51 blockchains have chosen Pyth to provide real-time price data, enabling high throughput DeFi. Pyth offers price feeds for various tokens including STRK, ZKF, LQTY, METIS, and more on over 50 chains. Additionally, Pyth added 15% more price feeds in January, totaling 469 feeds across digital assets, equities, and commodities.

The Pyth Network is excited to release its MANTA/USD price feed $MANTA is the native token of the @MantaNetwork, the new Modular Layer-2 The Pyth MANTA/USD price feed is now available on more than 50 blockchains, including on Manta powering @LayerBankFi and @zerolendxyz

The Pyth Network is excited to release its DYM/USD price feed $DYM is the native token of @dymension, a Layer 1 network built on the Cosmos SDK toolkit and connected to the Cosmos ecosystem via the IBC bridge The Pyth DYM/USD price feed is now available on more than 50 chains

The Pyth Network is excited to release its ZETA/USD price feed $ZETA is the native token of the @zetablockchain, a public L1 blockchain that enables omnichain, generic smart contracts, that can manage native assets and data on any chain The Pyth ZETA/USD price feed is now

The Pyth Network has released its JOE/USD price feed $JOE is the native token of @TraderJoe_xyz, the one-stop decentralized trading platform on Avalanche and Arbitrum The Pyth JOE/USD Price Feed is now available to smart contract developers on 50 blockchains

The Pyth Network has released its agEUR/USD price feed $AGEUR is a decentralized stablecoin pegged to the value of the Euro - € and is issued through the @AngleProtocol The Pyth agEUR Price Feed is now available to smart contract developers on 50 blockchains

#Pyth Data and its 400+ price feeds permissionlessly available across 50 blockchains 🔮 Pyth will go where the builders build!

The Pyth Network is excited to release its LQTY/USD price feed 🔮 $LQTY, the secondary token of @LiquityProtocol, captures the fee revenue that is generated by the protocol and incentivizes early adopters and frontend operators The Pyth LQTY/USD price feed is now available on

Pyth added 15% more price feeds in January for your trading pleasure That’s 469 total price feeds across digital assets, equities, ETFs, FX, and commodities throughout 50 ecosystems High frequency DeFi is #PoweredByPyth 🔮

The Pyth Network has released its THL/USD price feed $THL is the native token of @ThalaLabs, an Aptos-based protocol enabling users to swap in between assets and take on interest-free loans The Pyth THL/USD price feed is now available on more than 50 blockchains, including the

The Pyth Network is excited to release its DODO/USD price feed $DODO is the token of @BreederDodo, a leading DEX available on more than 10 EVM-based chains The Pyth DODO/USD price feed is now available on more than 50 blockchains

The Pyth Network is excited to release its ZKF/USD price feed $ZKF is the native gas token of the @ZKFCommunity, the first ZK-L2 based on Polygon CDK and Celestia DA, powered by Lumoz, a ZK-RaaS provider The Pyth ZKF/USD price feed is available on more than 50 blockchains,

The Pyth Network is excited to release its USDE/USD price feed 🔮 $USDe is a delta-neutral synthetic dollar, fully-backed, onchain, and censorship-resistant form of money, managed by @ethena_labs The Pyth USDE/USD price feed is now available on more than 50 blockchains

The Pyth Network is excited to release its JUP/USD price feed $JUP is governance token of the @JupiterExchange, the leading DEX aggregator on Solana The Pyth JUP/USD price feed is now available on @solana and more than 50 other blockchains

The Pyth Network is excited to release its MOBILE/USD price feed MOBILE is the token powering @helium 5G project, where 5G Hotspot bundle owners provide network coverage and earn the MOBILE token The Pyth MOBILE/USD price feed is now available on more than 50 blockchains

The Pyth Network is excited to release its ELON/USD price feed 🔮 $ELON is the dog-themed meme coin from @DogelonMars The Pyth ELON/USD price feed is now available on more than 50 blockchains

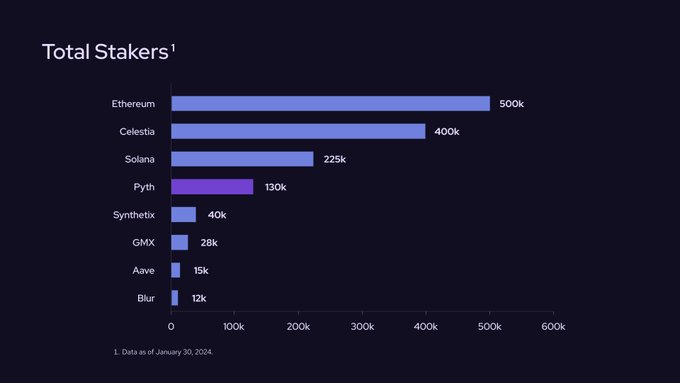

100K $PYTH stakers 🔮

The Pyth Network has released its RETH/USD price feed RETH is the second biggest Ethereum LST with over $1.3B in tokenized assets — RETH is issued through the @Rocket_Pool protocol The RETH/USD price feed is now available to smart contract developers on more than 50 blockchains

