Radiant Enables Auto-Compound Feature Across All Supported Chains

Radiant Enables Auto-Compound Feature Across All Supported Chains

🔥 Auto-Compound Unleashed Across Chains

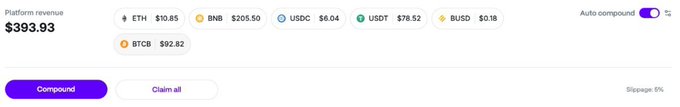

Radiant has recently enabled the auto-compound feature by default for all three chains it supports: BNB Chain, Arbitrum, and Ethereum. This feature aims to simplify the rewards claim process by automatically depositing pending platform revenue into a new locked dLP position, helping users save on gas fees and optimize their protocol rewards for greater yield. Additionally, Radiant has introduced the Relock feature, which ensures that users' dLP positions are always eligible for emissions boost by relocking them upon expiry. Users can manage both features and set their preferred lock length (1, 3, 6, or 12 months) from the 'Manage' page.

Auto-compound was recently enabled by default for all three chains available on Radiant: @BNBCHAIN, @arbitrum , and @ethereum. In this week's #RadiantDimensions, we will delve deeper into this feature, understand how it affects users, and compare it with another one of Radiant’s

Today, the Auto-compound feature has been deployed on @arbitrum and @ethereum, meaning that it is now available on all three chains! Friendly reminder: Bounty contracts for Ethereum rewards will be paused for 48 hours, ensuring a seamless transition for users. Users can manage

Autocompound for Radiant Platform Rewards is now live on @BNBCHAIN ! Going forward, Radiant emissions to dLP lockers will be autocompounded by default. Radiant users will be able to turn off this option, or enjoy compounding with no hassle.

Autocompound for Radiant Platform Rewards is now live on @BNBCHAIN ! Going forward, Radiant emissions to dLP lockers will be autocompounded by default. Radiant users will be able to turn off this option, or enjoy compounding with no hassle.

RIZ v2 Redesign Promises 10x Faster Market Deployment

**RIZ v1 Results & Limitations** Radiant's isolated markets proved the concept works but revealed critical scaling issues: - Each market requires 4-5 smart contracts - Deployment takes days to weeks with extensive configuration - Manual parameter tracking and complex liquidity monitoring create high overhead - Result: only 4-6 markets per chain with slow listings and high friction **v2 Solution Coming** A complete infrastructure rebuild is underway to address these bottlenecks. The redesign targets 10x faster deployment and cleaner isolation - not just surface-level improvements. Details on the new architecture will be shared next week.

Guardian Fund: DeFi Safety Capital That Actually Works While It Waits

**Traditional vs. Active Protection** Radiant introduces Guardian Fund, a reimagined approach to DeFi safety mechanisms. Unlike conventional safety funds that remain dormant, Guardian Fund capital: - **Generates yield** while maintaining protective function - **Stays composable** across DeFi protocols - **Deploys automatically** when needed When paired with gLP, the system creates a dual-purpose solution where capital simultaneously protects users and produces measurable returns. Risk metrics remain transparent, and participation is open to all users. This marks a shift from passive insurance models to active capital efficiency in protocol safety design.

🛡️ GuardianLP Introduces Risk-Sharing Model for Protocol Protection

Radiant's GuardianLP (gLP) system allows users to deposit ETH into a protection fund in exchange for yield-bearing tokens. The model operates as a transparent risk marketplace where holders earn returns from: - Protocol revenue - Staking rewards - DAO-managed growth strategies The tradeoff: deposited capital can be slashed to cover remediation payouts when needed. gLP tokens are DeFi-composable, meaning they can be used across other protocols while maintaining their yield-bearing properties. This creates a direct alignment between risk-takers and protocol security—holders profit during normal operations but absorb losses during security events.

Radiant Introduces Automated Exploit Compensation System

Radiant has launched an **automated remediation system** for exploit protection: - Users who lock 15% of their deposit value as dLP tokens become eligible for Guardian Fund coverage - If a covered exploit occurs, compensation is distributed automatically and proportionally to affected users - Coverage is capped at 100% of net deposit loss **Example:** A $1,000 deposit requires $150 in locked dLP tokens for full Guardian protection. The system aims to provide seamless security coverage for users across Radiant's omnichain money market.

Radiant Capital Opens 2026 Community Council Elections

Radiant Capital has opened nominations for its 2026 Annual Community Council Election, with a 30-day nomination period now underway. **Key Details:** - Elections are held annually as part of the DAO governance structure - Both self-nominations and community nominations are accepted - Process includes structured review followed by Snapshot ratification **Context:** The protocol has recovered from a previous security incident, rebuilding infrastructure and launching the Guardian Fund. TVL has grown from ~$3M post-incident to sustained levels above $15M. **Council Role:** Elected members will shape proposals, oversee implementation, and represent community interests during what the protocol describes as its most consequential growth phase. [Full election details](https://community.radiant.capital/t/annual-community-council-election-2026/2297)