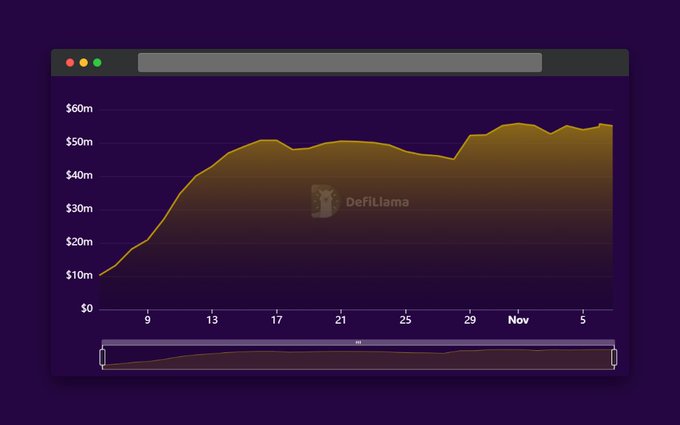

Savings Dai (sDAI) has seen a surge in value, reaching $10M in Total Value Locked (TVL) within a month. sDAI is a yield-bearing stablecoin that generates a 6.8% yield. The interest earned from DAI bridged to Gnosis Chain is redirected to sDAI holders. Whales are bridging xDAI to Gnosis Chain to earn high yields. The yield comes from the interest accrued by sDAI, which is redirected from the xDAI Bridge on Ethereum mainnet. This yield is generated by the revenue Maker generates on DAI minting and the RWAs it holds.

sDAI -->$10M in TVL --> $55M in one month ⤴️ What is sDAI? And what's behind its surge? ⤵️ Savings Dai (sDAI) is a yield-bearing stablecoin that generates 6.8% yield. 🧑🌾 All the DAI bridged to Gnosis Chain is earning interest at MakerDAO. This interest is redirected to the

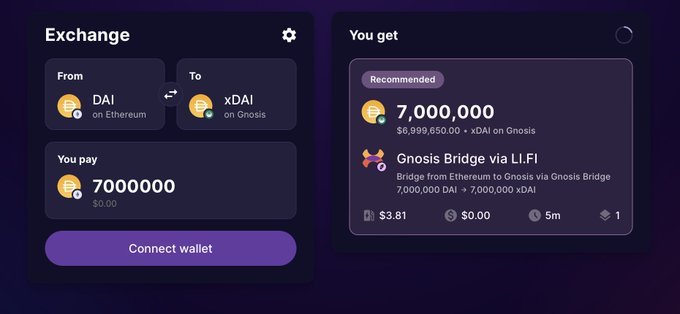

7,000,000 DAI & 6,000,000 DAI 🤯 A whale just bridged a staggering $13M $DAI in 2 txs to Gnosis on Jumper.exchange via the xDai Bridge. Here's the scoop: whales are actively bridging MILLIONS of DAI to deposit sDAI on @gnosischain. Are the whales onto something? 🦉

Jumper Partners with Katana for $270K Incentive Campaign

Jumper has launched the **Shogun Season** campaign in partnership with Katana, offering significant rewards for DeFi participants. **Key incentives include:** - 2.7M KAT tokens ($270,000 value) - Jumper XP bonuses for participants **How to participate:** Users can deposit funds into Yearn Finance, Morpho, or Spectra Finance protocols on the Katana network. In return, participants earn boosted yields plus additional Jumper XP rewards. The campaign is accessible through [Jumper's dedicated campaign page](https://jumper.exchange/campaign/katana). This partnership builds on Jumper's existing integration with Katana, which enables seamless bridging of ETH, USDT, USDC and other assets to the Katana network.

Flow Blockchain Integration Expands Jumper's Cross-Chain Capabilities

**Flow blockchain is now integrated with Jumper**, enabling seamless asset swaps into Flow's consumer DeFi ecosystem. - Users can swap assets from any supported chain directly into Flow - Integration follows Jumper's recent additions of Monad and Hemi networks - Flow positions itself as the **home for consumer DeFi** applications This expansion continues Jumper's growth trajectory after processing **$2.05 billion in November volume** and adding multiple new blockchain integrations.

🌉 Bitcoin DeFi Bridge Opens

**Jumper integrates Hemi network**, enabling seamless Bitcoin DeFi access. - Users can now **swap BTC directly into Hemi** through Jumper's platform - Access to **Bitcoin-native yield opportunities** and liquidity markets - **Rate markets** now available for BTC holders Hemi positions itself as the **chain powering Bitcoin DeFi**, offering new ways to put Bitcoin to work beyond simple holding. The integration expands **cross-chain accessibility** for Bitcoin users seeking DeFi participation.

🚀 Jumper Hits $2.14B Volume Record

**Jumper Exchange achieved a new all-time high** with $2.14B in trading volume during September. **Key developments include:** - Integration with @0xoogabooga and @HyperFlow_fun DEX platforms - Launch of official onboarding platform for @Plasma - Significant volume growth from August's $1.6B The bridge aggregation platform continues expanding its **DEX connectivity** and user onboarding capabilities. [Read full breakdown](https://jumper.exchange/learn/jumper-update-september)

BSC Trading Volume Doubles on Jumper as Chain Gains Momentum

**BSC trading activity surges on Jumper platform** Binance Smart Chain (BSC) users on Jumper have **doubled their swapping activity** over the past 5 weeks. This growth appears linked to what's being called the "Aster effect." **Key developments:** - BSC recently entered Jumper's **top 3 chains by net flows** - Trading momentum suggests BSC is experiencing renewed interest - Jumper users are capitalizing on the increased activity The platform continues positioning itself as a way to maximize transaction value on BSC trades during this uptick in network usage.