Prediction Markets Face Verification Challenges

Prediction Markets Face Verification Challenges

🔮 Prediction markets' trust issues

Decentralized prediction markets are grappling with the challenge of verifying real-world outcomes. This issue highlights the critical need for robust, decentralized systems in building trustworthy prediction platforms.

Key points:

- Outcome verification is a major hurdle for prediction markets

- Decentralized systems are crucial for building verifiable markets

- UMA's Optimistic Oracle is being used by Polymarket to address this challenge

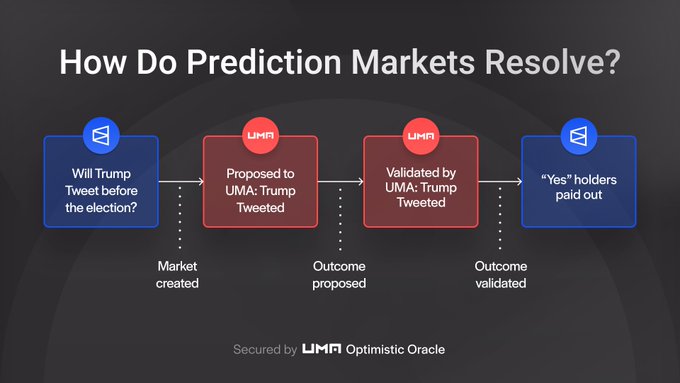

The Optimistic Oracle employs a three-step process: 1. Proposal submission 2. Challenge period 3. Decentralized dispute resolution if challenged

This system aims to ensure fairness and trustworthiness in prediction markets by relying on decentralized consensus rather than centralized decision-making.

Prediction markets are the first apps to take DeFi mainstream. Now, they’re evolving... Introducing @PredictDotFun. Live on @blast Secured by UMA

The Predict beta just went live on @blast! Put your money where your mouth is and predict the outcomes of the presidential elections and upcoming crypto prices.

Tweet not found

The embedded tweet could not be found…

UMA is the industry standard oracle for prediction markets. 🔮 Trusted by leading platforms including @Polymarket, our decentralized system is designed to verify real-world outcomes and settle prediction markets onchain. ✅

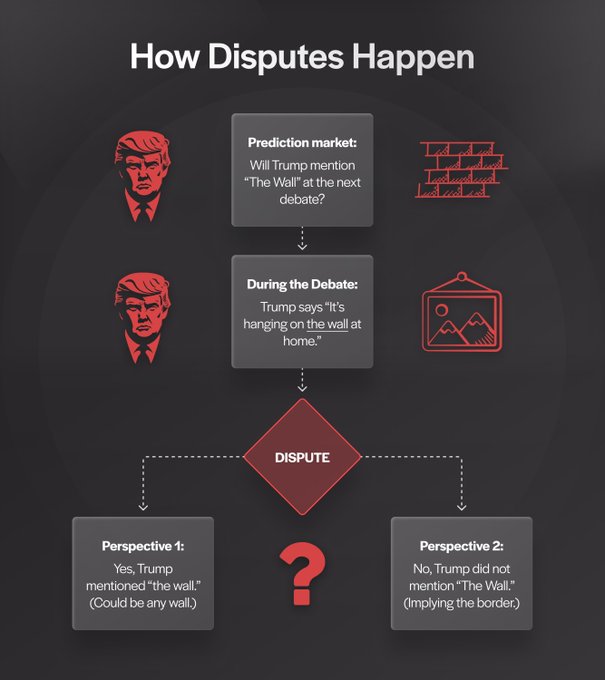

How do disputes happen in prediction markets? 🔮

UMA’s Optimistic Oracle is live on @Blast. Now you can validate ANY data on Blast using UMA. Build anything including prediction markets, fast bridges, insurance protocols, and more. What will you build on Blast? 💪

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

How UMA's Optimistic Oracle Secures Prediction Markets 🧵 📝 The Optimistic Oracle plays a crucial role in securing and resolving prediction markets, like @Polymarket. Decentralized prediction markets face the hard problems of getting the outcomes of real-world events onchain

Prediction markets face a major challenge… verifying outcomes Discover why decentralized systems are essential for building verifiable prediction markets 🧵 👇

Prediction market disputes are inevitable, but platforms can minimize risk: 🔴 Provide clear YES/NO conditions 🔴 Define credible resolution sources 🔴 Clarify ambiguous rules Proactive measures like these, pioneered by @Polymarket, help prevent disputes before they arise.

