Real-world assets (RWAs) are creating structural alpha for institutional investors through three key mechanisms:

- Reducing operational friction in traditional finance processes

- Unlocking access to new asset classes like digitalized private credit

- Mitigating risk through on-chain transparency

The transformation mirrors how SWIFT revolutionized banking through efficiency and standardization. Now blockchain technology applies the same principles to institutional finance.

Zharta is building infrastructure where institutional-grade systems and real-world assets converge on-chain, focusing on the standards institutions demand for widespread adoption.

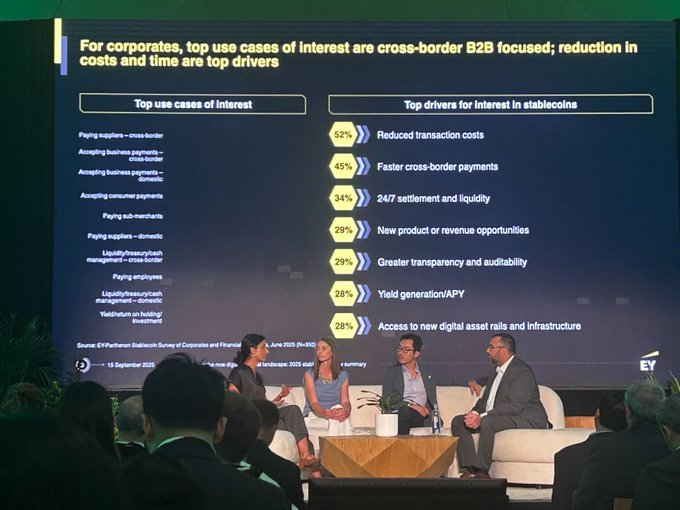

At the @rwasummit , new research from EY confirmed what many of us anticipated: corporates are increasingly turning to stablecoins. The drivers are clear: reduced costs, faster cross-border payments, 24/7 settlement and liquidity, greater transparency, and auditability. Yet

Even before products go live, institutions are setting the direction of on-chain finance: efficiency, transparency, and reliable infrastructure. At Zharta, we see lending and RWAs as the foundation of this shift. Our focus is simple: build with the standards institutions

The convergence of RWAs and lending is not a trend, it’s infrastructure. Institutions will rely on these markets to unlock yield, settle with confidence, and integrate onchain finance into existing frameworks. Tokenization brings assets onchain. Lending makes them useful for

At the @rwasummit, EY shared data that underscores how corporates view the path to stablecoin adoption: -69% are more willing to use stablecoins if integrated into ERP systems. -63% prefer to access them via traditional banks and payment partners, with 95% planning to leverage

For institutional investors, RWAs represent a new form of structural alpha: -reducing operational friction -unlocking access to new asset classes (such as digitalized private credit) -and mitigating risk through on-chain transparency The same principle that once drove the

The Evolution of DeFi Lending: From Identity to Proof

DeFi lending is undergoing a fundamental shift in approach. Instead of focusing on user identity, protocols are moving towards wallet-based verification through: - **Proof of Solvency**: Demonstrating financial capacity - **Proof of Behavior**: Showing transaction history and patterns - **Proof of Recourse**: Establishing clear recovery mechanisms This transition marks a significant evolution where reputation becomes earned through verifiable on-chain actions rather than traditional credit systems. Recent developments like Supercollateral showcase how borrowing can be restructured so network value generation handles loan repayment.

The Evolution of Onchain Credit: Building Blocks Emerge

The development of onchain credit infrastructure continues to progress steadily. Key primitives taking shape include: - Real-time collateral valuation systems - Atomic enforcement mechanisms - Interoperable identity frameworks - Composable capital market structures While still early, these foundational elements are creating the infrastructure for programmable credit markets. The focus remains on building durable liquidity primitives and trusted infrastructure that enables capital mobility without compromising security.

Zharta Launches V2 NFT Lending Protocol with P2P Features

Zharta has launched its V2 NFT lending protocol with several key features: - **Peer-to-Peer Lending**: Users can now set custom loan conditions - **Refinance Tools**: Lenders can sell loans, borrowers can improve terms - **Mobile Access**: New app for on-the-go lending management - **Custom Offers**: Target specific NFT traits for precise lending - **Gas Efficiency**: Up to 50% savings on transaction fees The protocol maintains pro-rata interest and no auto-liquidations. Multi-chain expansion is planned, and a token launch with rewards for early adopters is upcoming. *Visit app.zharta.io/lending to get started*