A breakthrough discovery has been made identifying a practical blockchain application with genuine real-world utility.

The finding represents a significant development in the ongoing search for meaningful blockchain implementations beyond speculative trading.

Key points:

- Actual use case identified after extensive research

- Represents departure from theoretical applications

- Could signal broader adoption potential

This discovery comes amid continued debate about blockchain's practical value in everyday scenarios. The specific details of the use case and its implementation remain to be fully disclosed.

The development may influence how the industry approaches blockchain integration moving forward.

‼️Breaking News‼️ We found a real world blockchain use case

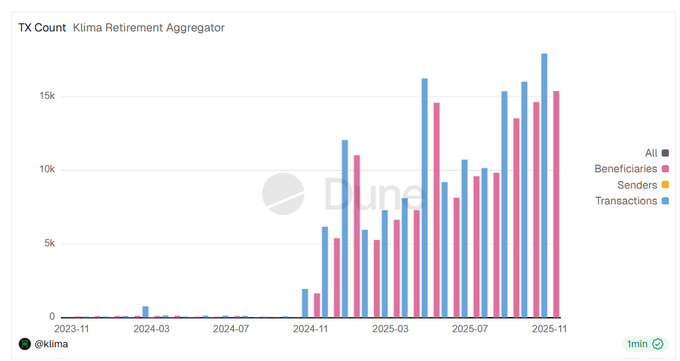

Smart contract automation meets #environmental #RWAs. @KlimaDAO's Retirement Aggregator has breached a new monthly ATH transaction count with four days still remaining in November. The majority of these new transactions ran through @carbonmarkcom's retirement API.

kVCM Single Staking Goes Live on HydrexFi Platform

**Single staking for $kVCM is now active** on HydrexFi following the recent epoch flip. Users can participate by visiting [hydrex.fi](http://hydrex.fi) to access the new staking functionality. **Key partnership benefits:** - Automated yield-generating liquidity strategies - Enhanced $kVCM liquidity markets - ve tokenomics integration The collaboration aims to strengthen liquidity through HydrexFi's specialized DeFi infrastructure. For detailed information about the platform and staking mechanics, users can review the documentation at [docs.hydrex.fi](http://docs.hydrex.fi).

Klima Allocates 100% veAERO Votes to kVCM Pools, Prepares for Protocol 2.0 Winter Launch

**Klima has fully committed its veAERO voting power to kVCM pools on Aerodrome Finance.** The allocation breakdown: - **USDC/kVCM pool**: 3.3 million votes - **USDC/WETH pool**: 1.9 million votes This represents a **complete shift** from the previous 50/50 split between WETH and USDC pools announced in October. **Strategic transition underway** as Klima continues moving toward the USDC pool in preparation for **Klima 2.0's Protocol deployment** scheduled for winter. The move signals Klima's focus on stablecoin liquidity as it approaches its next major protocol upgrade. [View kVCM pools on Aerodrome](https://aerodrome.finance/liquidity?query=kvcm)

Carbon Markets Generated $100B in 2024, But Transparency Issues Persist

**Carbon markets reached $100 billion in 2024**, funding critical climate projects worldwide. These markets bridge financing gaps for emerging economies, potentially doubling global climate ambition by 2035. **Real-world impact examples:** - Indonesia's Katingan Peatland Project: 149,800 hectares restored, 7.5M tons CO2 avoided yearly - Myanmar mangrove restoration: 15km coastline strengthened, 45K tons CO2 captured annually - Timor Leste forestry: 100K+ trees planted, 150+ jobs created **Current market challenges:** - Opaque trading dominated by over-the-counter transactions - High intermediary fees reducing project funding - Fragmented liquidity across siloed infrastructure **Blockchain solutions** like KlimaDAO aim to address these issues by moving carbon trading onchain, improving transparency, and scaling capital flow to climate projects.

🌱 Carbon Markets Disrupted

**Klima 2.0** launches tonight on Aerodrome, introducing fee-free carbon market infrastructure after years of development. **Current carbon market problems:** - Transaction costs exceed 100% of trade value - Broken trading infrastructure kills market confidence - Hidden markups reduce efficiency **Klima 2.0 solutions:** - End-to-end carbon market technology - Transparent pricing with zero extractive fees - Community-driven governance for portfolio curation - Seamless credit integration and retirement process **Two-token system:** - **$kVCM**: Risk-balanced portfolio ownership token that mints when acquiring carbon, burns during retirement - **$K2**: Fixed-supply governance token that shapes pricing and earns protocol incentives The protocol operates autonomously through algorithms and token inputs, adapting to carbon market changes. All financial value flows to token holders through incentives. **Key features:** - Auditable and community-driven - No VCs or insider allocations - Built specifically for carbon market complexity - Transparent pricing at all times Klima aims to create a lasting operating system for carbon markets, anchored in real-world credits and governed by users. [Learn more](http://klimaprotocol.com)