, Chainlink TVS (incl. borrows) surged by over 50% to over $65B+, driven by several major integrations, including:

“CCIP is going to be the key pathway for institutions to reliably interact with Solana.” Watch @SergeyNazarov’s presentation from @SolanaConf today to discover how Chainlink is powering internet capital markets ↓

⬡ Chainlink Adoption Update ⬡ This week, there were 16 integrations of the Chainlink standard across 7 services and 15 different chains: Abstract, Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Lisk, Metal L2, Mint, Optimism, Plume, Polygon, Solana, Soneium, and Taiko Hekla.

YieldFi has upgraded to Chainlink CCIP & is using the CCT standard for yUSD—its $200M+ market cap stablecoin—across @arbitrum, @base, @ethereum, & @Optimism. In addition, @GetYieldFi has adopted Chainlink Price Feeds to support secure markets around yUSD.

YieldFi has upgraded from LayerZero to @Chainlink CCIP with yUSD now exclusively bridged via CCIP. Enabling secure, seamless cross-chain transfers! A short thread🧵👇

Tomorrow, @SergeyNazarov joins @BlackRock's Joseph Chalom in a fireside chat at Digital Assets Week New York to discuss: • The acceleration of tokenized asset adoption • How traditional finance and DeFi are converging • The future of the digital asset industry And much more.

Chainlink CCIP Cross-Chain Tutorial Released

Chainlink has released a new developer tutorial demonstrating token transfers between Solana and EVM-compatible chains using Cross-Chain Interoperability Protocol (CCIP). The tutorial builds on CCIP v1.5's features, showing developers how to: - Create Cross-Chain Tokens (CCTs) - Implement token transfers between Solana and Ethereum - Set up cross-chain infrastructure This educational content aims to simplify cross-chain development and foster blockchain interoperability. [Watch the tutorial](https://chainlinklabs.com/tutorials)

Real-World Assets: The Next Growth Engine

Industry experts are increasingly pointing to Real-World Assets (RWAs) as the primary driver of future blockchain industry growth. This trend represents a significant shift from purely digital assets to tokenized physical assets. The success of RWA initiatives heavily relies on accurate and reliable data infrastructure. This connection between real-world data and blockchain systems is becoming crucial for market expansion. Key points: - RWAs emerging as main growth catalyst - Data quality critical for RWA adoption - Integration of physical assets with blockchain technology gaining momentum *The convergence of traditional assets with blockchain technology marks a pivotal moment for the industry's maturation.*

States Follow Federal Lead on Bitcoin Reserves

Following the Presidential Executive Order establishing a strategic Bitcoin reserve, individual states are now pursuing legislation to hold digital assets in their treasuries. - Multiple states drafting bills for digital asset holdings - Represents significant shift in public sector approach to crypto - Part of broader government innovation in digital finance This development marks a notable evolution in how U.S. government entities approach cryptocurrency management. The state-level initiatives complement the federal strategic reserve, potentially creating a multi-layered public sector presence in digital assets. [Learn more about state digital asset reserves](https://blog.chain.link/why-states-are-exploring-digital-asset-reserves/)

Programmable Token Transfers: The Future of Financial Assets

Chainlink CCIP is introducing programmable token transfers, a breakthrough that allows value and data to move simultaneously across markets and institutions. Key features: - Single-transaction execution of complex financial operations - Reduced processing time from days to near-instant - Minimized manual intervention and counterparty risks - Seamless integration of token transfers with arbitrary messaging This technology enables financial institutions to streamline multi-step transactions while maintaining security and efficiency. Learn more: [Chainlink Blog](https://blog.chain.link/stages-enriching-real-world-assets/#the_universal_standard_powering_programmable_token_transfers)

Chainlink Labs Joins Global Sync Foundation to Advance Blockchain Interoperability

Chainlink Labs has joined the Global Sync Foundation (GSF), which governs the Global Synchronizer interoperability layer of the Canton Network. Key points: - Collaboration with major industry players including Broadridge, Cumberland, and Euroclear - Focus on developing standards for enterprise-grade blockchain applications - Aims to enhance interoperability across blockchain networks The move strengthens Chainlink's position in connecting traditional systems with blockchain technology, supporting their mission of providing essential infrastructure for the financial system's transition to blockchain. [Learn more about the partnership](https://sync.global/blog/2025/chainlink-joins-the-gsf/)