Pyth Network representatives joined B33Fbanks to discuss how their oracle solution delivers institutional-grade data directly from sources to Hyperliquid builders.

Key discussion points:

- Direct source data delivery for HIP-3 builders

- Integration with Hyperliquid's ecosystem

- HIP-3.1 Oracle Amendment implementation

This follows Pyth's ongoing collaboration with Hyperliquid to provide high-quality data infrastructure for decentralized applications. The partnership aims to support builders with reliable oracle services through the HIP-3 relayer system.

Background: Pyth has been actively working with Hyperliquid builders to enhance data quality and delivery mechanisms for the platform's growing ecosystem.

Institutional grade data for HIP-3 builders @0xKaco joined @B33Fbanks to discuss how Pyth brings data directly from the source, straight to Hyperliquid.

Thrilled to be supporting builders with Pyth’s HIP-3 Relayer and HIP-3.1 in collaboration with @sedaprotocol. Hyperliquid.

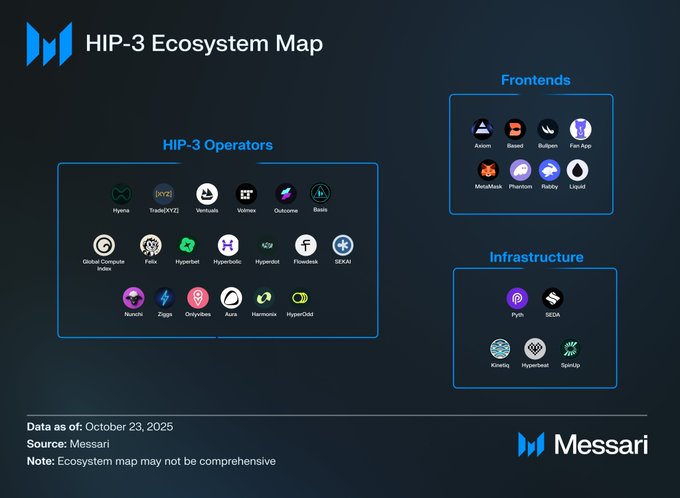

The HIP-3 Ecosystem Map: Full report and projection of year one HIP-3 volumes dropping tomorrow on @MessariCrypto

ICYMI: BD and Ecosystem Lead @0xKaco joined @B33Fbanks to cover the HIP-3.1 Oracle Amendment and where Pyth’s HIP-3 relayer fits in 👇

HyperMeat x @0xKaco of @PythNetwork--HIP3.1? 🥩 ▫️What does HIP3 unlock? 1:16 ▫️@tradeperps $XYZ100 2:05 ▫️Watershed moment 2:29 ▫️HIP3 unlocks 3:43 ▫️Oracle roles with HIP3 4:09 ▫️What is the HIP3.1 proposal? 7:05 ▫️HIP3.1 halting mechanism 8:22 ▫️HIP3.1 configurable price caps

📺 Pyth's TradFi Breakthrough

**Pyth Network is making significant inroads into traditional finance**, with Douro Labs' Head of Institutional BD Mike James appearing on CNBC's Crypto World to discuss the company's progress. **Key developments include:** - Partnerships with major exchanges to create a unified source of financial data - Integration of prediction market data from Kalshi - Collaboration with the U.S. Department of Commerce on GDP data The appearance highlights Pyth's growing role as a bridge between traditional financial markets and blockchain infrastructure. The network continues expanding its data offerings across 100+ chains. [Watch the full CNBC episode](https://youtu.be/uwD7kZgnmB0)

Pyth Launches Grant Program for Entropy Smart Contract Verification

The **Pyth Data Association** has launched a new grant program targeting developers to verify Pyth Entropy smart contracts across multiple blockchain networks. **Mission Overview:** - Verify Pyth Entropy proxy and implementation contracts - Cover both mainnets and testnets across supported chains - Strengthen network transparency and streamline integration **Reward Structure:** - **1,000 PYTH tokens** per eligible chain verified - First-come, first-served basis for each chain - Separate rewards for mainnet and testnet verification **How to Participate:** Developers can access full details and terms through the [official dev forum](https://dev-forum.pyth.network/t/pyth-entropy-smart-contract-verification/442). This initiative builds on Pyth's expanding Entropy ecosystem, which provides on-chain random number generation services across various blockchain networks.

Global Finance Unification Requires Trusted Source Data

**Building unified global financial markets** depends on accessing trusted, verifiable data directly from original sources. The foundation for connecting worldwide financial systems lies in **data integrity and verification**. Rather than relying on intermediaries or processed information, the focus shifts to obtaining financial data straight from its origin. This approach addresses a core challenge in global finance: ensuring that market participants worldwide can access the same reliable information simultaneously. - Direct source data eliminates potential manipulation or errors from intermediaries - Verification processes ensure data authenticity across different markets - Unified access creates more efficient global financial operations The emphasis on **first-party data sources** represents a shift toward more transparent and reliable financial infrastructure, potentially reducing discrepancies between different market regions.

🔮 Pyth Oracle Expands: Hylo Asset Feeds Go Live Across 100+ Blockchains

**Pyth Network** has launched price feeds for three **Hylo assets**: xSOL, hyUSD, and sHYUSD. The feeds are now **live on Solana** and available across **100+ blockchains**, expanding Pyth's oracle coverage. **Key adoptions:** - Kamino selected Pyth for their markets - Loopscale integrated Pyth feeds Developers can integrate these **Hylo price feeds** through Pyth's platform. [Access Hylo feeds](https://insights.pyth.network/price-feeds?search=hylo)