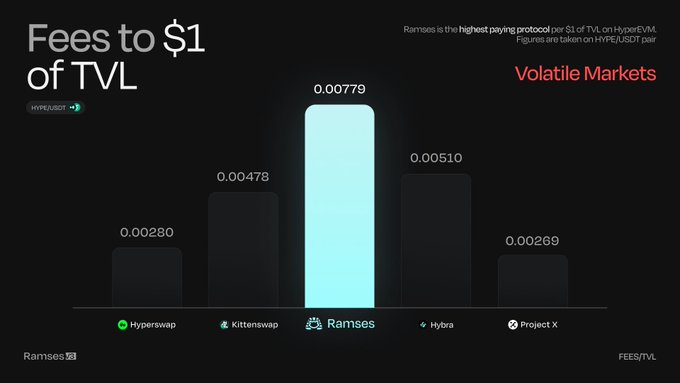

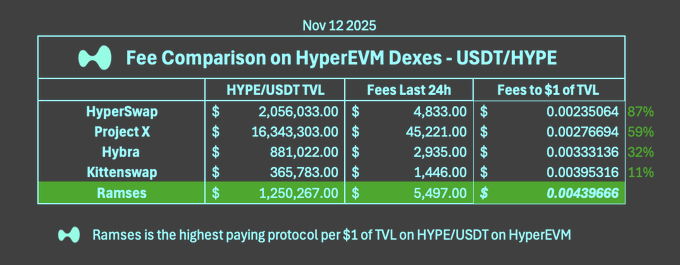

Ramses outperforms competitors by 179% in fee generation per dollar of TVL on HyperEVM through two key innovations:

Dynamic Fee Algorithm

- Real-time fee adjustments based on market volatility

- Monitors DEX + CEX volume, liquidity distributions, and price deviations

- Specialized algorithms for different asset types (volatiles, stables, LSTs)

- Protects liquidity providers from toxic flow during market stress

MEV Internalization

- Frontruns arbitrage opportunities that typically exploit LPs

- Captures value that would otherwise leak to external arbitrageurs

- Reduces adverse selection costs for liquidity providers

The system adapts in real-time: spiking fees during volatile periods to shield LPs while monetizing volatility, then optimizing for smooth trading during stable markets.

Cross-venue visibility gives Ramses an edge - tracking CEX flows and price deviations across all venues including HyperCore spot trading.

Result: LPs earn more and risk less compared to traditional DEX models.

Our dynamic fee algorithm monitors DEX + CEX volume (HyperCore spot included), liquidity distributions, price deviations, and trade sizes across ALL venues, with specialized algorithms for volatiles, stables, and LSTs—each optimized for unique trading patterns and liquidity

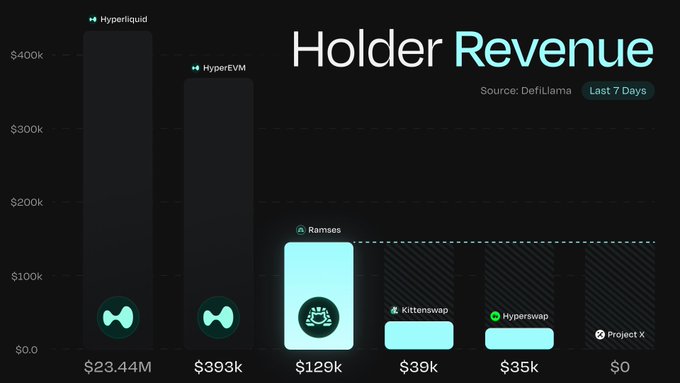

Ramses = Highest holder revenue on HyperEVM! 🐱 How? We give 100% of fees back to holders. ✅ ✅ Gauged pools = 0% protocol fee (~99% of pools) ✅ Ungauged pools = 5% (lowest in market) ❌ Competitors = 10-15% protocol fee on ALL pools Users first, always. HyperRAM.

$RAM is live! 🐱 CA: 0x555570a286F15EbDFE42B66eDE2f724Aa1AB5555 Deposit liquidity in ramses.xyz and prepare to earn $RAM emissions!

Ramses generates up to 179% more fees per $1 of TVL than competitors on HyperEVM—leading in both stable AND volatile market conditions. How? We're the only DEX on HyperEVM with dynamic fees + the only DEX to internalize MEV.

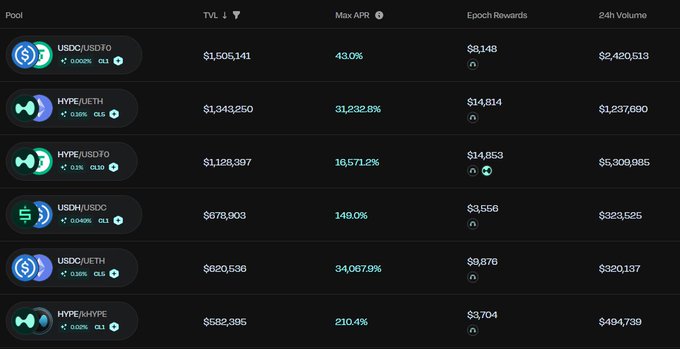

Emissions are now live on Hyper Ramses. Providing liquidity has never been more rewarding on HyperEVM, with a range of options to choose from for a range that suits your risk profile. Earn $RAM & mint xRAM (fully liquid) to vote for your share of fees and incentives. HyperRAM.

