Optimism Ecosystem Update: New Liquidity Pools on Velodrome

Optimism Ecosystem Update: New Liquidity Pools on Velodrome

🔥 New Opportunity Knocks

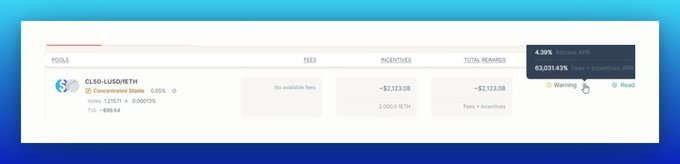

Optimism, an Ethereum Layer 2 scaling solution, has announced the availability of new liquidity pools for LUSD and fETH on Velodrome, a decentralized exchange. Liquidity providers can now earn rewards by supplying liquidity to these pools, which are designed to be aligned with the Ethereum ecosystem.

another one to continue @Optimism summer ☀️ 🔴 are you a LP looking to deploy stables that are as Ethereum aligned as can be? look no further 👇 LUSD / fETH pools are now available on @VelodromeFi ! LPs can earn rewards by supplying liquidity on: velodrome.finance

🎙️ Epicenter Podcast Clip

A podcast clip from Epicenter has been shared, featuring discussion on current crypto and blockchain topics. The clip appears to be part of a longer episode covering industry developments and market analysis. - **Source**: Epicenter podcast - **Format**: Video clip with timestamp - **Platform**: YouTube This follows previous crypto market coverage including Bitcoin volatility, jobs report impacts, and major exchange earnings. [Watch the clip](https://youtu.be/UmPA0T9Cdjk?t=654)

15+ Venues Now Available for BOLD Token Yield Farming

**BOLD token holders** can now access **15+ different venues** to earn yield on their holdings. The comprehensive list includes platforms offering: - Double-digit returns on BOLD deposits - Potential airdrop opportunities - Various DeFi protocols and yield strategies All venues are tracked and accessible through a dedicated [Dune Analytics dashboard](https://dune.com/liquity/liquity-v2-yields) that provides real-time data on yields and links to each platform. *Check the dashboard to compare rates and find the best yield opportunities for your BOLD tokens.*

🔥 Enosys Explosion: 200+ Troves

**Enosys Global**, a Liquity V2 licensed fork on Flare Networks, saw rapid adoption with **200+ troves created in just 24 hours**. Key highlights: - Built on Flare Networks infrastructure - Licensed fork of Liquity V2 protocol - Stability Pools now available for users - CDP/USDT pool offering **90%+ APR** The platform represents a significant DeFi deployment on Flare, bringing proven Liquity mechanics to the network. The high APR rates reflect early-stage incentives typical of new protocol launches. Users can explore the Stability Pools and liquidity mining opportunities as the protocol establishes itself in the Flare ecosystem.

wstETH Stability Pool Delivers Highest Stable Yield in DeFi Through Liquidation Proceeds

**wstETH Stability Pool** achieved the highest stable yield across all DeFi protocols based on yearly averages. **Key yield sources:** - Regular borrower interest payments - **Liquidation proceeds** from market downturns - Depositors acquire discounted ETH and LSTs during price drops **Pool advantages:** - Funds remain in pool, not lent out - Hold truly decentralized stablecoin - **24/7 withdrawal** availability - No lending counterparty risk Liquidation events create yield spikes - while irregular, they provide substantial returns when markets decline sharply.

🔥 Enosys Global Launches on Flare Network with CDP Dollar Minting

**Enosys Global** has officially launched on **Flare Network**, bringing CDP (Collateralized Debt Position) functionality to the ecosystem. **Key Features:** - Mint **CDP Dollar** using $FXRP and $WFLR as collateral - Stake or provide liquidity for CDP Dollar to earn fee shares - Built as a **Liquity V2 licensed fork** **Early Adoption Success:** - Over **200 troves created** within first 24 hours - Stability Pools now available - CDP/USDT pool offering **90%+ APR** This launch expands DeFi options on Flare Network, allowing users to leverage their FXRP and WFLR holdings to mint stablecoins while earning yields through various participation mechanisms.