Propchain Launches Comprehensive Documentation 2.0

Propchain Launches Comprehensive Documentation 2.0

📚 Propchain's Secret Sauce Revealed

Propchain has released an extensive documentation update detailing their real estate tokenization infrastructure. The new Gitbook 2.0 covers:

- Prop.com ecosystem integration and asset origination

- Technical architecture combining blockchain, AI, and IoT

- $PROPC token utility and incentive structures

- Vision 2030 roadmap for global real estate tokenization

This release follows recent recognition in CoinGecko's RWA report and growing institutional interest, with EY projecting tokenized real estate allocations to reach 6% by 2027.

Sustainability isn’t just a narrative — it’s a growing priority for forward-looking capital. At Propchain, we’re building ESG-aligned real estate infrastructure that links environmental efficiency with durable returns. Built for long-term value.

When buildings account for 40% of global carbon emissions, sustainability becomes essential for smart investors. At Prop.com, we're proving that sustainable properties deliver sustainable returns through energy-efficient developments. Book a consultation at

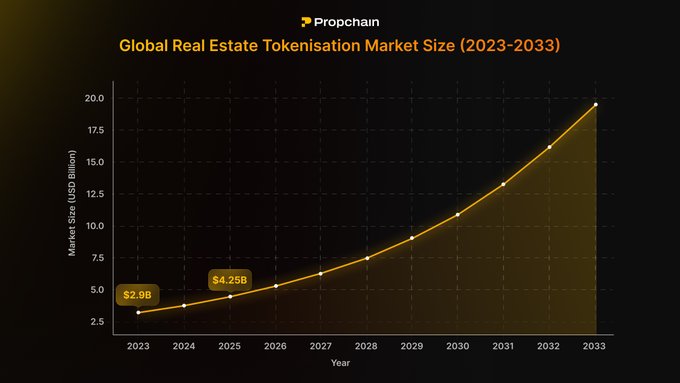

The paper era of real estate is on its way out. According to new research, the global Real Estate Tokenisation Market is projected to grow from $3.5B in 2024 to $19.4B by 2033. Real estate tokenisation isn’t just about fractionalising buildings — it’s about redefining how

Real estate strategy at global scale. @PropGlobal is actively shaping the future of real estate — and Propchain is laying the technological rails beneath it. An institutional-grade strategy: diversified, global, and now coming onchain.

Seven countries. One vision. Global reach. We're mapping the future of institutional real estate investment, one market at a time. #Prop #Investment #RealEstate

$185B in Q1 transaction volume shows one thing clearly: institutional appetite for real estate is accelerating -- even in choppy macro conditions. Propchain is building the rails that let investors access resilient, real-world strategies -- wherever the market stands. Because

Global real estate transactions surged to US$185 billion in Q1 2025—a remarkable 34% year-over-year increase despite broader economic fluctuations. This growth signals strong institutional confidence in premium real estate as a strategic asset class that can deliver value through

The fundamentals are clear: real estate remains a cornerstone of global wealth. At Propchain, we’re enabling institutional grade access to this $700T+ market through compliant, onchain infrastructure. Built for capital preservation, scalability, and long-term value.

Strategic investors are positioning themselves in the evolving global real estate landscape where market fundamentals remain strong despite economic shifts. Institutional capital is flowing toward premium assets with long-term value creation potential. Book a consultation to

Momentum is building. Propchain TVL on @DefiLlama has doubled - now at $8.7M, and growing. Transparent. Verifiable. Live. 🔗 defillama.com/protocol/propc…

Today marks 2 years of Propchain 🎉 From day one, our mission has been clear: reshape real estate through technology. And none of it would’ve been possible without the belief and support of our community, partners, and early adopters. Thank you for being part of the journey.

Distressed real estate, restructured for performance. PropCapital -- a Prop.com vertical -- deploys institutional strategies to turn underperforming assets into secured, income-generating investments. Propchain is building the onchain infrastructure to surface

PropCapital transforms distressed real estate into performing assets through strategic debt solutions. Our institutional approach delivers secured returns with comprehensive risk protection. Book a consultation now at eu1.hubs.ly/H0klRqB0. #Prop #RealEstate #Investment

