Polygon Processes $1.82B in Q3 Payments Across 50 Platforms

Polygon Processes $1.82B in Q3 Payments Across 50 Platforms

💳 Polygon's payment dominance

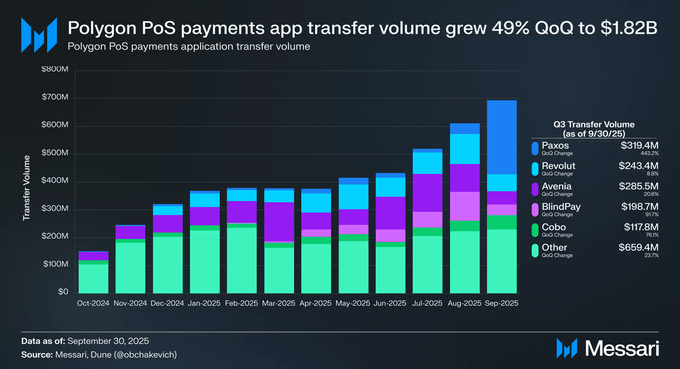

Polygon dominated payments in Q3 2025 with $1.82B processed across 50 platforms, marking a 49% increase from Q2.

Key highlights:

- Stablecoin-linked crypto card volume reached $322M via Visa and Mastercard

- POL market cap grew 39% to $2.36B (vs 21% for total crypto market)

- Stablecoin supply increased 22% to nearly $3B, driven by USDT's 35% growth

Transaction costs continue falling thanks to the Gigagas roadmap:

- Average POL fee: 0.0114 POL (23.6% lower)

- USD fee: $0.0027 (12.8% lower)

RWA tokenization reached $1.14B with institutional backing from JusToken Global, Betoken, and DBM.

The full Messari report provides comprehensive Q3 data analysis.

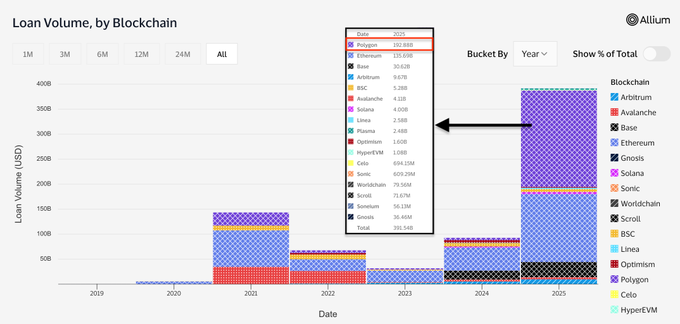

The @Visa x @AlliumLabs report just dropped. Polygon leads all chains in stablecoin lending this year, with $192 B+ in volume. That's more than Ethereum, Arbitrum, Base and Solana. The numbers speak for themselves.

If it’s payments, it’s Polygon. Q3 2025 proved it. Payments apps moved $1.82B on Polygon across 50 platforms. Up 49% from Q2 And stablecoin-linked crypto card volume grew to $322M across Visa and Mastercard The @MessariCrypto Polygon Q3 report is out, with much more data to

World's First Yen-Pegged Stablecoin Launches on Polygon

Japan has officially launched the **world's first yen-pegged stablecoin** on Polygon, marking a significant milestone for both Japan's digital currency adoption and Polygon's ecosystem. Key developments: - JPYC received approval as Japan's first fully backed stablecoin - **1:1 peg** to the Japanese yen ensures stability - Built on Polygon for low fees and fast settlement This launch represents a shift from experimental digital payments to **government-backed adoption** of stablecoins. The move demonstrates how traditional financial systems are integrating blockchain technology for real-world use cases. Polygon's infrastructure provides the necessary foundation with its low transaction costs and global accessibility, making it an attractive platform for institutional stablecoin deployments.

Polygon Rio Upgrade Goes Live with Near-Instant Finality

Polygon's **Rio upgrade** is now live on mainnet, delivering the network's biggest payments upgrade to date. **Key improvements include:** - Near-instant finality with zero reorg risk - Increased throughput capacity heading toward 5k TPS - Lighter validator nodes reducing operational costs - New Validator-Elected Block Producer (VEBloP) architecture The upgrade introduces **one-block finality** through stateless block validation, where validators elect a single producer per span. This eliminates reorganization risks that previously caused delays for exchanges and payment applications. **Real-world impact:** Payment service providers gain higher capacity, while P2P apps can offer faster asset availability. The lighter node requirements lower barriers for validators and builders seeking direct network access. Rio represents a major milestone in Polygon's **gigagas roadmap**, positioning the network as infrastructure for global payments and real-world assets. [Read the full technical details](https://polygon.technology/blog/polygon-launches-major-payments-upgrade-with-rio-faster-lighter-and-easier-to-build)

StableFlow Launches Cross-Chain Bridge for Million-Dollar Stablecoin Transfers to Polygon

**StableFlow** has launched a new bridging solution that enables **effortless stablecoin transfers** from any blockchain to Polygon. Key features: - Transfer amounts **up to $1M+** - Works from **any source chain** - Direct integration with **Polygon network** This follows StableFlow's previous launch of one-click transfers to Arbitrum, expanding their cross-chain infrastructure. The service aims to **simplify DeFi operations** by removing traditional bridging complexity for large stablecoin movements.

🚂 Money Rails Summit Approaches Buenos Aires

**Money Rails**, a one-day summit focused on the future of onchain payments, is set for **November 18** in Buenos Aires. The event brings together builders of global finance to discuss payment infrastructure and networking opportunities. Attendees will participate in: - Panel discussions on payment systems - Networking sessions - Access to payment industry insights The summit runs from **11:00-18:00** at the Devconnect Main Venue in Buenos Aires, Argentina. **Registration is free** for Devcon ticket holders. To register: 1. Visit [devconnect.org/calendar](https://devconnect.org/calendar?event=moneyrails) 2. Verify your Zupass Devconnect ticket 3. Register for your free Money Rails ticket Alternatively, register directly at [moneyrails.io](https://moneyrails.io/) The event is organized by Polygon Labs as part of the broader Devconnect conference activities.