Oval: Capturing Liquidation Oracle Extractable Value for Lending Protocols

Oval: Capturing Liquidation Oracle Extractable Value for Lending Protocols

🔒 Liquidation Season Profits

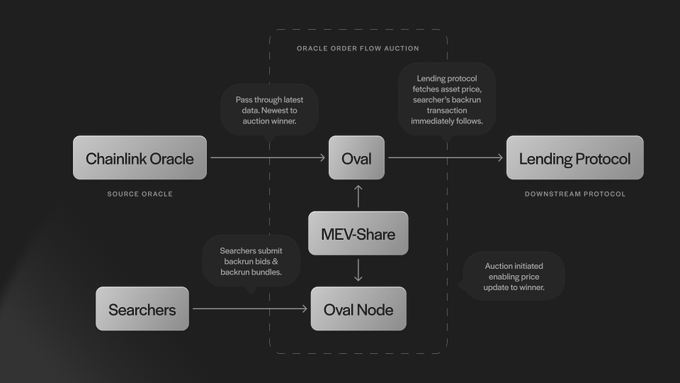

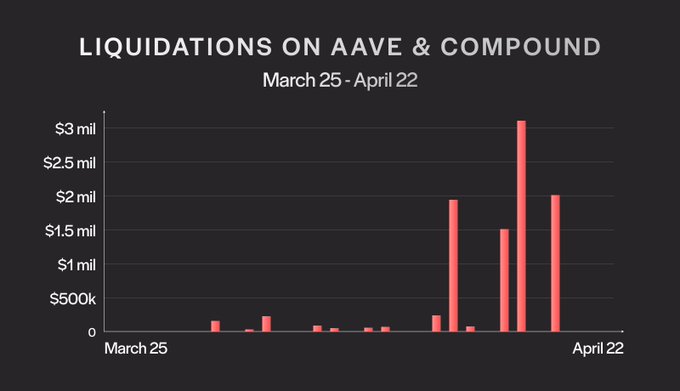

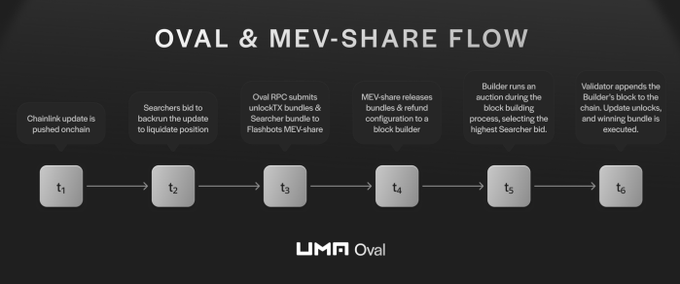

Oval is a new application built on Flashbots' MEV-Share infrastructure that allows lending protocols to capture Oracle Extractable Value (OEV) generated during liquidations. When Chainlink price feeds update and trigger potential liquidations, it creates OEV. Oval uses MEV-Share's order flow auctions to allow searchers to bid for the right to backrun these price updates and execute liquidations. The winning bid proceeds are then distributed to the lending protocol and oracle providers. This system promotes capital efficiency by ensuring liquidators are compensated based on market demand, redirecting up to 90% of OEV back to protocols. Over $2.5M has been lost to OEV on Aave and Compound in the past 30 days alone.

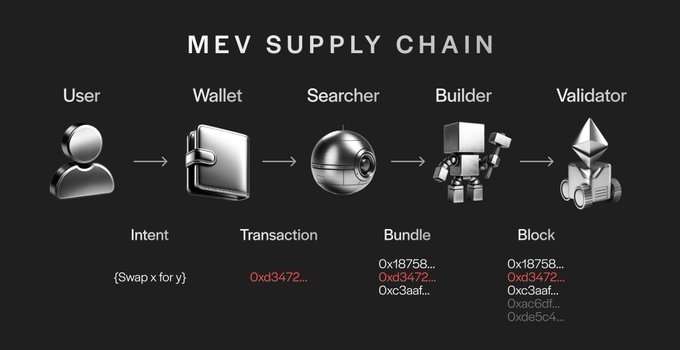

Almost 300 ETH is lost to MEV every day. This happens at the expense of everyone in the Ethereum ecosystem. How can we capture MEV and distribute the profits fairly instead? MEV Capture is about building tools that capture MEV and redirect it to the protocols and users that

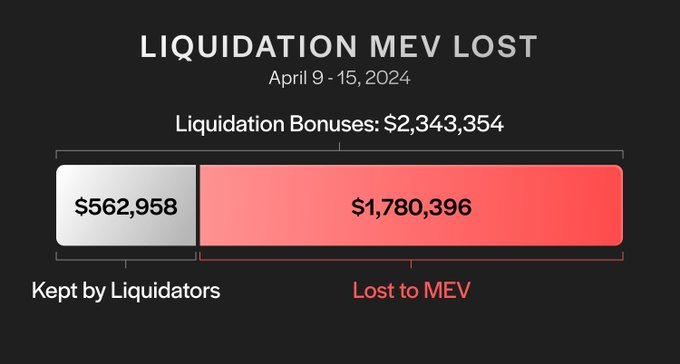

Liquidation season is upon us. Last week, we witnessed over $6.7 million in liquidation volume across Aave and Compound, totaling almost $9.6 million over the past 30 days. About $2.5 million has been lost to OEV because of this.