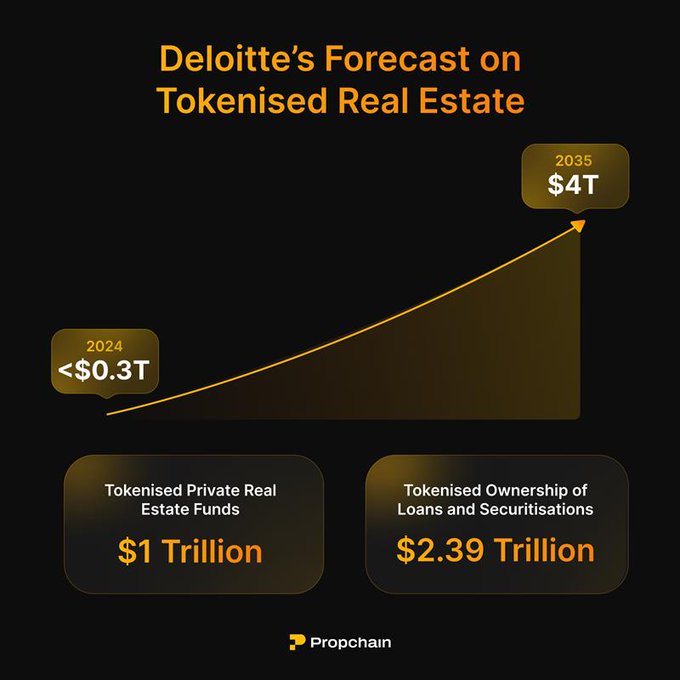

Real estate tokenisation is on a $4 trillion trajectory. @Deloitte projects the market will grow 13x by 2035, led by private funds and securitised debt. This shift isn’t just about putting property onchain. It’s about re-architecting how value moves through real estate - with

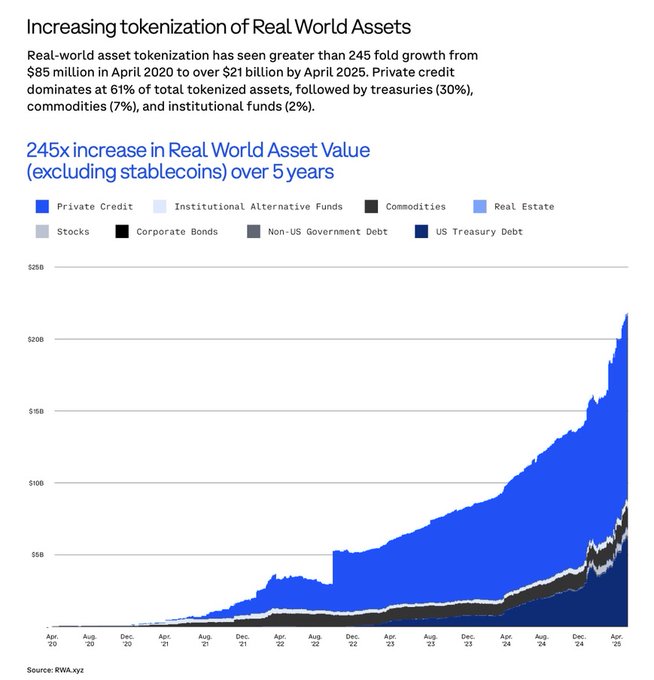

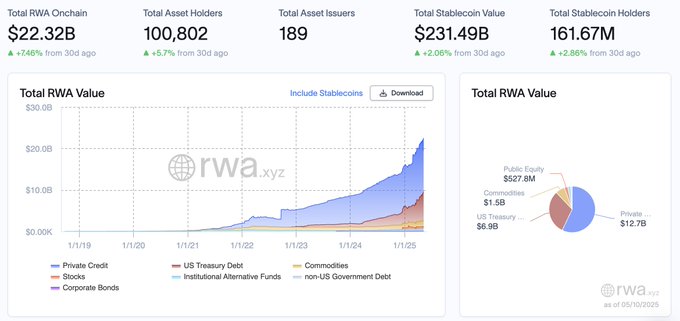

Tokenized real-world assets have grown from $85M in April 2020 to over $21B in April 2025 - a 245x increase in five years. (Source: @RWA_xyz) Real estate is emerging as a key category - offering steady cash flows and direct exposure to real economic activity. @PropChainGlobal

Everything you need to understand Propchain - A quick reminder that Gitbook 2.0 is live. → The Prop.com Ecosystem How our real estate infrastructure powers asset origination and capital deployment at scale. → Propchain Technology The infrastructure layer for

Tokenised real estate is beginning to show up in institutional models — quietly, but measurably. According to @EY, allocation is projected to grow from 1.3% in 2023 to over 6.0% by 2027. Propchain is supporting this shift — by providing onchain access to institutional-grade

Our biggest documentation upgrade yet. From the @PropGlobal ecosystem to Propchain’s technical architecture. From $PROPC utility to the 2030 Vision - It’s all in Gitbook 2.0. Everything you need to know about Propchain is one click away: 📚 docs.propchain.com

A key resource, fully updated. We're proud to announce that Gitbook 2.0 is now live - the new home for Propchain docs: Clearer structure. Cleaner design. Deeper context. Everything you need to understand how Propchain works, and where it's going. Visit 📚

Behind every PropYield product is real operational expertise. PropManagement brings the oversight, optimisation, and institutional discipline that anchors the real-world assets tokenised through Propchain. Stronger fundamentals mean more reliable returns, on and offchain.