Prediction markets are fun, but disputes aren’t. It’s a zero-sum game and intersubjectivity is inevitable, especially when the stakes are high. So, what is the best way to resolve prediction market disputes? Read our comprehensive overview: blog.uma.xyz/articles/what-…

The ever-growing challenge in prediction markets is disputes 🔮 Learn how UMA's Optimistic Oracle is setting the standard for decentralized dispute resolution 👇👇👇 blog.uma.xyz/articles/what-…

Are you ready for another prediction market? 👀 @predictdotfun is the first prediction market building on @blast. They will be using the Optimistic Oracle to settle markets and resolve disputes securely. 💪

Ready for the first prediction market on @blast? @predictdotfun goes live on Tuesday! Secured by the Optimistic Oracle 🔮

𝙿𝚛𝚎𝚍𝚒𝚌𝚝 𝚐𝚘𝚎𝚜 𝚕𝚒𝚟𝚎 𝚘𝚗 𝚃𝚞𝚎𝚜𝚍𝚊𝚢, 𝚂𝚎𝚙𝚝𝚎𝚖𝚋𝚎𝚛 𝟹, 𝚠𝚒𝚝𝚑 𝟾𝟽𝟿,𝟶𝟶𝟶+ 𝙱𝚕𝚊𝚜𝚝 𝙶𝚘𝚕𝚍 𝚎𝚊𝚛𝚖𝚊𝚛𝚔𝚎𝚍 𝚏𝚘𝚛 𝚕𝚒𝚚𝚞𝚒𝚍𝚒𝚝𝚢 𝚙𝚛𝚘𝚟𝚒𝚍𝚎𝚛𝚜 𝚒𝚗 𝚒𝚝𝚜 𝚏𝚒𝚛𝚜𝚝 𝚖𝚘𝚗𝚝𝚑 — 𝚊𝚗𝚍 𝚗𝚊𝚝𝚒𝚟𝚎 𝚢𝚒𝚎𝚕𝚍 𝚎𝚊𝚛𝚗𝚎𝚍 𝚘𝚗 𝚎𝚟𝚎𝚛𝚢 pic.x.com/1SzGTKnGAn

Within days of announcing the Optimistic Oracle's @blast deployment, @predictdotfun is already building a prediction market platform using it 🔮 Who’s next? 🤔

UMA’s Optimistic Oracle is live on @Blast. Now you can validate ANY data on Blast using UMA. Build anything including prediction markets, fast bridges, insurance protocols, and more. What will you build on Blast? 💪

🏛️ UMA Launches Library to Preserve Prediction Market History Onchain

UMA has introduced **Library of UMA** ([library.uma.xyz](http://library.uma.xyz)), a permanent onchain archive designed to preserve prediction market data and world history. **Key Features:** - Immutable storage of prediction market outcomes and historical events - Protection against data erasure or manipulation - Built on UMA's oracle infrastructure that powers platforms like Polymarket The initiative addresses a growing need for permanent records as prediction markets become increasingly important information sources. By storing data onchain, the Library ensures that historical outcomes and market resolutions remain accessible and verifiable indefinitely. UMA's oracle system already secures significant value across prediction markets and cross-chain bridges like Across Protocol. The Library extends this infrastructure to create a permanent historical record that cannot be altered or deleted.

Polymarket's Complete Question History Now Permanently Recorded On-Chain

Polymarket has archived its entire question history on an immutable blockchain ledger. Every prediction market question the platform has ever posed is now permanently recorded on-chain, creating a transparent and tamper-proof historical record. This move represents a significant step toward full on-chain transparency for prediction markets. The immutable nature of blockchain ensures that the complete archive of questions cannot be altered or deleted, providing researchers and users with a permanent reference point. The initiative builds on earlier efforts to record platform data on-chain, extending the scope to encompass the platform's complete question catalog. This creates accountability and enables long-term analysis of prediction market trends and accuracy.

Delphi Digital Launches Research Markets on Polymarket

**Delphi Digital** has launched prediction markets on **Polymarket**, secured by UMA's optimistic oracle technology. - The markets focus on industry research outcomes - UMA provides the oracle infrastructure ensuring market security - This represents a new approach to research validation through prediction markets The integration combines Delphi Digital's research expertise with Polymarket's prediction market platform and UMA's decentralized oracle system.

UMA Doubles Minimum Stake Requirement for Voting Gas Rebates to 1000 Tokens

**UMA increases voting participation barrier** Starting November 1st, UMA voters need to stake **1000 $UMA tokens** (up from 500) to qualify for gas rebates. This follows the initial introduction of minimum staking requirements in February 2025, when rebates shifted from universal coverage to requiring 500+ tokens. **Key changes:** - Minimum stake doubles from 500 to 1000 $UMA - Gas rebate eligibility becomes more restrictive - Change reflects ongoing cost management efforts The adjustment continues UMA's strategy to control rebate expenses, which previously surged 5x since July 2024. Full details: [docs.uma.xyz/using-uma/votin](https://docs.uma.xyz/using-uma/votin)

UMA's Optimistic Oracle Secures Polymarket with Real-World Data

**UMA's Optimistic Oracle** brings real-world data onchain to secure prediction markets like Polymarket. The system works through **three key steps**: - **Proposal**: Event outcomes are submitted to the oracle - **Challenge Period**: Proposed outcomes can be disputed within a set timeframe - **Resolution**: Challenged outcomes trigger decentralized dispute resolution This **decentralized approach** eliminates single points of failure, ensuring fair and trustworthy market outcomes through consensus rather than centralized control. **Key achievements**: - Resolved over **10,000 markets** for Polymarket - Secures multiple prediction platforms including poly_bet, ForeProtocol, and predictdotfun The Optimistic Oracle addresses prediction markets' core challenge: **accurately determining real-world event outcomes onchain** while maintaining decentralized integrity.