Pyth Network Launches Market Price Feeds for xStocks Across Multiple Chains

Pyth Network Launches Market Price Feeds for xStocks Across Multiple Chains

🔥 Stocks Never Sleep Now

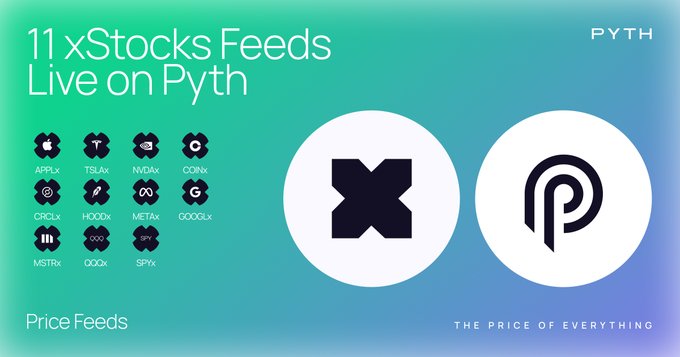

Pyth Network has expanded its services by launching market price feeds for xStocks, tokenized versions of U.S. stocks, across Solana and 100+ blockchains.

The new price feeds cover major stocks including:

- Apple (AAPLx/USD)

- Google (GOOGLx/USD)

- Tesla (TSLAx/USD)

- Nvidia (NVDAx/USD)

- Meta (METAx/USD)

- Popular ETFs (QQQx/USD, SPYx/USD)

This integration enables 24/7 trading and fractional ownership capabilities. Several DeFi applications including Kamino Finance, FlashTrade, and RainFi are set to integrate these assets for perpetuals and lending services.

xStocks go liquid 💦 First came @xStocksFi redemption rates. Now Pyth is publishing market prices for AAPLx/USD and more across @solana and 100+ chains. Builders can lock in on the full picture.

Pyth Network Adds suiUSDe Price Feed Integration

Pyth Network has launched a new price feed for suiUSDe, expanding its oracle infrastructure to support Ethena's synthetic dollar on the Sui blockchain. **What's Available:** - Direct integration access through Pyth's price feed dashboard - Real-time price data for suiUSDe/USD trading pairs - Developer resources at [insights.pyth.network](https://insights.pyth.network/price-feeds/Crypto.SUIUSDE%2FUSD) This follows the recent addition of JUPUSD price feeds in late January, showing continued expansion of Pyth's supported assets. The oracle network provides on-chain price data that protocols use for lending, derivatives, and other DeFi applications. Developers building on Sui can now access reliable price information for suiUSDe, enabling new use cases for Ethena's stablecoin within the Sui ecosystem.

suiUSDe Price Feed Goes Live Across 100+ Blockchains

The **suiUSDe price feed** is now live across more than 100 blockchains. This native yield-bearing stablecoin was developed through a partnership between Sui Network and Ethena. **Key Details:** - suiUSDe combines stablecoin functionality with native yield generation - Price feed provides real-time data across a multi-chain ecosystem - Built on Sui Network infrastructure in collaboration with Ethena The deployment expands cross-chain liquidity options for DeFi applications and traders seeking yield-bearing stablecoin exposure.

Lighter Joins Pyth Pro for Zero-Fee Perpetuals Trading

**Lighter**, a leading perpetual decentralized exchange, has become a Pyth Pro user. The platform offers: - **Zero-fee perpetuals** across multiple asset classes - Trading in **ETFs, commodities, and crypto** - Integration with Pyth's oracle network for price feeds This follows Avantis joining Pyth Pro in late January. Avantis operates on Base and provides traders with up to 500x leverage and zero fees. The trend shows major perp DEXs adopting Pyth's oracle infrastructure to power their trading platforms with reliable price data.

Pyth Infrastructure Ready for Onchain U.S. Equities

Pyth Network has completed infrastructure development to bring U.S. equity markets onchain. The oracle network, known for providing real-time price feeds, now has the technical capability to support tokenized stocks and traditional equity trading on blockchain networks. **Key developments:** - Infrastructure deployment complete - Market conditions favorable for launch - Builds on Pyth's existing oracle capabilities The move positions Pyth to bridge traditional finance with decentralized markets, enabling blockchain-based trading of U.S. stocks.

DouroLabs Explores Tokenization Challenges at Solana Conference

DouroLabs' Head of Business Development will participate in a panel discussion at Solana Conference in Hong Kong, addressing a fundamental challenge in blockchain tokenization. **Key Details:** - **Speaker:** Head of BD at [DouroLabs](https://twitter.com/DouroLabs) - **Topic:** Why comprehensive tokenization requires universal pricing mechanisms - **Date & Time:** February 11, 2026 at 2:30pm GMT+8 - **Location:** Hong Kong Convention and Exhibition Centre, Hall 1A The panel will examine the practical limitations of tokenizing assets on Solana's blockchain infrastructure. The discussion centers on the prerequisite of establishing pricing frameworks before assets can be effectively tokenized. This session builds on ongoing industry conversations about tokenization's potential and constraints. Previous discussions at events like Swiss Web3 Fest have highlighted how tokenization enables novel solutions, while this panel will focus on the technical and economic requirements that must be met first. The presentation offers insights into oracle networks' role in providing the pricing data necessary for tokenization at scale.