Real World Assets (RWA) continue gaining traction in DeFi markets. Key developments:

- Traditional finance assets being tokenized at increasing rates

- Major platforms like Maker and Centrifuge expanding RWA vaults

- Regulatory frameworks evolving to accommodate tokenized securities

Institutional adoption shows steady growth, with banks piloting RWA programs. Market analysts project $16T in tokenized assets by 2030.

Notable challenges remain:

- Custody solutions

- Regulatory compliance

- Infrastructure scalability

The intersection of TradFi and DeFi through RWAs represents a significant shift in market structure.

Real world assets?

I put up collateral with tBTC, and took out a loan with @CurveFinance's crvUSD. We financed half of the house with BTC at $60k — and instead of losing out, this time we got a new house, backed by Bitcoin.

Curve Finance Expands to XDC Network and Hyperliquid

Curve Finance continues its multi-chain expansion with two new deployments: - Successfully launched on **XDC Network** on June 11, 2025 - Deployed and tested on **Hyperliquid** chain on June 6, 2025 These integrations expand Curve's automated market maker (AMM) capabilities to new blockchain ecosystems, offering users more options for efficient token swaps and liquidity provision. [Learn more about XDC deployment](https://news.curve.finance/curve-now-live-on-xdc-network/) [Learn more about Hyperliquid deployment](https://news.curve.finance/curve-live-on-hyperliquid/)

Curve Finance Proposes Market-Driven Fee Optimization

Curve Finance has introduced a proposal for dynamic fee optimization through market mechanisms. This follows their November 2024 initiative to enhance scrvUSD parameters. Key points: - Free market would determine optimal fee structures - Builds on previous scrvUSD parameter improvements - Earlier changes allowed fee split growth up to 20% - System aims for sustainable fee generation The proposal suggests a more flexible approach to fee management, letting market forces naturally find efficiency points. This represents a significant shift from fixed-rate models. Read the full proposal: [Curve Letters - Fee Boost](https://github.com/curvefi/curve-letters/blob/main/articles/2.%20May%202025/Fee_Boost.pdf)

HyperEVM Integration Update on Octav.fi

Octav.fi has expanded its @HyperliquidX support with new HyperEVM features: - Real-time token statistics visualization - Protocol deposit tracking capabilities - API integration for direct HyperEVM data access These enhancements provide deeper insights into HyperEVM operations. Users can access these features through [Octav Pro](http://pro.octav.fi).

Curve Finance Maintains Strong Yield Performance in Week 3

Curve Finance continues to demonstrate consistent yield performance in the third week of 2025, maintaining the positive trend observed since the start of the year. Key metrics: - Weekly yield reports show sustained stability - Multiple pools maintaining competitive returns - Trend continues from previous weeks' positive performance This marks the third consecutive week of notable yields in 2025, following the reporting structure implemented in December 2024. *Note*: Detailed pool-specific data available in the full report.

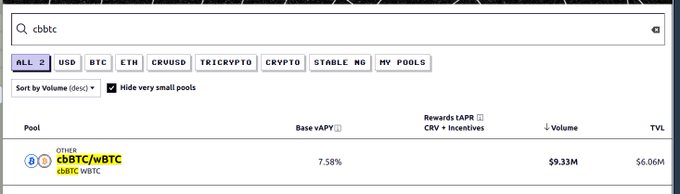

Coinbase cbBTC Swap Demand Surges

The demand for swapping Coinbase's cbBTC continues to rise, with notable metrics: - **Pool utilization** reaches 150% - **Unincentivized APR** stands at 7.6% This trend has persisted for at least two days, indicating sustained interest in cbBTC swaps. The high pool utilization suggests increased trading activity, while the attractive APR may draw more liquidity providers to the pool. Traders and investors should monitor these metrics closely, as they may impact swap costs and potential earnings from providing liquidity.