🔄 Resolv Labs Relaunches PT-RLP with New Expiry

🔄 Resolv Labs Relaunches PT-RLP with New Expiry

🔄 PT-RLP Returns Again

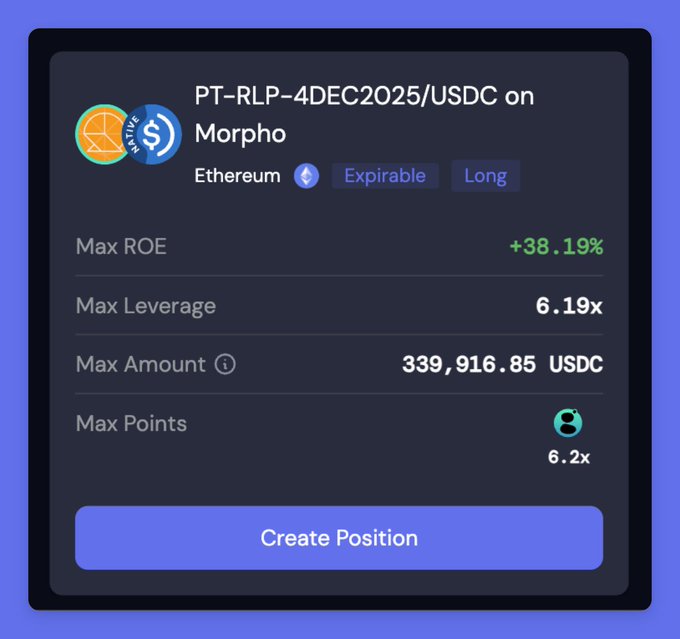

Resolv Labs has relaunched PT-RLP with a new expiry date, continuing their innovative approach to stablecoin risk management.

The USR/RLP System:

- USR: Overcollateralized stablecoin backed by ETH and stETH

- Uses short futures positions to hedge price movements

- RLP: Liquidity pool token that absorbs market risks

- RLP holders receive higher profit shares in exchange for risk exposure

Key Features:

- True delta-neutral strategy eliminates market exposure

- RLP price represents ETH backing value per token

- Risk Premium rewards distributed to RLP holders

Important Warnings:

- Complex multi-layered product requiring full understanding

- Trading on leverage carries significant risks

- Not financial advice

Read the full documentation at Resolv's litepaper before trading.

Understand the mechanics before participating in these sophisticated DeFi instruments.

It came back. PT-RLP from @ResolvLabs is out with a new expiry:

Contango Publishes Complete Guide to PT Loop Trading

**Contango releases comprehensive PT trading guide** covering leveraged Principal Token strategies on Pendle. **Key trading considerations:** - Research underlying assets thoroughly before trading - Choose quote assets carefully to minimize market impact - Longer maturities generally safer than short-term trades - Exit early if unable to handle volatile markets at maturity **Critical risks highlighted:** - MEV attacks without protection can cause significant losses - Oracle type affects liquidation risk - avoid market rate feeds - YT speculation can drive PT prices down, affecting returns **Technical mechanics explained:** - PT loops combine fixed yield lending with variable rate borrowing - Profit = PT yield minus borrowing costs, minus fees and slippage - Positions must be manually closed after expiry to avoid ongoing costs Guide emphasizes education over speculation, warning that **uneducated PT trading often results in losses**. Contango automates complex looping strategies but traders must understand all variables affecting their positions.

🔄 Contango Launches Longest-Dated PT-stcUSD

**Contango launches its longest-dated instrument** featuring PT-stcUSD from Cap Money protocol. **Cap Protocol Overview:** - Offers two main products: cUSD (dollar-denominated) and stcUSD (yield-bearing) - cUSD reserves backed by blue-chip stablecoins: USDC, USDT, pyUSD, BUIDL, BENJI - stcUSD generates yield for holders **Key Details:** - New instrument now available for trading on Contango - Built on variable rate markets with leverage capabilities - Documentation available at [docs.cap.app](https://docs.cap.app/) **Risk Warning:** Leverage trading carries significant risks. Users should understand Contango's mechanics before participating. Full documentation at [docs.contango.xyz](https://docs.contango.xyz/) *Always conduct your own research before trading.*

🔄 syrupUSDC Looping Now Available

**syrupUSDC looping is now live** against both USDC and USDT through Morpho Labs and Euler Finance. **Key details:** - Earn **Drips rewards** only on Morpho positions - Get **$SYRUP tokens** at season end - Keep loops open longer for **extra Drips** **Current rates:** - Borrow rates: 2-3% - Underlying syrupUSDC yield: 7-8% + Drips - Initial capacity: 20M ⚠️ **Risk warning:** Trading on leverage carries significant risk. Understand the mechanics before participating. [Learn more about Contango](https://docs.contango.xyz/)

🚨 Level Trading Pairs Delisted

**Level-related trading pairs have been delisted** from the exchange as of September 30, 2025. **Key points for traders:** - Positions can still be closed despite delisting - **Liquidity is shrinking** on underlying markets - High market impact expected when trading This follows a pattern of delistings, with over 20 trading pairs removed in late 2023 for failing to meet listing criteria. **Traders should act carefully** when closing positions due to reduced liquidity conditions.