RWA Market Hits $30B Milestone as Centrifuge Expands Cross-Chain

RWA Market Hits $30B Milestone as Centrifuge Expands Cross-Chain

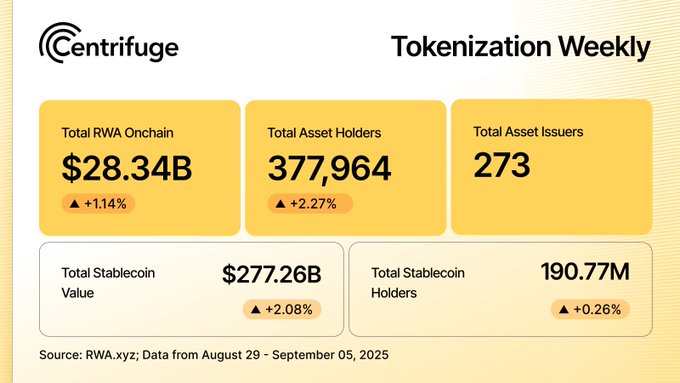

🚀 RWAs hit $30B

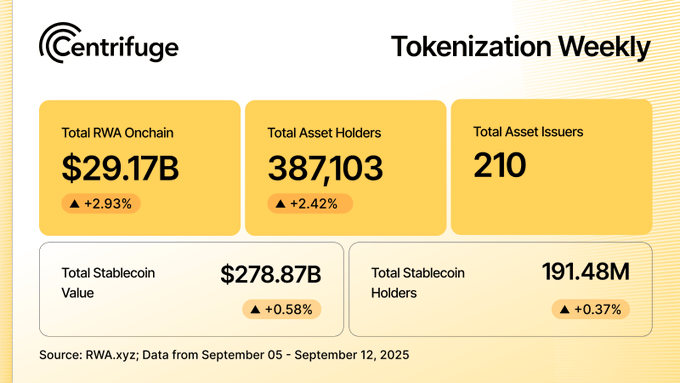

The total value of onchain real-world assets has surpassed $30 billion, marking steady adoption of tokenized finance infrastructure.

Key Centrifuge developments:

- Grove Finance deploys $50M to Apollo Diversified Credit Fund (ACRDX) via Plume Network partnership

- deRWA tokens launch on Stellar with $20M allocation into deJTRSY and deJAAA strategies

- Centrifuge backs USST stablecoin powered by tokenized treasuries and AAA CLOs

- Joins as founding partner of TokenizedVault to establish digital asset management standards

The expansion brings 24/7 trading and institutional-grade assets to Stellar's DeFi ecosystem through partnerships with Soroswap, Aquarius, and Blend Capital.

Cross-chain composability via LayerZero enables seamless integration across multiple blockchain networks.

