Polygon's AggLayer: Enabling Near-Instant Cross-Chain Transactions

Polygon's AggLayer: Enabling Near-Instant Cross-Chain Transactions

🔑 Mind-Blowing Cross-Chain Solution

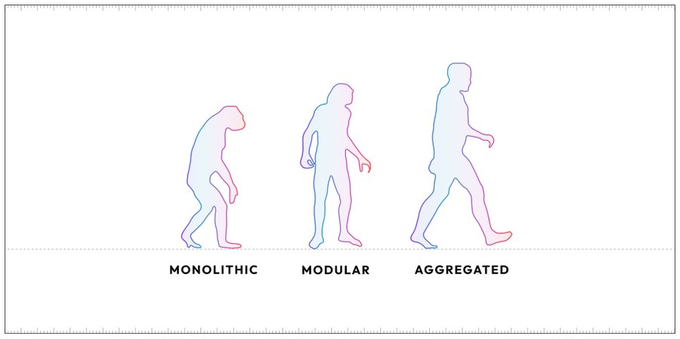

Polygon has introduced AggLayer, a decentralized protocol that aggregates zero-knowledge (ZK) proofs from connected chains, enabling near-instant cross-chain transactions without bridging. This allows users to seamlessly interact with dApps and purchase non-fungible tokens across different connected chains. AggLayer provides benefits for Layer 1 and Layer 2 networks by tapping into a unified liquidity pool, making it easier to bootstrap liquidity. For dApp developers, users from aggregated chains can interact without bridging. End-users benefit from a more internet-like experience without frequent bridging, enabling chain abstraction. The future goal is to onboard more chains, further simplifying Web3 interactions.

AggLayer for people who slept on it (like me) What is Agglayer It’s a decentralized protocol from @0xPolygon that aggregates ZK proofs from all connected chains and ensures safety for near-instant cross-chain transactions. Basically, you can buy non-fungible tokens on a

What is the future of Web3? What is chain abstraction? Why modularity will win? Learn answers to these questions with @_bfarmer, Co-founder of @0xPolygon in the new @epicweb3 podcast! This episode is part of the @therollupco & @ayyyeandy Modular March! Tune in below:

🏆 Polygon Processes $100M in Tokenized Commodities

**Polygon has processed $100 million in tokenized commodities**, marking a significant milestone in bringing real-world assets on-chain. This achievement comes as the tokenized commodities market continues to expand, with over **$1.2 billion in tokenized gold** and **$7 million in tokenized silver** already circulating globally. Key players in this space include: - **MatrixDock** and **Aorus Official** leading tokenization efforts - **Polytrade marketplace** enabling redemption of tokenized silver and gold through RAGMI The growth demonstrates increasing institutional and retail adoption of blockchain-based commodity trading, offering benefits like: - Fractional ownership of precious metals - 24/7 trading accessibility - Reduced custody and storage costs - Enhanced liquidity for traditionally illiquid assets This milestone reinforces Polygon's position as a leading platform for real-world asset tokenization.

JPYC Lending Markets Launch on Morpho via Polygon

**JPYC lending markets are now operational on Morpho**, marking a significant expansion for Japanese yen-pegged stablecoin lending in DeFi. **Key Details:** - Partnership between Morpho, Steakhouse Financial, and PAOTECH Labs - Exclusively available on Polygon network - Enables users to lend and borrow JPYC tokens This launch expands Morpho's lending infrastructure following their previous integration with Coinbase DeFi lending in October 2025. The Polygon deployment offers users access to yen-denominated lending markets with the network's lower transaction costs.

🤖 Polygon Adopts ERC-8004 Standard for Trustless Agent Transactions

Polygon is implementing **ERC-8004**, a new standard designed to enable trustless agents and reliable onchain money movement at scale. The standard addresses a critical gap in web-based payments: establishing trust and reputation for payment agents. ERC-8004 creates a **portable on-chain reputation system** that works across different platforms. A new discovery tool, [8004scan.io](http://8004scan.io), has launched to help users verify agent reputation and validation history before conducting transactions. The platform currently supports Ethereum, Base, and Polygon testnet. This development combines payment infrastructure with a trust layer, forming what developers call "the agent economy stack" - essential infrastructure for scaling automated onchain transactions with verified, trustworthy intermediaries.

Polygon Emerges as Leading Rail for x402 Agentic Payments

Polygon has become a preferred infrastructure for x402 agentic payments, offering fast, affordable, and predictable stablecoin transactions. **Key Features:** - Transaction speeds under one second - Costs as low as $0.001 per transaction - Universal compatibility across platforms The network's efficiency has made it a go-to choice for x402 facilitators and agentic commerce applications seeking reliable payment rails for internet-native transactions.

Polymarket Expands with Major Announcement on Onchain Infrastructure

Polymarket has announced significant developments in bringing mainstream demand to prediction markets through onchain infrastructure. **Key Points:** - The platform is leveraging blockchain rails to scale its operations - This follows their recent expansion to the Based network in November - The move signals growing institutional and mainstream interest in decentralized prediction markets The announcement emphasizes Polymarket's continued focus on making prediction markets accessible to a broader audience while maintaining decentralized infrastructure.