Pendle Protocol Offers Protection for DeFi Investments

Pendle Protocol Offers Protection for DeFi Investments

🔒 Secure Your DeFi Yields

Pendle Protocol is offering bundled protocol cover to protect users' investments in various DeFi protocols against smart contract risks such as hacks and exploits. The cover provides coverage across multiple protocols, including EigenLayer, KelpDAO, Pendle, Zircuit staking contracts, and others. Users can purchase the bundled protocol cover on platforms like Nexus Mutual and OpenCover. The cover aims to provide peace of mind for users earning high yields in DeFi by safeguarding their deposits against potential risks.

Arbitrum enjoooyers earning fixed yield on $rsETH in the Pendle markets can safeguard their deposits against smart contract risk with coverage from Nexus Mutual 🛡️ EigenLayer + KelpDAO + Pendle Bundled Protocol Cover provides protection across all 3 protocols! Learn more 👇

Looking to get deep in the weeds on $rsETH (Zircuit) Fixed Yield? Be sure to protect your position against smart contract risk with KelpDAO (Zircuit) Pendle Bundled Protocol Cover, w/ coverage for: 🔹 EigenLayer 🔹 KelpDAO 🔹 Pendle 🔹 Zircuit staking contract Learn more 👇

In the $eETH (Zircuit) Fixed Yield Market on Pendle earning double-digit yields? Protect your deposit with Etherfi (Zircuit) Pendle Bundled Protocol Cover 🛡️ Protect against smart contract risk across all 4 protocols and earn with peace of mind!

Protect your PTs with Pendle Protocol Cover 🛡️ Earn high APYs with peace of mind knowing you're covered against the biggest risks in DeFi ⬇️ v2.nexusmutual.io/cover/product/…

You know those crazy fixed yield loopers on @SiloFinance? The ones who are driving up them ETH yield in PT Silos? Here's your chance to get a piece of the action yourself: 🔹 sETH ( @RenzoProtocol PT-ezETH Silo) 🔹 sETH ( @ether_fi PT-eETH Silo) Now live on Pendle @Arbitrum 💙

Earning a high APY in the Swell fixed yield in the Pendle Ethereum markets? Don't forget to safeguard your deposits with EigenLayer + Swell + Pendle Bundled Protocol Cover 🛡️ Protect against smart contract risk across all 3 protocols and earn with peace of mind! Learn more 👇

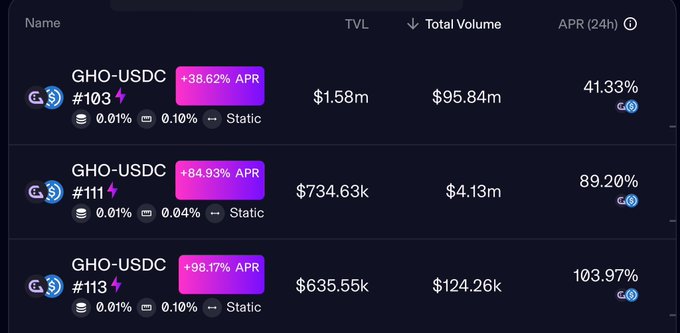

$GHO LPs earning on Maverick can protect their deposits against smart contract risk with Maverick Protocol Cover 🛡️ Protect against hacks/exploits with coverage that pays when you need it most 👇 v2.nexusmutual.io/cover/product/…

$GHO @GHOAave yield on @mavprotocol is next level 👀 Whales can enjoy and not dilute this Boosted Position 111 or 113 if you want long duration elevated yield anon app.mav.xyz/boosted-positi…

First Comprehensive Onchain Risk Taxonomy Launches with Expert Webinar

The **Onchain Risk Map** has launched as the first comprehensive taxonomy for crypto and DeFi risk assessment. Built in collaboration with OpenCover, this common-good framework provides risk professionals and onchain users with a systematic approach to understanding digital asset risks. The framework categorizes onchain risk across **six core dimensions**: - Custody - Transactions - Protocols - Digital Assets - Staking - Systemic Risk A launch webinar is scheduled for **February 11 at 17:00 CET**, featuring experts including Jeremiah, tokendata, and s3mtur4n. The session will include a detailed walkthrough and Q&A, streaming live on X and LinkedIn. This institutional framework aims to help both professionals and everyday users navigate the complex risk landscape of decentralized finance more effectively.

DeFi Risk Briefing: Protecting Institutional Capital in Crypto

A DeFi risk management discussion is scheduled for January 22nd, featuring industry experts Hugh Karp and tokendata. The briefing will cover: - Vault security and architecture - Institutional participation in DeFi - Recent hacks and vulnerabilities - Claims processes and risk mitigation The session aims to address the critical challenge of maintaining institutional confidence in decentralized finance as traditional players enter the space. [Join the discussion](https://x.com/i/spaces/1ynJOMBYWLAKR)

Nexus Mutual Releases Q4 Report on DeFi Risk and Claims

Nexus Mutual has published **The Nexus Review**, their Q4 and 2025 wrap-up report covering DeFi risk management and claims processing. The report, introduced by Hugh Karp, emphasizes the protocol's consistent approach to onchain risk. Key areas covered include: - DeFi risk assessment and management - Claims processing and payouts - Vault operations - Institutional adoption trends The full report is available at [docs.nexusmutual.io](https://docs.nexusmutual.io/bookshelf/NM_Q4_REPORT.pdf)

Multi Protocol Cover Extends DeFi Protection Across Multiple Platforms

**Multi Protocol Cover** now offers comprehensive protection for DeFi strategies spanning multiple protocols. This consolidated coverage extends beyond single protocol protection, safeguarding users against: - Smart contract hacks and exploits - Oracle failures - Cross-protocol risks The service builds on existing single protocol coverage for platforms like Aave and Uniswap, now providing **unified protection** for complex multi-protocol strategies. [Watch the walkthrough](https://youtu.be/yITiIAgGsd0?si=_9tzenRdBEMruoit) to understand how consolidated coverage works across different protocols.

Nexus Mutual Proposes USDC Yield Vault for Real-World Insurance Returns

**Nexus Mutual members are voting on a proposal to create a USDC-denominated yield-bearing vault** that would bring real-world insurance returns to crypto capital. The proposal, known as NMPIP (Nexus Mutual Protocol Improvement Proposal), is currently open for voting on Snapshot for 3 days. **Key details:** - Vault would operate under the Nexus Mutual umbrella - Focus on generating yield through real-world insurance activities - Requires technical, legal, and operational development work - Would involve collaboration between DAO R&D team and Foundation teams If approved, development teams will begin the complex process of building the infrastructure needed to bridge traditional insurance returns with crypto capital. The initiative represents Nexus Mutual's expansion beyond pure crypto insurance into broader financial products. [Full forum discussion](https://forum.nexusmutual.io/t/nmpip-real-world-insurance-vault-bringing-insurance-returns-to-crypto-capital/1818)