Premia Finance Introduces Put Vaults for Stablecoin Yield Generation

Premia Finance Introduces Put Vaults for Stablecoin Yield Generation

🔑 Unlock Stablecoin Yields

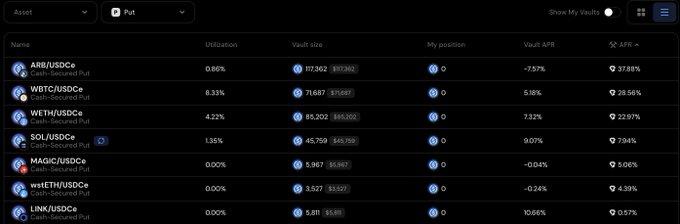

Premia Finance has announced the launch of Put Vaults, allowing users to generate premiums with their stablecoins in both crabbing and bullish markets. These vaults offer yield on top of the PREMIA Options liquidity mining rewards. Previously, Premia Finance had introduced Call Vaults, enabling users to earn the underlying asset if the price moves down, providing a hedge for those bullish on an asset in the long term but bearish in the short term.

Our Put vaults, on the other hand, let you put your stables to work. Put Vaults allow users to generate premiums with their stablecoins in crabbing and in bullish markets🦉 This of course with the PREMIA OLM yield on top of it💎 x.com/PremiaFinance/…

Besides the APR from $PREMIA Options liquidity mining, our vaults help hedge your exposure to the markets ⬇️ If you are bullish an asset in the long term, but are bearish in the short term, our call vaults will let you earn the underlying asset if the price moves down🦉

Kyan (Premia v4) Development Update

Premia's upcoming v4 release, Kyan, is advancing with significant features announced: - **Portfolio Margin System**: Calculates risk across entire portfolios, managing Initial Margin (IM) and Maintenance Margin (MM) for liquidation risk - **Perpetual Futures Integration**: First DEX to seamlessly incorporate perps as core risk management tools - **Key Features**: - Advanced combo trade system with strategy builder - Sub-account functionality - Portfolio margin capabilities competing with tier-1 exchanges Detailed documentation available in [Premia's blog posts](https://blog.premia.blue/) covering features, margin systems, and combo trades.

ETH and BTC Hit New Highs as ETH Takes Center Stage

ETH reached nearly $4,300 while BTC topped $122k in recent market movements. ETH has shown exceptional performance, outpacing most altcoins and even BTC in trading volume. Multiple positive factors supported ETH's rise, including new ETH Treasury companies and increased media presence of ETH founders. Key market indicators: - 86.4% chance of September rate cut - 95% chance of October cut - 99% chance of December cut BTC volatility (Deribit's DVOL) is approaching all-time lows, last seen in Aug/Sept 2023. Traders are advised to exercise caution as 50% price swings can occur in either direction. [Read the full analysis](https://blog.premia.blue/p/monday-alpha-50)

Premia x @thinkingvol Monday Alpha: Rektober or Uptober?

The latest Premia x @thinkingvol Monday Alpha report highlights: - Large notional volume traded on Greeks.live Block Trade Marketplace for month-end and quarter-end - Increased options activity, with players targeting various ETH October strikes - Larger players extending positions to 100k strikes into March - 2-week crypto returns underperforming, contradicting 'Uptober' expectations - Only meme coins showing positive performance - Anticipated market indecision towards month-end due to U.S. presidential race, potentially increasing volatility across term structure For detailed analysis and charts from @velodata and trades from @greekslive Block Marketplace, visit the full blog post.

Premia v4: Enhancing DeFi Trading Experience

Premia is set to release v4 of its platform, addressing DeFi's UX challenges and introducing new features: - Multi-leg options strategies and efficient order matching - Perpetual futures contracts - Portfolio margin for improved capital efficiency - Smart accounts for managing multiple products - Chain-abstraction for cross-chain interactions These updates aim to empower traders and maximize efficiency in DeFi trading. Premia continues its journey of innovation, building on its history of developing on-chain options matching engines. For more details, visit: https://blog.premia.blue/p/premia-v4-in-september

Archetype Blue Introduces Active Protection for Simplified Hedging

Archetype Blue has launched a new feature called Active Protection, aimed at simplifying hedging for users. This development represents an evolution in the Premia ecosystem, potentially offering more accessible risk management tools for crypto investors. Key points: - Active Protection is designed to make hedging more user-friendly - The feature is part of Archetype Blue's ongoing innovations - It may help lower the barrier to entry for crypto risk management For more details on how Active Protection works and its potential benefits, users are encouraged to check out the full blog post on the Premia Blue website.