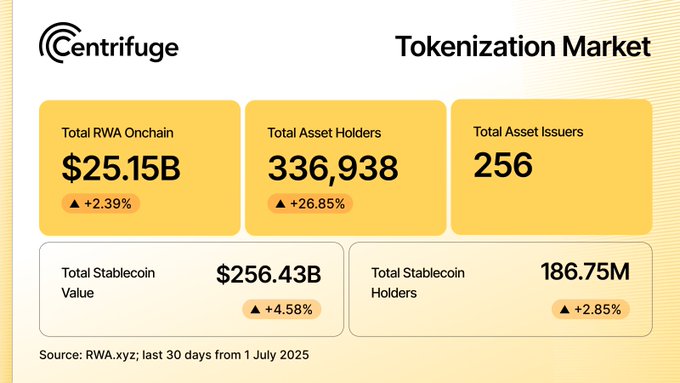

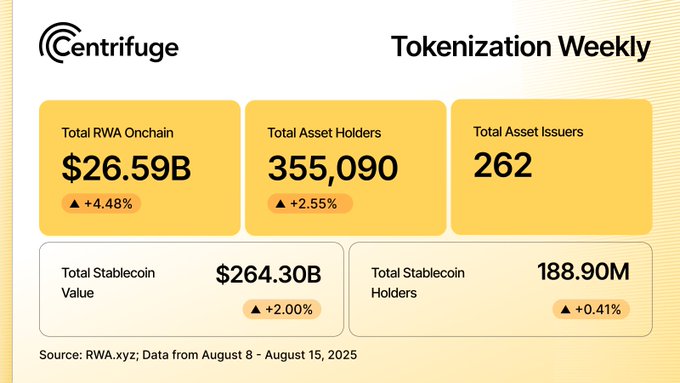

A powerful and transparent financial layer is being forged, driven by institutional adoption. The tokenized asset ecosystem continues to expand on a bedrock of high-quality assets like treasuries and credit. Explore the latest data on this fundamental shift 👇

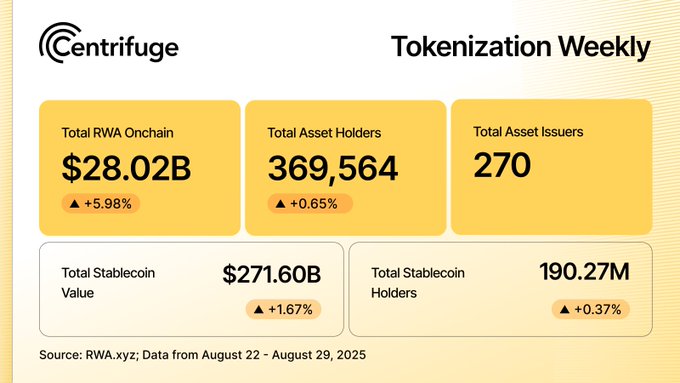

Amid the market's noise, the signal is clear: the onchain economy is growing. RWAs continue to provide a stable foundation for DeFi, with fundamental growth week after week. Here's your latest signal boost 👇

The definitive report on the state of real-world assets, launched today at the @RWASummit. Essential, data-driven insights from the teams at @Dune and @RWA_xyz for every builder in the space.

📙 RWA Report 2025 is live, co-produced by @Dune × @RWA_xyz, launched at the @rwasummit in Brooklyn. Clear theses + key trends, grounded in onchain data. Established players and emerging projects across treasuries, credit, equities, commodities & more. dune.com/rwareport2025

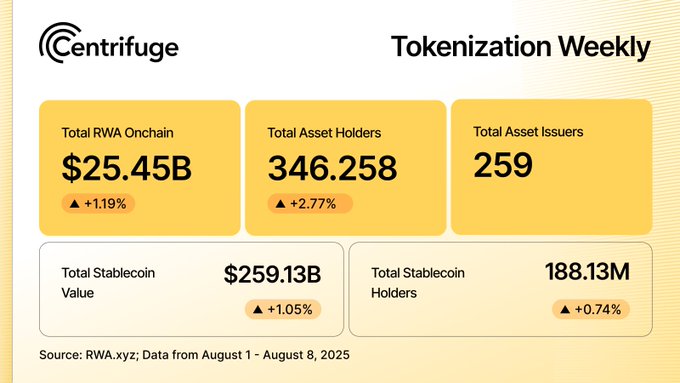

The real story of market adoption is told by the growth of the network itself. Each new asset holder and issuer onchain makes the ecosystem more resilient and decentralized. This is the foundation for a more open economy being built, week by week. Here's your weekly briefing on

"Centrifuge plays a central role in this system, handling the full tokenization pipeline from asset onboarding to issuance. Their infrastructure enables strategies like JAAA and JTRSY to launch, scale, and operate across chains with institutional clarity and onchain

Grove expands to @avax. With a $250M target deployment into tokenized institutional credit strategies, @JHIAdvisors’ JAAA and JTRSY, Grove is laying the foundation for scalable, institutional credit onchain. What this unlocks → grove.finance/blog

First, it was tokenized treasuries. Then, CLOs. The next frontier for institutional-grade RWAs is coming to @Centrifuge. Stay tuned 👀

