The proposal to enable the PSP/OP 80/20 'A Night at the OPara' Gauge on optimismFND has been approved. This is a step towards better aligning liquidity providers and a leap towards sustainable, long-term liquidity for Paraswap.

The proposal to enable the PSP/OP 80/20 "A Night at the OPara" Gauge on @optimismFND has been approved 💜 One small step towards better aligning liquidity providers and a giant leap forward towards sustainable, long-term liquidity for @paraswap x.com/AuraFinance/st…

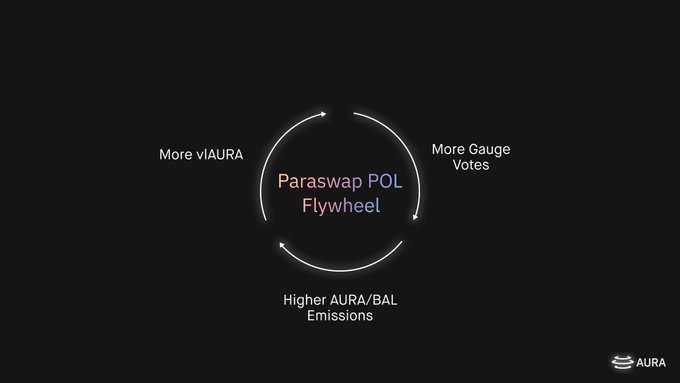

A proposal to bootstrap @ParaSwap OP mainnet liquidity on Aura is live! The mechanics of the proposal seeks to bolster 80/20 PSP/OP liquidity on @OptimismFND Mainnet, boosting rewards for stakers, and allowing ParaSwap to accumulate vlAURA. Let's dive in 🧵

Balancer v2 Composable Stable Pools Hit by Significant Exploit

Balancer's v2 Composable Stable Pools suffered a **significant exploit**, impacting the DeFi protocol's ecosystem. **Key Details:** - Only v2 Composable Stable Pools were affected - Other pool types remain unaffected and operational - Recovery efforts are currently ongoing - Engineering and security teams are actively investigating **Current Status:** Balancer has released a preliminary incident report detailing the exploit. The team is working on recovery while maintaining transparency with the community. **User Safety:** Users should avoid engaging with potential scam messages or phishing attempts that may exploit this situation. The protocol continues operating normally for unaffected pools while addressing the security breach.

**uniETH Pool Delivers 21% Yield as Gas Fees Drop**

The **uniETH | WETH pool** on Mainnet is currently offering **21% vAPR** through Aura Finance. **Bedrock DeFi** originally designed uniETH for institutional users, but an unexpected shift has occurred. With **gas fees routinely under 1 gwei**, DeFi-native users are now the primary beneficiaries capturing this yield. This represents a notable trend where **lower transaction costs** are making institutional-grade products more accessible to retail DeFi participants. [Access the pool](https://app.aura.finance/#/1/pool/222)

slpETH-gtWETHe Pool Launch on Balancer with Aura Rewards

Loop Finance's slpETH, a restaking-powered ETH receipt token designed for auto-leveraged yield, has formed a new partnership with Gauntlet's gtWETHe in a boosted Balancer pool. The pool is now live on Aura Finance offering a 22% variable APR for liquidity providers. - Pool combines two innovative ETH receipt tokens - Available on [Aura Finance](https://app.aura.finance/#/1/pool/256) - Current vAPR: 22% This launch expands the ecosystem of automated yield strategies on Balancer, following successful implementations like Tokemak's Autopilot.

GHO-EURC Pool Launch on Base

A new liquidity pool combining GHO and EURC stablecoins has launched on Base, offering 12% APR. - GHO: Backed by Aave, a leading DeFi lending protocol - EURC: Circle-issued, same team behind USDC - Platform: Available on Aura Finance - Features: Implements Balancer's StableSurge Hook for enhanced swap fees during volatility The pool provides an opportunity to earn yield while supporting euro-denominated stablecoin liquidity on Base. [Join the pool on Aura Finance](https://app.aura.finance/#/8453/pool/22)

Balancer v3 Boosted Pools Launch Multiple Yield Sources

Balancer v3's new Boosted Pools are revolutionizing liquidity provision by offering multiple yield sources in a single vault. Key features include: - **Simplified LP Experience**: Users can access various yield sources through one straightforward position - **Multiple Revenue Streams**: Earnings from trading fees, lending protocols, yield-bearing tokens, and token emissions - **Notable Pools**: - csUSDC | csUSDL pool with Morpho yields - pxETH | WETH pool featuring Dinero and Morpho integration - GHO | USDC | USDT pool earning Aave yields Pools are now live on Ethereum, Gnosis Chain, and other networks via [Aura Finance](https://app.aura.finance).