Significant Liquidity on Balancer Protocol

Significant Liquidity on Balancer Protocol

💰 Massive Liquidity Milestone

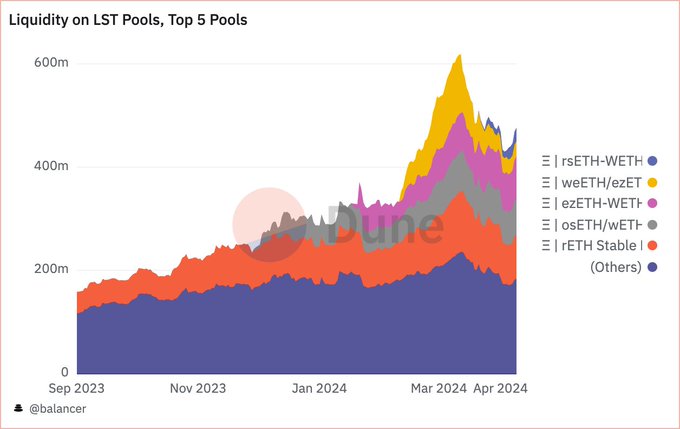

According to reports, the total value locked (TVL) in LST/LRT liquidity pools on the Balancer decentralized exchange currently stands at $468 million. Balancer Tech has developed custom technology with integrated rate providers, optimized swap paths, and aggregator integrations to facilitate efficient yield-bearing liquidity provision.

There is currently $468M of TVL in LST/LRT liquidity on Balancer collectively. With custom-built technology featuring in-built rate providers, streamlined swap paths, and aggregator integrations, Balancer Tech is optimized for YB liquidity. dune.com/balancer/lst

Monad Launches Boosted Pool Combining Kintsu Liquid Staking with Neverland Lending Yields

A new boosted pool has launched on Monad, pairing Kintsu's liquid staking token (sMON) with wrapped MON (WMON). **Key Features:** - sMON allows users to stake MON while maintaining liquidity and earning staking rewards - Both tokens are deposited on Neverland Money to generate lending yield - Tokens remain available for swaps while earning passive income - Uses StableSwap math for capital-efficient trading - Pool automatically pulls needed tokens for swaps and redeploys surplus **Dual Yield Strategy:** Liquidity providers earn from two sources simultaneously: - Swap fees from trading activity - Lending market interest through Neverland Money integration The pool requires zero manual intervention, automatically managing capital deployment between lending and swap liquidity.

Monad Community Draws 100 Attendees to Thailand Post-Mainnet Without Incentives

**Organic Community Gathering Post-Launch** Following Monad's mainnet launch, 100 community members traveled to Thailand without any financial incentives or rewards. Some participants flew 18 hours from Canada and Europe to attend. **Notable Observations** - Community member @buntyverse, with 5 years in crypto, stated they've "never seen anything like this" - The gathering represents unusual organic engagement in the crypto space - Monad had previously announced Q1 2025 mainnet launch plans at Rollup Day Bangkok The turnout suggests strong community alignment around the Monad project, with members willing to invest significant time and travel costs independently.

Balancer Reveals Monad Deployment Details in Ecosystem Livestream

Balancer shared deployment plans for the Monad ecosystem during a recent livestream featuring Marcus from Balancer. **Key Points:** - Marcus_Balancer provided details on Balancer's upcoming deployment on Monad - The livestream highlighted partnerships supporting the integration - Event featured multiple ecosystem partners including Fastlane, Magma, Neverland, Curvance, and Kintsu The announcement follows Monad's growing ecosystem momentum, with Balancer joining other DeFi protocols in expanding to the network.

Balancer V3 Launches Capital-Efficient Liquidity Pools on Monad

Balancer V3 has deployed on Monad, bringing programmable liquidity infrastructure to match the chain's 10,000 TPS and sub-second finality. **Key pools now live:** - **syzUSD/AUSD pool** - Pairs Yuzu Money's DeFi-native stablecoin with optimized capital efficiency - **AUSD/USDC/USDT0 three-token pool** - Multi-stablecoin pool stacking swap fees on lending yield Balancer's stable pools address a critical gap: Monad's parallel execution enables institutional-scale throughput, but speed without deep liquidity leads to slippage and user attrition. V3's capital-efficient design ensures pools can absorb serious trading volume. [Explore pools](https://balancer.fi/pools/monad/v3/)

Two New Stablecoins Launch: Yuzu's syzUSD and VanEck-Backed AUSD

Two stablecoins are entering the market with different backing mechanisms: **syzUSD (Yuzu)** - Overcollateralized stablecoin - Backed by curated DeFi strategies - Available on Pendle with yield and points options **AUSD (withAUSD)** - 1:1 fiat-backed stablecoin - Reserves managed by VanEck - Custodied by State Street Both projects are focused on building efficient trading infrastructure to support scale. The syzUSD offers underlying yield with 1x points, while yzUSD provides 5x points without base yield. [syzUSD Pool](https://app.pendle.finance/trade/pools/0xea9b070db9a823148d6d75d0875c25d5e51436ba/zap/in?chain=plasma) [yzUSD Pool](https://app.pendle.finance/trade/pools/0xd5b13c8871a6e337e6492b30a7cac5c7d38737ac/zap/in?chain=plasma)