The future of finance is not a battle between TradFi and DeFi, but their convergence into a single, global market. This evolution requires a common language, a universal, chain-agnostic infrastructure capable of bringing any RWA onchain. That is what we are building at

RWAs are the next pillar of global finance. And @joinrepublic agrees. That's why today, Centrifuge is excited to announce a strategic investment from Republic Digital’s Opportunistic Digital Assets Fund. From pioneer to leader in tokenized finance, Centrifuge is setting the bar

The Horizon RWA market by @aave is live, with Centrifuge at launch. RWAs are no longer just tokens onchain. They’re active collateral powering real-time liquidity. For the first time, Aave users can borrow stablecoins against: 📌 Tokenized U.S. Treasuries (JTRSY) 📌 AAA-rated

Great to join Will Beeson on the Rebank podcast! Our COO Jürgen Blumberg and CEO @itsbhaji dive deep into the evolution of Centrifuge, the drivers of RWA adoption, and how we see DeFi and TradFi converging into "just finance." Listen to the full episode to hear how tokenized

🎧 Ep 248: Scaling Tokenized Real World Assets with Centrifuge Bhaji Illuminati and Jürgen Blumberg of Centrifuge join Will Beeson, CFA Beeson to explore: ➡ The evolution of Centrifuge from esoteric assets like invoice financing to treasuries, CLOs, and beyond ➡ Why buy-side

As founders of @rwasummit, we’re proud to return to The William Vale in Brooklyn this September as Title Partner for the flagship event’s third consecutive year, where the leading minds in crypto and capital markets meet. Our CEO, @itsbhaji, will take the stage to tackle the

Real-world yield doesn't just mean treasuries. The largest pools of institutional capital are traditional assets with limited liquidity. Soon, they will be unlocked on @Centrifuge. The next generation of institutional RWAs is loading 🔄

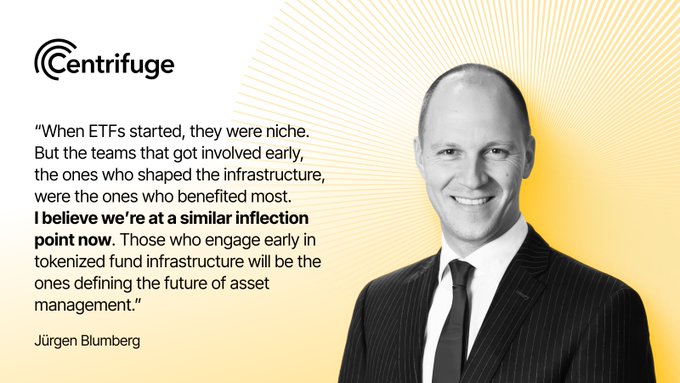

Goldman Sachs. BlackRock. Invesco. Jürgen Blumberg helped build the ETF market from the inside. Now he joins Centrifuge as COO, and CIO of @anemoycapital, to lead the shift from legacy structures to regulated, onchain investment products. Blumberg’s move is a signal:

The narrative has shifted. "It feels less controversial to talk about trillions onchain today than 2 years ago." — Centrifuge's co-founder, @lucasvo, on the maturation of the RWA industry, live from the @RWASummit.

Centrifuge V3 is now live on @avax, with its first major deployment on the way. @grovedotfinance is allocating up to $250M into the Janus Henderson Anemoy AAA CLO Strategy (JAAA), part of a $1B partnership with Centrifuge and @JHIAdvisors to scale institutional credit onchain.

