A prediction about Ethereum 4844 suggests Blob will be cheaper than calldata on mainnet. Users urged to be cautious with L2 upgrades, conduct audits and have backup plans. Scroll has prepared for the upgrade to reduce fees, maintain security. Concern raised about projects launching without audits, testnets or proper security measures in the current bullish market.

My slightly controversial prediction about 4844: 1) Blob will be 3-5x cheaper than calldata (the number comes from Goerli testnet), Polymarket doesn’t have big enough counter party. Hopefully, there won’t be blob-inscription to further compete with Rollups 😂 2) It’s super

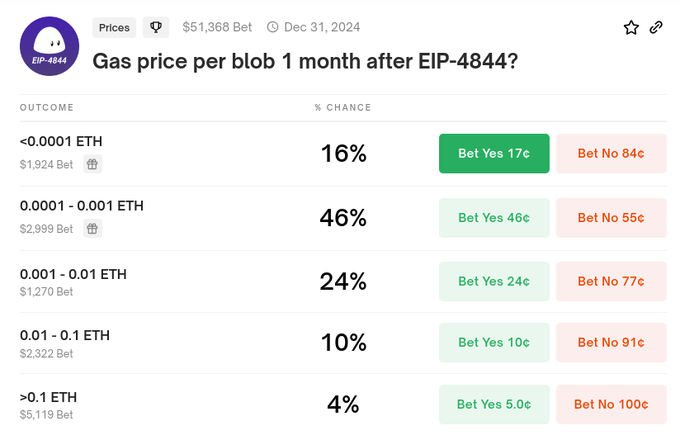

Polymarket is predicting that blobs (~125 kB) will cost ~0.001 ETH. Today, 125 kB calldata costs ~30 gwei per gas * 16 gas per byte * 125000 gas ~= 0.06 ETH And if you think polymarket's guess that blobs will be 60x cheaper is over-optimistic, you can use the market to hedge!

ChatterPay Presents WhatsApp Crypto Integration at DAO Governance Call

ChatterPay demonstrated their WhatsApp-based crypto payment solution at a weekly DAO governance call. The platform enables crypto transactions through WhatsApp messages without requiring additional app downloads. **Key Discussion Points:** - Traction metrics and current product features - Launch of Ambassador Program - 2026 development roadmap - Active delegate participation with questions and collaboration proposals The session highlighted the DAO's collaborative approach, with ecosystem projects presenting updates and delegates engaging in substantive discussions about potential partnerships. Weekly DAO & Governance Calls are open to all participants and take place every Wednesday at 3pm UTC.

Scroll DAO Delegate Accelerator Program Completes 7-Week Training Initiative

The **Scroll DAO Delegate Accelerator** has concluded its comprehensive 7-week program, with StableLab releasing a full roundup of achievements and outcomes. The program trained **20+ selected delegates** from a competitive applicant pool, focusing on: - DAO governance fundamentals - Active contribution to ecosystem growth - Hands-on learning with expert tutors **Key partners** included StableLab, SEEDGov, and Factory Labs as program tutors. The initiative aimed to build lasting governance knowledge within the Scroll community, equipping delegates with skills to effectively participate in DAO decision-making processes. StableLab's comprehensive report details the program's impact and lessons learned from this governance education experiment.

Scroll Launches Cloak: Privacy-Focused Validium for Institutional Crypto

**Scroll introduces Cloak**, a new validium designed to bring privacy back to crypto transactions while maintaining institutional compliance. **Key Features:** - Uses **ZK proofs** to validate transactions without revealing underlying data - **RPC Authentication Proxy** adds compliance, audits, and controlled access for institutions - Maintains **EVM compatibility** for seamless developer experience **How It Works:** - Integrates with existing tools through **ERC-4361** (Sign In With Ethereum) - RPC Proxy manages asset access using **JWTs** and standard EVM calls - Balances user **confidentiality** with institutional **control requirements** Cloak addresses the critical need for privacy in crypto while ensuring institutions can meet regulatory and audit requirements. The solution preserves the familiar Ethereum development environment. [Learn more about Cloak](https://scroll.link/privacy) | [Technical breakdown](http://scroll.link/privacy-blog)

Scroll Launches 7-Week Delegate Training Program

Scroll has launched a comprehensive Delegate Accelerator program to train the next generation of effective DAO delegates. The 7-week curriculum includes: - Interactive workshops - One-on-one mentorship with veteran delegates - Practical experience through mock voting - Skill-building through gamified challenges **Key Details:** - Application deadline: June 23rd - Program focus: DAO governance and delegation - Goal: Building the Open Economy [Apply for the program here](https://app.deform.cc/form/5e670c2f-179c-4041-a37c-037216e5b8c2/?page_number=0)

Tempest Finance Launches AI-Powered Vaults on Ambient Finance

Tempest Finance has launched AI-powered vaults on Ambient Finance, offering users simplified liquidity management through one-click optimization. The vaults are now natively deployed on the Scroll network. Key features: - Single-click liquidity management - AI-powered optimization - Native integration with Ambient's web frontend - Full deployment on Scroll network The integration streamlines DeFi operations for users seeking efficient portfolio management without complex manual adjustments.