PYUSD Leads Tokenized Asset Growth on Arbitrum

PYUSD Leads Tokenized Asset Growth on Arbitrum

💰 PYUSD's Arbitrum surge

PYUSD has emerged as the leading tokenized asset by market cap growth on Arbitrum. The stablecoin's expansion follows PayPal and Paxos leveraging Arbitrum's infrastructure.

Key factors driving adoption:

- Deep shared liquidity pools

- Fast settlement times

- Low transaction costs

This follows a pattern seen with Spiko's tokenized products (EUTBL and USTBL), which reached $273M+ in total value locked on the platform. The growth demonstrates how platforms offering design flexibility, liquidity depth, and cost predictability attract tokenization projects.

Incredible to see PYUSD leading all tokenized assets in market cap growth on Arbitrum When issuers like @Paxos and @PayPal tap into Arbitrum’s deep shared liquidity, fast settlement and low costs, fast tokenization adoption follows

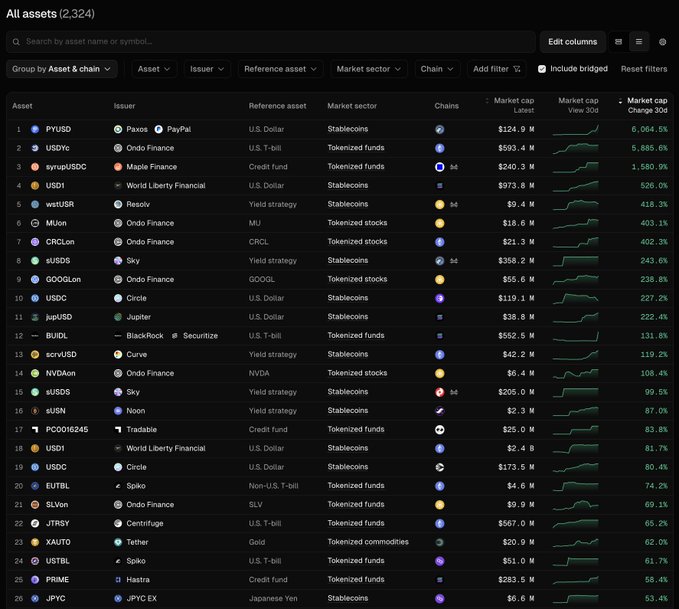

🚨 Fastest growing tokenized asset deployment (among 2,324): PYUSD on @arbitrum, issued by @Paxos and distributed by @PayPal. A leaderboard to follow 👇

Hyve Brings Real-Time Data Infrastructure to Arbitrum

**Hyve has integrated with Arbitrum** to build shared, verifiable data infrastructure for web3 applications. The platform transforms real-time data into a primitive that apps can access, promising: - Faster application performance - Reduced infrastructure overhead - Improved data accessibility Hyve will leverage **Arbitrum's speed, reliability, and deep liquidity** to develop its data economy infrastructure. This follows Arbitrum's recent integration with Pyth's institutional-grade data feeds in January. The move positions Arbitrum as a growing hub for data infrastructure projects in the L2 ecosystem.

Robinhood Chain Testnet Goes Live on Arbitrum Platform

Robinhood has launched its testnet for Robinhood Chain, a dedicated Layer 2 built on the Arbitrum platform. This follows the debut of Stock Tokens on Arbitrum One, which already offers EU users access to 2,000+ tokenized U.S. stocks and ETPs. **Key Features:** - Custom gas token support - Control over fees, throughput, and permissions - Fast confirmations with low costs **Phased Rollout:** - **Phase 1 (Testnet):** Developer onboarding, infrastructure testing, simulated asset flows - **Phase 2 (Mainnet):** Production network with broader access and service migration Robinhood is sponsoring Arbitrum's Open House program to support developers building on the new chain. The testnet allows contract deployment, bridging, and testing of tokenized asset flows without production risk. This represents a shift from traditional brokerage infrastructure to programmable onchain systems, where issuance, execution, and settlement can run continuously with fewer intermediaries. [Start building on testnet](http://robinhood.com/chain) | [Learn more about the roadmap](http://blog.arbitrum.io/robinhood-chain-testnet)

Arbitrum Introduces Multi-Dimensional Gas Pricing Model

Arbitrum is rolling out a **dynamic pricing system** that fundamentally changes how transaction costs are calculated on the network. **Key Changes:** - Moving away from single gas number to multi-dimensional pricing - Separate measurements for compute, storage, and history growth - Designed to eliminate surge pricing patterns - Tracks real network bottlenecks instead of aggregate demand **Why It Matters:** The new model aims to create more predictable and sustainable scaling by pricing different resource types independently. This approach could smooth out the fee spikes that have plagued L2s during high-traffic periods. The system represents a shift toward resource-specific pricing that better reflects actual network constraints. [Read the full technical roadmap](https://blog.arbitrum.io/dynamic-pricing-update-2026/)

Arbitrum One Stabilizes Enterprise Fees Through Dia Upgrade

Arbitrum One has implemented new gas targets and adjustment windows through its ArbOS Dia upgrade, addressing a critical need for enterprises: **predictable transaction costs during high-demand periods**. **Key improvements include:** - Reduced fee volatility under heavy network traffic - More reliable execution environments for institutional users - Enhanced throughput capacity - Mobile-grade authentication support The upgrade represents the first step toward **Dynamic Pricing**, a system where fees will reflect actual resource demand rather than fixed rates. This approach aims to provide transparency while maintaining network stability. For enterprises, the changes mean fewer unexpected cost spikes during peak usage, making Arbitrum One more suitable for production deployments that require consistent performance. [Technical details on ArbOS Dia](https://blog.arbitrum.io/arbos-dia/) [Video breakdown of enterprise benefits](https://youtu.be/DQ03A_C8754?si=Ec9Sb6V8MTdaVO-t)