"The Stellar Development Foundation plus Centrifuge is... a powerful union of two organizations that really want to bring real world assets into the world of DeFi." — @AdaVaughan, Senior Director of DeFi Partnerships at Stellar. We're thrilled to partner with @StellarOrg to

A great discussion on the institutional adoption of RWAs. Our CEO, @itsbhaji, joined the latest episode of @TokenizedPod to talk about Centrifuge's pioneering role in the space since 2017, the debate on tokenized deposits, and the future of onchain finance. Check it out 👇

🚨 Ep. 46 of @TokenizedPod: Every Bank Should Tokenize Deposits @sytaylor & @cuysheffield are joined by: ➡️ @KAndrewHuang, Founder @conduitxyz ➡️ @itsbhaji, CEO @centrifuge To discuss: ⚙️ Centrifuge's role in tokenizing real world assets since 2017 🥊 Debate on tokenized

Why did a 20-year ETF veteran from Goldman Sachs & BlackRock join @centrifuge? Because as our new COO Jürgen Blumberg explains, tokenization today feels just like the early days of ETFs: A moment where a new technology challenges the entire financial system.

Goldman Sachs. BlackRock. Invesco. Jürgen Blumberg helped build the ETF market from the inside. Now he joins Centrifuge as COO, and CIO of @anemoycapital, to lead the shift from legacy structures to regulated, onchain investment products. Blumberg’s move is a signal:

The financial system is being rewritten on new rails. From institutional credit funds moving operations onchain to tokenized treasuries becoming a core DeFi primitive, the groundwork for a more open economy is being laid. Here's your weekly briefing on the real progress in

Centrifuge is a proud founding partner of @tokenizedvault, a global initiative setting the standard for secure and transparent digital asset management. Together, we’re raising the bar for trust and innovation in digital finance. Learn more:

"Once an asset is onchain, the most interesting question is what you can do with it," as our CEO, @itsbhaji, said on the @TokenizedPod. This is the fundamental question we answer by building open, multichain infrastructure. We create the tools, like our deRWA tokens, that

On the latest episode of Tokenized, Bhaji Illuminati (@itsbhaji), CEO of @centrifuge asks the question: “What do you do after tokenizing an asset?” Hear her thoughts below 👇 🎙️ Listen to the latest episode of Tokenized: tokenized.simplecast.com/episodes/every… 📷 Watch on YouTube:

The most powerful force in finance is compounding growth. Week after week, the onchain economy expands as more assets, holders, and issuers build a stronger, more resilient foundation. This is how a new system is built, with a relentless progress. Here's your weekly briefing👇

Most “multichain” protocols fragment liquidity. Centrifuge unifies it. In this first deep dive on Centrifuge V3, we sat down with Jeroen Offerijns (@offerijns), CTO, and Frederik Gartenmeister (@mustermeiszer2), Head of Product, to unpack the core technical unlocks: - Chain

Liquidity fragmentation ends now. Centrifuge V3 is LIVE, first launching on @ethereum, @plumenetwork, @base, @arbitrum, @avax, and @BNBCHAIN, with chain interoperability powered exclusively by @wormhole. Fund managers can manage liquidity across multiple chains from a single

We're at a rare inflection point in finance. Our new COO, Jürgen Blumberg, saw this happen once before with the rise of ETFs. Here’s his take on why the opportunity in tokenization is just as profound, and why the time to build is now!

Traditional finance is clogged with intermediaries, adding costs and complexity. Tokenization on @centrifuge will change that. By representing RWA onchain, we aim to reduce reliance on these intermediaries, creating a more open, transparent, and efficient way to access finance.

The gravity of onchain finance is growing stronger. Week by week, the pull of real-world yield and transparent infrastructure brings more assets, holders, and issuers into the ecosystem, building undeniable momentum. Here's your weekly look at the numbers 👇

Institutional trust meets DeFi composability. In Part 2 of our deep dive series, @offerijns and @mustermeiszer2 explore the "why" behind Centrifuge V3: our core design philosophy for bridging two financial worlds. Read more at: centrifuge.io/blog/centrifug…

A must-read @Dune RWA Report affirms what we’ve championed: U.S. Treasuries have defined product-market fit for tokenization, establishing a credible, liquid foundation for the next evolution in DeFi. We’re proud to see JTRSY recognized as the largest RWA collateral on @Aave's

1/9 RWA Report 2025 — Thesis #1: U.S. Treasuries proved the product–market fit for tokenization. They set the credibility + liquidity base for everything that followed. dune.com/rwareport2025

Data integrity is the bedrock of institutional trust in DeFi. @rwa_xyz has upgraded its analytics dashboard to fully support Centrifuge V3, our scalable, multi-chain protocol for asset tokenization.