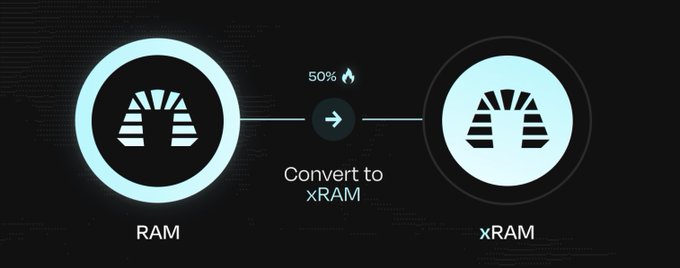

Traditional ve(3,3) exchanges mint tokens to locked positions to offset dilution. Indefinitely—even if the user died. We do the opposite. When users convert to $xRAM, we burn 50% of the underlying RAM to combat dilution, making Ramses the first deflationary (3,3) exchange. 🐱🔥

Ramses is the most efficient exchange on HyperEVM, up to 87% more fees per $1 of TVL than competitors. How? We are the only DEX with dynamic fees. 😼 This will only improve as we scale with emissions and add more aggregator integrations. ☑️ Learn more 👇

RAMSES Achieves Sustainability Milestone with Fees Exceeding Emissions

**RAMSES DEX reaches key sustainability milestone** as fees now exceed emissions for the first time. **Key metrics from latest epoch:** - $59k worth of $RAM converted to $xRAM - $29k worth of $RAM burned in the process - 90,381 $RAM bought and burned via internal MEV bot **Strong performance indicators:** - Revenue of $111k+ surpassed emissions of $104k+ - Trading volume exceeded $117M - Holder revenue reached $83,419 - $hyperRAM ratio increased to 1.077 with 93.27% APR This marks a significant turning point for the ve(3,3) DEX on Arbitrum, demonstrating the protocol's ability to generate sustainable revenue through trading fees while maintaining deflationary tokenomics through systematic burning mechanisms.

🕐 Final Hour Alert

**Voting deadline approaching fast** - less than one hour remains before the current epoch ends at 7pm EST/00:00 UTC. **Action required for xRAM users:** - Vote now to secure rewards - Deadline is imminent **HyperRAM users can relax** - no immediate action needed. **Strong epoch performance:** - Over $113k generated in fees and incentives - Top 3 performers leading the way Don't miss out on rewards - xRAM holders should vote immediately.

NestExchange Pays $25k Bug Bounty After Critical Vulnerability Discovery

**NestExchange paid out a $25,000 bug bounty** after security researchers identified a critical vulnerability in their core contracts that put user funds at risk. The exchange announced the bounty payment this morning following the vulnerability disclosure. **The $25k will be used to incentivize voters this epoch** rather than being retained by the team. Security researchers had reached out to collaborate on details and provide guidance on restoring safety for users and the ecosystem. The quick response and bounty payment demonstrates the platform's commitment to security and community protection. This incident highlights the importance of responsible disclosure and bug bounty programs in maintaining DeFi protocol security.

Security Researchers Identify Critical Vulnerability in NestExchange Core Contracts

Security researchers have discovered a **critical vulnerability** in NestExchange's core smart contracts that poses significant risk to user funds. The researchers are offering to collaborate with the exchange to: - Provide detailed information about the vulnerability - Offer guidance on restoring safety measures - Help protect users and the broader ecosystem This follows a pattern of security incidents in the DeFi space, including a previous multi-signature wallet breach at UXLINK that resulted in significant cryptocurrency theft. That incident required coordination with centralized and decentralized exchanges to freeze suspicious deposits. **Key concerns:** - User funds currently at risk - Need for immediate security patches - Importance of collaborative disclosure The researchers' willingness to work directly with NestExchange demonstrates responsible disclosure practices in the web3 security community.

USDC/USD0 Pool Offers 62% APR on Ramses DEX

**Ramses DEX** is offering **62% APR** on USDC/USD0 liquidity pools with multiple position strategies available. **Pool Options:** - Wide (3 ticks): **30% APR** - Narrow (2 ticks): **44% APR** - Degen (1 tick): **88% APR** The pools generated **$22.7M+ in volume** this week, indicating strong trading activity. **Key Points:** - Higher risk positions (fewer ticks) offer significantly higher returns - Substantial weekly volume suggests good liquidity and trading opportunities - Multiple strategy options allow users to choose risk/reward balance This represents a notable yield opportunity in the current DeFi landscape for stablecoin pairs.