Nothing will stop $PYTH stakers

100K $PYTH stakers have mapped their ERC addresses 🗺️

Pyth Data is on the move 💃 Pyth Price Feeds are now available on M1, a community-first blockchain built by @movementlabsxyz powering the Parthenon Testnet. Learn more about our partnership below: ℹ️ About Movement Movement is developing tools and infrastructure to improve

The Pyth Network is excited to release its TENET/USD price feed 🔮 $TENET is the native token of @tenet_org, a Layer-1 Ecosystem for LSDs, dedicated to unlocking liquidity and safely increasing yields The Pyth TENET/USD price feed is now available on more than 50 blockchains

The Pyth Network is excited to release its BLZE/USD price feed 🔮 $BLZE is the governance token of @solblaze_org, a leading provider of $SOL liquid staking derivatives with bSOL The Pyth BLZE/USD price feed is now available on more than 50 blockchains, including @solana

🎤 Pyth Director to Speak at Binance Blockchain Week

**Pyth Network** is participating in Binance Blockchain Week with a key presentation on December 4th. **Key Details:** - PDA Director @KemarTiti will speak about Pyth's price layer technology - Focus on **performance and reliability** improvements for developers - Session scheduled for Thursday, December 4, 12:20-12:50 PM GMT+4 The presentation will explore how Pyth's oracle infrastructure is creating new opportunities for blockchain builders through enhanced data feeds and network performance.

Major Banks and Institutions Adopt Pyth Pro for On-Chain Financial Data

**Major financial institutions are rapidly integrating Pyth Pro** as the oracle network gains momentum in traditional finance. **Key adopters include:** - Revolut (digital banking) - Sygnum (digital asset bank) - CBOE (options exchange) - Integral Corp (market data provider) The trend suggests **institutional appetite for reliable on-chain financial data** is accelerating. Pyth's value proposition centers on making market data "affordable, accessible, and open to all." **Why the adoption surge?** - Need for real-time, accurate price feeds - Growing institutional DeFi participation - Demand for cross-chain financial infrastructure Integral's recent partnership highlights how traditional market data providers are **bridging legacy systems with blockchain infrastructure**. This institutional momentum positions Pyth as a critical piece of financial market infrastructure, potentially becoming the standard for **institutional-grade oracle services**.

FlashTrade Launches US Equities Trading with Pyth Oracle Feeds

**FlashTrade** has gone live with US equities trading, powered by **Pyth's institutional-grade data feeds**. The platform leverages Pyth's oracle network to provide real-time market data for equity trading. This integration brings traditional financial markets closer to the web3 ecosystem through reliable, institutional-quality price feeds. - US equities now available on FlashTrade platform - Powered by Pyth's proven oracle infrastructure - Represents continued expansion of traditional assets into DeFi This launch follows previous developments combining Pyth's data with Seda's composability features for 24/7 equity market access.

🚀 Pyth Reveals Network Evolution at Breakpoint 2025

**Pyth Network** is set to unveil major developments at Breakpoint 2025 in Abu Dhabi on December 12th. **Key Highlights:** - Core Contributor @mdomcahill will present the **next evolution** of the Pyth network - Focus on **Pyth Pro**, described as the network's fastest-growing product - Event takes place at @SolanaConf in the United Arab Emirates The announcement positions this as a significant year-end reveal for the oracle network, suggesting substantial updates to their infrastructure and product offerings. *Stay tuned for what could be pivotal developments in the oracle space.*

🔄 Pull vs Push

**Pyth Network** offers two integration methods for price feeds: **pull** and **push** models. **Key differences:** - Pull feeds: Apps request data when needed - Push feeds: Data streams continuously to apps DevRel Nidhi Singh explains when to use each approach based on your application's specific requirements. **Why it matters:** Choosing the wrong integration method can impact your app's performance and cost efficiency. Watch the [full explainer video](https://youtu.be/25lIVs8b2Ho) to understand which model fits your use case.