PropManagement drives asset performance through strategic optimisation, active oversight, and technological innovation. Our global team combines local market expertise with institutional standards to maximise property value and operational efficiency. From luxury redevelopments

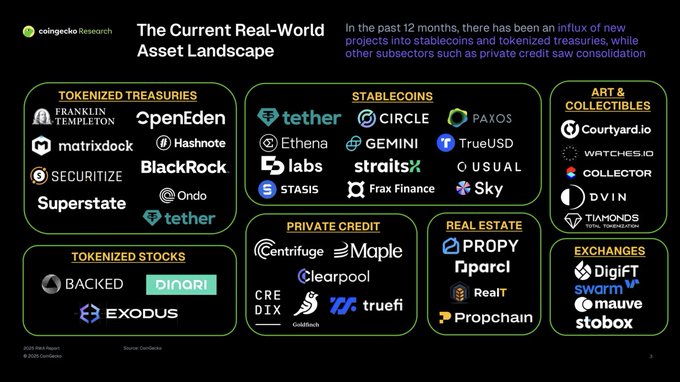

Propchain was featured in @CoinGecko’s latest Real World Assets report, highlighting key players shaping the tokenisation space. We’re glad to be recognised as leaders in the landscape -- and to see institutional-grade onchain real estate gaining wider recognition. 🔖 See full

A key milestone in our journey. Propchain is now LIVE on @DefiLlama - with $4.3M in real estate TVL, tracked and verifiable! 🔗 defillama.com/protocol/propc… The first step in a much larger footprint.

"For Propchain, it unlocks a scalable, compliant environment to grow their ecosystem of tokenized assets." Read the full article about the partnership between @PropChainGlobal and @Nexera_Official below. 🔗nexera.network/news/nexera-an…

🏡 The future of real estate is on-chain. Nexera teams up with @PropChainGlobal, the tech arm of Prop.com, with a real estate pipeline of over €1.1B, redefining access to real estate investments through blockchain. This game-changing partnership will: 🔹 Launch

From vision to validation. Propchain has evolved from niche origins to operating across leading jurisdictions like Dubai, Luxembourg, and Germany — supported by a €1.1B+ real estate pipeline. What began as a product for early adopters is now a platform trusted by

AI Revolutionizes European CRE Distressed Debt Evaluation

The European Commercial Real Estate (CRE) market faces an 86B distressed debt challenge. AI technology is transforming how institutional teams handle non-performing loans (NPLs): - Automated data extraction improving efficiency - Enhanced pricing accuracy through AI analytics - Streamlined evaluation processes Propchain is leveraging these operational insights to bring real estate transactions on-chain, focusing on: - Discounted asset portfolio opportunities - Strategic debt restructuring - Underserved market segments This dual approach aims to unlock value while promoting financial system stability. [Learn more about AI in CRE](http://eu1.hubs.ly/H0kK-k_0)

PropGlobal Capital Markets Head to Host Live Discussion on Real Estate Strategy

Judith Tan, Head of Capital Markets at PropGlobal, will host a live discussion on June 25th at 14:00 CET. Key topics include: - Strategic approaches to real estate capital markets - Structured financing insights - Navigation of distressed market cycles - PropChain's onchain real estate pipeline The livestream, hosted by PropChainGlobal and featuring BD Lead Diarmuid, will explore the institutional mechanisms behind Prop.com and its role in powering PropYield. *Watch live through PropChainGlobal's channels - link to be shared.*

Propchain Launches Comprehensive Documentation Update with Gitbook 2.0

Propchain has released a major documentation upgrade with the launch of Gitbook 2.0. The new documentation hub features: - Detailed insights into the PropGlobal ecosystem - Technical architecture specifications - $PROPC token utility explanations - 2030 Vision roadmap The refreshed platform offers: - Improved structural organization - Enhanced design elements - More comprehensive context - Streamlined user navigation All documentation is now centralized at [docs.propchain.com](https://docs.propchain.com), providing a single source of truth for all Propchain-related information.

PropYield Products Backed by PropManagement Expertise

PropYield's real estate products are underpinned by PropManagement's operational expertise, providing institutional-grade oversight and optimization for tokenized real-world assets on Propchain. - Focus on strong fundamentals for reliable returns - Integration with $700T+ global real estate market - Emphasis on compliant, onchain infrastructure - Built for capital preservation and scalability PropManagement's institutional discipline ensures the stability and performance of tokenized assets, bridging traditional real estate with blockchain technology.