Lending protocols can capture liquidation OEV with Oval. This is possible because Oval is built on MEV-Share infrastructure developed by Flashbots. Here’s how it works. Flashbots’ MEV-Share is an open-source protocol designed to capture MEV. It achieves this by efficiently

Over the last 7 days, 404 liquidations happened on @aave and @compoundfinance. These protocols paid $2.3M+ in liquidation incentives, 76% of which were lost to MEV. This is why MEV capture is crucial. More liquidations will happen in this bull market. Be prepared with Oval.

Start capturing OEV now with Oval. 🥚 Oval is a plug-and play tool that any EVM lending protocol can quickly integrate without making any contract adjustments. Simply plug in Oval and start getting paid to use your oracle. x.com/UMAprotocol/st…

Almost 300 ETH is lost to MEV every day. This happens at the expense of everyone in the Ethereum ecosystem. How can we capture MEV and distribute the profits fairly instead? MEV Capture is about building tools that capture MEV and redirect it to the protocols and users that

🏛️ UMA Launches Library to Preserve Prediction Market History Onchain

UMA has introduced **Library of UMA** ([library.uma.xyz](http://library.uma.xyz)), a permanent onchain archive designed to preserve prediction market data and world history. **Key Features:** - Immutable storage of prediction market outcomes and historical events - Protection against data erasure or manipulation - Built on UMA's oracle infrastructure that powers platforms like Polymarket The initiative addresses a growing need for permanent records as prediction markets become increasingly important information sources. By storing data onchain, the Library ensures that historical outcomes and market resolutions remain accessible and verifiable indefinitely. UMA's oracle system already secures significant value across prediction markets and cross-chain bridges like Across Protocol. The Library extends this infrastructure to create a permanent historical record that cannot be altered or deleted.

Polymarket's Complete Question History Now Permanently Recorded On-Chain

Polymarket has archived its entire question history on an immutable blockchain ledger. Every prediction market question the platform has ever posed is now permanently recorded on-chain, creating a transparent and tamper-proof historical record. This move represents a significant step toward full on-chain transparency for prediction markets. The immutable nature of blockchain ensures that the complete archive of questions cannot be altered or deleted, providing researchers and users with a permanent reference point. The initiative builds on earlier efforts to record platform data on-chain, extending the scope to encompass the platform's complete question catalog. This creates accountability and enables long-term analysis of prediction market trends and accuracy.

Delphi Digital Launches Research Markets on Polymarket

**Delphi Digital** has launched prediction markets on **Polymarket**, secured by UMA's optimistic oracle technology. - The markets focus on industry research outcomes - UMA provides the oracle infrastructure ensuring market security - This represents a new approach to research validation through prediction markets The integration combines Delphi Digital's research expertise with Polymarket's prediction market platform and UMA's decentralized oracle system.

UMA Doubles Minimum Stake Requirement for Voting Gas Rebates to 1000 Tokens

**UMA increases voting participation barrier** Starting November 1st, UMA voters need to stake **1000 $UMA tokens** (up from 500) to qualify for gas rebates. This follows the initial introduction of minimum staking requirements in February 2025, when rebates shifted from universal coverage to requiring 500+ tokens. **Key changes:** - Minimum stake doubles from 500 to 1000 $UMA - Gas rebate eligibility becomes more restrictive - Change reflects ongoing cost management efforts The adjustment continues UMA's strategy to control rebate expenses, which previously surged 5x since July 2024. Full details: [docs.uma.xyz/using-uma/votin](https://docs.uma.xyz/using-uma/votin)

UMA's Optimistic Oracle Secures Polymarket with Real-World Data

**UMA's Optimistic Oracle** brings real-world data onchain to secure prediction markets like Polymarket. The system works through **three key steps**: - **Proposal**: Event outcomes are submitted to the oracle - **Challenge Period**: Proposed outcomes can be disputed within a set timeframe - **Resolution**: Challenged outcomes trigger decentralized dispute resolution This **decentralized approach** eliminates single points of failure, ensuring fair and trustworthy market outcomes through consensus rather than centralized control. **Key achievements**: - Resolved over **10,000 markets** for Polymarket - Secures multiple prediction platforms including poly_bet, ForeProtocol, and predictdotfun The Optimistic Oracle addresses prediction markets' core challenge: **accurately determining real-world event outcomes onchain** while maintaining decentralized integrity.