Size Credit Offers Fixed-Rate USDC Borrowing Below sUSDe PT Yields

Size Credit Offers Fixed-Rate USDC Borrowing Below sUSDe PT Yields

🤑 Free Money Glitch Found

Size Credit is offering fixed-rate USDC loans at 4.58% against various crypto assets on Base, significantly below Ethena's sUSDe Principal Token implied yield of 7.92%.

Key points:

- Current fixed rate: 4.58% for USDC borrowing

- Available collateral: ETH, cbETH, cbBTC, wstETH

- Platform: Base network

- Opportunity: ~3.34% spread vs sUSDe PT yields

This rate compares favorably to Aave's variable rates, which have been trending upward in recent weeks. Users can lock in these rates for durations between 1-128 days.

Lock in a borrow rate lower than your current Aave one 🔒 Right now, we’ve got market-leading low rates for borrowing against cbETH, cbBTC, wstETH, and ETH Switch to Size today

sUSDe PTs are yielding 7.45% Fixed borrow rate on Size? Just 4.76% Do the math

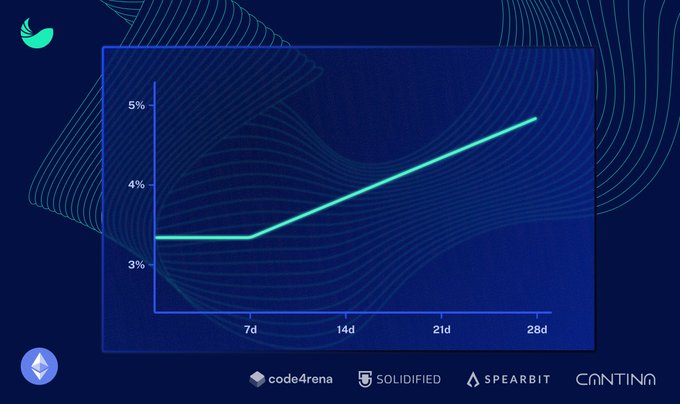

A random pick of ETH-USDC fixed rates on @Base 7d - 2.98% 28d - 5.73% 127d - 8.51% 230d - 9.21% Lock in these, or any rate along the blue, only on Size Credit today

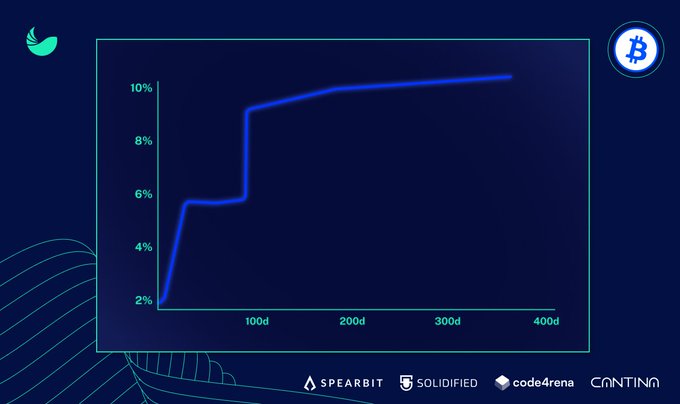

A snapshot of today's cbBTC-USDC fixed borrow rates 👀 7d - 2.3% 30d - 5.46% 90d - 5.58% Head to our Borrow page now and lock down any rate along the blue line 🐋

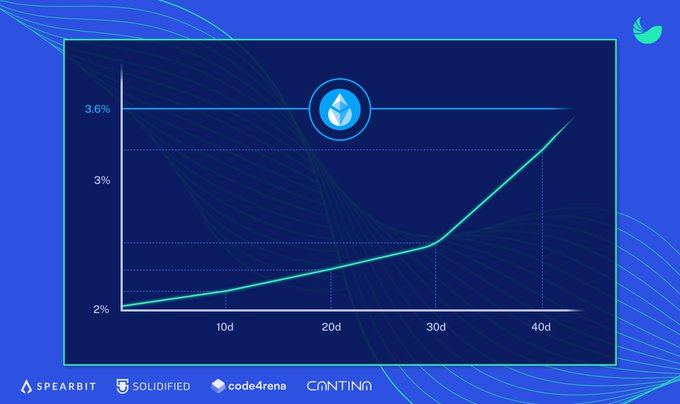

Borrow against wstETH and pay less than the staking yield Fixed rates on Size Credit (vs 3.6% native): 2.15% — 10d 2.33% — 20d 2.5% — 30d 3.27% — 40d

