QuantAMM Launches Blockchain Traded Funds on Aura

QuantAMM Launches Blockchain Traded Funds on Aura

🎯 BTFs: ETFs Evil Twin

QuantAMM has introduced two Blockchain Traded Funds (BTFs) on Aura, built using Balancer v3 technology:

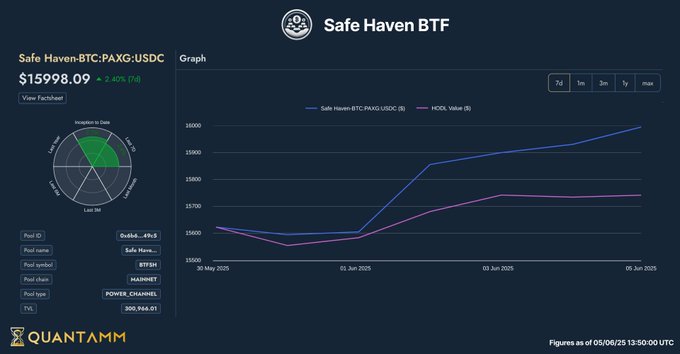

Safe Haven BTF: A dynamic pool of BTC, USDC, and PAXG with automated daily weight adjustments. Currently weighted heavily toward gold at 94% exposure.

Bull BTF: A new offering focused on capturing upward market momentum.

These BTFs function like enhanced ETFs, automatically adjusting asset weights on-chain to optimize for market momentum and volatility management while generating additional yields.

Access the pools:

- Safe Haven: Ethereum Pool

- Bull: Base Chain Pool

Retreat to the Safe Haven or ride the Bull? Blockchain Traded Funds are like supercharged ETFs. They dynamically adjust asset weights onchain to capture momentum and manage volatility. Built by @QuantAMMDeFi on @Balancer v3 with amplified yields on Aura. Safe Haven:

The Safe Haven BTF is now live on Aura! It’s a dynamic blend of $BTC, $USDC, and $PAXG — with weights shifting daily. Lately, gold has taken over, making up 94% of the pool’s exposure. Extra incentives are on the way. 🔗 app.aura.finance/#/1/pool/263

In the past week Bitcoin has been in a bear market trend, while gold has been steady or moving up. The Safe Haven pool has done its job: it is positive both in absolute terms and benchmarked against uniform HODL. LP token price is up ~2.3% in the last 7 days and this is before

vlAURA Vote Incentives Generate Significant Returns

vlAURA lockers earned $108,000 in vote incentives during the latest two-week period through HiddenHand and Paladin vote marketplaces. The program demonstrated strong efficiency, with protocols receiving $1.58 in emissions for every $1 invested. This marks an improvement from the previous epoch which generated $97,000 in rewards and achieved a return ratio of $1.44 per dollar invested. - Current epoch rewards: $108,000 - Return on investment: 1.58x - Previous epoch rewards: $97,000 - Previous return ratio: 1.44x [Lock AURA tokens on Aura Finance](https://app.aura.finance/#/1/lock)

GHO and USDf Launch New Pool on Aura Finance

FalconStable has launched a new GHO/USDf pool on Aura Finance. USDf, their synthetic dollar, is backed by delta-neutral strategies including: - Funding rate arbitrage - Basis trades - Altcoin inventory flows The pool has already accumulated over **$500M in Total Value Locked (TVL)**. This follows earlier GHO integrations on Aura, where GHO-USDC-USDT pools on Arbitrum and Ethereum are earning 17% and 14% APY respectively. [View pool on Aura Finance](https://app.aura.finance/#/1/pool/262)

Portals.fi Launches Aura Pool Integration with Multi-Asset Support

Portals.fi has introduced a new feature enabling users to deposit any asset into Aura pools through their platform. The integration includes: - Direct zapping functionality for seamless pool entry - Historical token data tracking via Portals Explorer dashboard - Real-time pool performance monitoring The update builds on Aura's recent launch of boosted pools, including the GHO/USDC/USDT v3 pool with additional AAVE yields. *Check out the new features at* [Portals Explorer](https://explorer.portals.fi/yield/ethereum%3A0x815d1efecb9cf5cb88b924b60de35ff34d15c9c8)

Frax Finance Launches New v3 Boosted Pools on Optimism

Frax Finance expands its DeFi presence with four new v3 Boosted Pools on Optimism, implemented through Beethoven X: - sfrxUSD/USDC pool offering 11.4% APR - sfrxUSD/WETH pool with 17.1% APR - sfrxETH/WETH pool yielding 9.8% APR - sfrxETH/wstETH/WETH pool at 9.8% APR These pools build on Frax's previous successful launches, including the sfrxETH-sFRAX pool which achieved 45% vAPR on Optimism. Access these pools via [Aura Finance](https://app.aura.finance/#/)