Size Protocol Enhances Lending Flexibility with Multi-Market Offers

Size Protocol Enhances Lending Flexibility with Multi-Market Offers

🐋 Lending Just Got Bigger

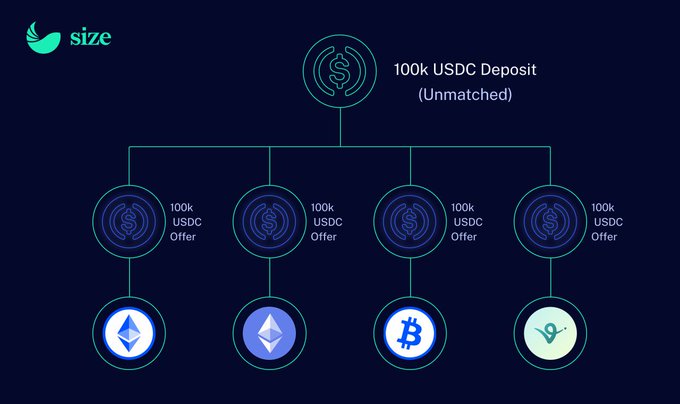

Size Protocol has introduced a significant update to its lending capabilities on Base:

- Lenders can now create multiple unique lending offers across different markets simultaneously

- Each offer can utilize up to 100% of unmatched deposit value

- Supported assets include ETH, cbETH, cbBTC, AIXBT, and VIRTUAL

The feature leverages unified protocol liquidity, making deposits more versatile and efficient. Lenders maintain variable rate earnings via Aave while waiting for their custom offers to fill.

Key Benefit: Enhanced capital efficiency through concurrent market participation.

Unified liquidity = adaptive capital We know that AMM lending models are restrictive Lender capital is confined to individual pools and lacks the capacity to be reactive Size's unified liquidity approach now makes deposits infinitely more functional Users can set concurrent

🎙️ Stream Fallout Sparks

**New Crypto Yield Curve podcast episode** explores the **Stream Finance fallout** and its impact on DeFi trust. Key topics covered: - Why Stream drama dominated crypto timelines - **Code hardening vs. innovation** debate - Potential revival of **onchain insurance** - How to rebuild trust in DeFi protocols The Size core team unpacks lessons from the controversy and discusses **trust bonds** as a potential solution. Episode runs approximately 15 minutes. [Listen now](podcast-link) to hear expert analysis on DeFi's trust crisis.

Size Credit Launches Earn Vaults with 54% APY USDC Yields

**Size Credit's Earn platform** is offering competitive USDC yields through their new vault system. **Key Features:** - Base USDC yield with additional reward boosts - Currently **54% APY** with weekly payouts - Flexible exit terms - withdraw anytime - Pure USDC rewards without leverage or loops **How It Works:** The platform uses "Very Liquid Vaults" that convert term premiums into higher-than-variable returns. Users can deposit USDC and earn boosted rewards while maintaining liquidity. **Access:** Available at [app.size.credit/earn](http://app.size.credit/earn) This represents Size's approach to generating premium yield through fixed-rate lending mechanics.

🎯 Size Protocol Launches P2P Risk Isolation

**Size Protocol** introduces a **Term Structure Order Book** that revolutionizes DeFi lending risk management. Key features: - **P2P settlement and liquidation** - isolates risk between individual borrower-lender pairs - **Minimized socialized losses** - prevents cascade failures affecting the entire protocol - **Unified liquidity** across all maturities for optimal rate discovery The protocol aggregates lending offers protocol-wide, allowing borrowers to secure **fixed rates for any duration** while lenders earn variable rates through Aave integration. This architecture represents a significant departure from traditional pooled lending models, offering more precise risk management. [Learn more in the documentation](https://docs.size.credit/)

🚀 Size Earn Delivers 50%+ USDC Yields

**Size Earn** has maintained **USDC yields above 50% APY** for over a week, offering one of the market's highest returns. **Key Features:** - Premium USDC yield opportunities - **No lock-up periods** - withdraw anytime - Boosted reward system available The platform provides flexible earning options with **variable rates** while users wait for custom yield curve offers to fill. *Ready to explore high-yield opportunities? Check Size Earn's boosted rewards program.*

Size Protocol Launches Term Structure Order Book for Fixed USDC Rates

Size Protocol has introduced its **Term Structure Order Book**, enabling users to access fixed USDC lending rates across any maturity date. Key features: - **Unified liquidity** scaling across all maturities - **Flexible borrowing** - lock in rates for any chosen timeframe - **Competitive rates** - among the lowest fixed USDC rates available The platform allows borrowers to secure **predictable costs** by choosing their preferred maturity dates, while lenders can earn variable rates through Aave integration while waiting for their custom yield curve offers to fill. This launch builds on Size's previous offering of fixed-rate USDC borrowing against cbBTC collateral, expanding the protocol's fixed-rate lending capabilities.