Base(d) borrow rates 🐋 Lock in a loan ~ for any duration ~ against your blue chips on @Base

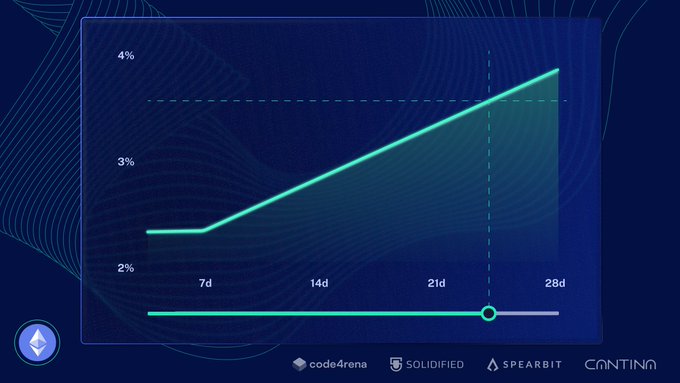

Make bank when you borrow 🐋 Fixed 1–28 day rates against wstETH — all below the 3.6% staking APR Net the spread now on our /Borrow page

Bullish markets typically drive variable interest rates higher Case in point: USDC borrowing on Aave (Base) has climbed 4.43% → 4.92% in just two weeks Choose any maturity from 1-90 days and lock in a lower, fixed rate on Size today 🐋

Crypto’s risky enough without getting nuked by rate spikes Lock in a leading fixed USDC borrow rate for 1–28 days using ETH 🐋 app.size.credit/borrow

Market-beating borrow rates against ETH 🐋 Lock in for any duration between 1-28 days today on Size

Aave USDC borrow rates hit 6-month lows (4.47%) Size fixed rates are still cheaper by a margin over the next 30 days Lock one in, exit at any time 🐋

Loop your Ethena sUSDe PTs for moooooar profit Borrow fixed-rate USDC at 4.58% - well below the implied yield (7.92%) app.size.credit/borrow

Size Protocol Launches Fixed-Rate Lending with Unified Liquidity

Size Protocol has introduced a new fixed-rate lending platform that unifies liquidity across different maturity periods. - **For Borrowers**: Access to optimized fixed rates regardless of chosen maturity period - **For Lenders**: Earn variable rates through Aave while waiting for custom yield curve offers The protocol aims to streamline fixed-rate lending by providing a unified liquidity pool, making it more efficient for both lenders and borrowers to participate in the DeFi ecosystem. [Learn more about Size Protocol](x.com/i/article/191834601007)

Is crypto mirroring TradFi turmoil? DeFi prices and yields tell two different stories

Despite recent market volatility causing significant price drops in major cryptocurrencies, DeFi metrics show surprising resilience: - Bitcoin flash crashed 14% (59k to 51k) with other cryptos following - DeFi Total Value Locked (TVL) maintains $60B+ all-time high - Compound leads DeFi with $10.94B TVL (18.2% market share) - Major DeFi tokens (AAVE, MKR, SUSHI) down 15-21% Upcoming catalysts: - Uniswap V3 launch May 5 - Projected UNI token surge above $50 Key takeaway: While crypto prices remain volatile, DeFi fundamentals show strength through maintained TVL and continued protocol development.

Size Protocol Launches Fixed-Rate Earn Product on Base

Size Protocol has introduced a new Earn product featuring Collections - curated baskets of fixed-rate yields. The product, launched on Base network, currently offers: - Expert-curated fixed yield opportunities - 71% bonus APY paid in USDC - Protection from market volatility through fixed rates The Collections feature allows users to access optimized yields selected by experts, providing a streamlined approach to fixed-rate lending. Users can now deposit on Base to participate in the first Collection. [Join Base Collection](https://base.size.protocol)

Size Protocol Pays Out 2,500 USDC to Early Earn Depositors

Size Protocol has distributed over 2,500 USDC to early participants in their fixed-rate lending product. The protocol continues to maintain a 75% APY for depositors. Key points: - Payments made to initial Earn depositors - Current APY remains at 75% - Product offers fixed-rate lending with unified liquidity This follows their December launch which offered 22.5% APY on USDT/USDC deposits through Angle USD Savings.