Grove Labs co-founder (@0x_roo) on our partnership with @grovedotfinance & @avax: Combining our technologies "lays the foundation for a new era of scalable onchain credit markets.” Read more in @CoinDesk's article: coindesk.com/business/2025/…

Tokenized T-bills proved the rails work. They were the gateway. But the future of the onchain economy won't be financed by treasuries alone. The true institutional leap, and the solution for DeFi's collateral, is bringing diversified, yield-bearing, non-correlated assets

The onchain economy is growing, driven by the adoption of institutional-grade assets like tokenized treasuries and credit funds. This fundamental shift is building a resilient foundation for the future of finance. Here's the latest data on this progress 👇

Another week, another major milestone. The total value of onchain real-world assets has officially surpassed $30 billion, proving the steady adoption of this new financial layer. Here's the latest data on this progress 👇

deRWA are coming to @StellarOrg 🚀 Launching with: deJTRSY → short-term US Treasuries deJAAA → AAA CLO strategy Backed by a $20M investment at the start. RWA embedded in Stellar’s global financial rails.

STBL Launches USST Stablecoin Backed by Tokenized Treasuries and AAA CLOs

**STBL introduces USST stablecoin** with institutional-grade backing through tokenized assets on Centrifuge. **Key Features:** - Collateralized by Treasury tokens (deJTRSY) and AAA-rated CLOs (deJAAA) - Diversified yield generation from multiple asset classes - Full onchain transparency for all collateral - Built on real-world asset tokenization infrastructure This approach differs from other stablecoin models by combining traditional financial instruments with blockchain transparency, aiming to provide stable value through diversified institutional assets.

Apollo Attracts $50M for Tokenized Credit Strategy

**Institutional investors** have committed **$50 million** to Apollo's tokenized credit strategy, marking a significant milestone for real-world asset (RWA) tokenization. The investment demonstrates growing institutional confidence in: - **Blockchain-based credit markets** - Enhanced transparency and efficiency - Real-world impact of tokenized assets This development signals that **traditional finance is embracing onchain solutions** for credit strategies. The move represents a shift toward building credit markets in public, transparent blockchain environments. Read the full report at [CoinDesk](https://www.coindesk.com/business/2025/09/16/blockchain-based-rwa-specialists-bring-usd50m-to-apollo-s-tokenized-credit-strategy)

Janus Henderson Embraces Blockchain for Asset Management Future

**Janus Henderson** is positioning blockchain as the foundation for future asset management. Nick Cherney from JHI Advisors outlined how **tokenization is transforming finance**, with the firm bringing core strategies like JAAA and Treasury products onchain. This follows their recent launch of the **VAO Dashboard** with Chronicle Labs, which provides transparency for their JTRSY tokenized treasury fund by showing how asset data is: - Sourced and verified - Monitored onchain in real-time - Made accessible to users The move reflects growing institutional adoption of blockchain technology for traditional financial products, emphasizing **transparency and efficiency** in asset management.

🏦 deRWA Launch

**Centrifuge is bringing decentralized Real World Assets (deRWA) to Stellar** with a $20M initial investment backing. **Two initial products launching:** - deJTRSY: Short-term US Treasuries - deJAAA: AAA CLO strategy Key integrations include: - **Soroswap Finance**: Native DEX trading pairs for instant swaps - **Aquarius DeFi**: Enhanced liquidity layer participation - **Blend Capital**: Borrowing and lending with institutional-grade collateral - **Defindex**: Yield-backed onchain products **Benefits for Stellar ecosystem:** - 24/7 trading capabilities - Cross-chain composability via LayerZero OFT Standard - Institutional-grade assets as DeFi collateral - Enhanced market depth and liquidity This integration embeds real-world assets directly into Stellar's financial infrastructure, expanding beyond traditional stablecoins.