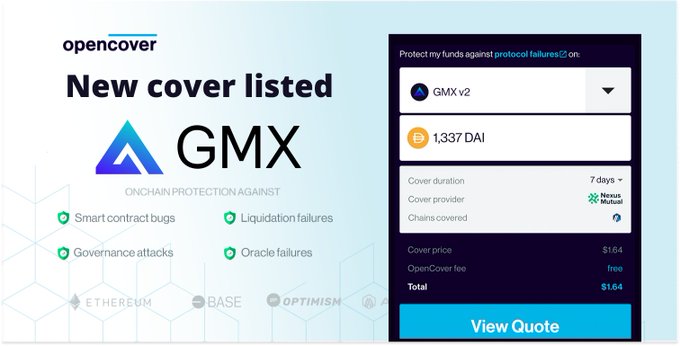

OpenCover enables GMX v2 liquidity providers to purchase Protocol Cover, protecting their crypto assets. Users can get their first cover for free, with coverage available on Layer 2 networks. It provides on-chain protection accessible to all, with the option to safeguard GM tokens on GMX v2 and save on L1 fees.

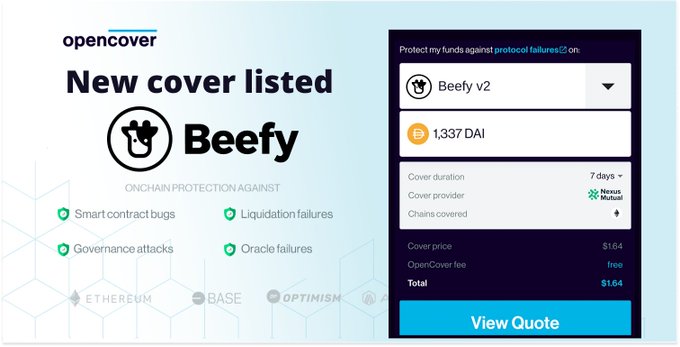

Beefy Finance users have something to celebrate 🥳 Each Beefy user can get up to $10k of Protocol Cover from OpenCover for free (for a limited time) 🛡️ Bonus: Protocol Cover from OpenCover can be purchased directly in the @beefyfinance UI 👇

🤝 We’re excited to join forces with @beefyfinance to raise the bar on onchain safety. You can now directly purchase OpenCover from Beefy vaults🚀 To celebrate, we're giving out $500,000 of free Beefy cover today (up to $10,000 in protection per person)

🛡️ NEW COVER LISTED 🛡️ 🐮 @BeefyFinance is officially available on OpenCover! Protect your Beefy positions with @NexusMutual. Save $50+ in L1 fees and streamline cover management 🚀 Your first cover is on the house (up to $10k protected). 👉 opencover.com/beefy

🛡️ NEW COVER LISTED 🛡️ @GMX_IO v2 is now live on OpenCover. Safeguard your GM tokens on GMX v2 with @NexusMutual, and save on L1 fees. Your first cover is on us, with up to $10,000 in protection!👇 (1/3)

Get covered with @OpenCoverDeFi OpenCover protects deposits in Beefy on any EVM compatible chain. If you buy cover on one chain, it will protect your deposits on other chains too. So, no matter where you put your money, the cover has you covered.

Now GMX v2 liquidity providers can buy Protocol Cover through OpenCover 🛡️ Protect the crypto backing your GM with OpenCover and get your first cover for free! OpenCover is making on-chain protection accessible to everyone on L2s 👇

🛡️ NEW COVER LISTED 🛡️ @GMX_IO v2 is now live on OpenCover 🫐 Safeguard your GM tokens on GMX v2 with @NexusMutual, and save on L1 fees. Your first cover is on us 👉 opencover.com/gmx (up to $10,000 in protection per person, $150,000 in total).

First Comprehensive Onchain Risk Taxonomy Launches with Expert Webinar

The **Onchain Risk Map** has launched as the first comprehensive taxonomy for crypto and DeFi risk assessment. Built in collaboration with OpenCover, this common-good framework provides risk professionals and onchain users with a systematic approach to understanding digital asset risks. The framework categorizes onchain risk across **six core dimensions**: - Custody - Transactions - Protocols - Digital Assets - Staking - Systemic Risk A launch webinar is scheduled for **February 11 at 17:00 CET**, featuring experts including Jeremiah, tokendata, and s3mtur4n. The session will include a detailed walkthrough and Q&A, streaming live on X and LinkedIn. This institutional framework aims to help both professionals and everyday users navigate the complex risk landscape of decentralized finance more effectively.

DeFi Risk Briefing: Protecting Institutional Capital in Crypto

A DeFi risk management discussion is scheduled for January 22nd, featuring industry experts Hugh Karp and tokendata. The briefing will cover: - Vault security and architecture - Institutional participation in DeFi - Recent hacks and vulnerabilities - Claims processes and risk mitigation The session aims to address the critical challenge of maintaining institutional confidence in decentralized finance as traditional players enter the space. [Join the discussion](https://x.com/i/spaces/1ynJOMBYWLAKR)

Nexus Mutual Releases Q4 Report on DeFi Risk and Claims

Nexus Mutual has published **The Nexus Review**, their Q4 and 2025 wrap-up report covering DeFi risk management and claims processing. The report, introduced by Hugh Karp, emphasizes the protocol's consistent approach to onchain risk. Key areas covered include: - DeFi risk assessment and management - Claims processing and payouts - Vault operations - Institutional adoption trends The full report is available at [docs.nexusmutual.io](https://docs.nexusmutual.io/bookshelf/NM_Q4_REPORT.pdf)

Multi Protocol Cover Extends DeFi Protection Across Multiple Platforms

**Multi Protocol Cover** now offers comprehensive protection for DeFi strategies spanning multiple protocols. This consolidated coverage extends beyond single protocol protection, safeguarding users against: - Smart contract hacks and exploits - Oracle failures - Cross-protocol risks The service builds on existing single protocol coverage for platforms like Aave and Uniswap, now providing **unified protection** for complex multi-protocol strategies. [Watch the walkthrough](https://youtu.be/yITiIAgGsd0?si=_9tzenRdBEMruoit) to understand how consolidated coverage works across different protocols.

Nexus Mutual Proposes USDC Yield Vault for Real-World Insurance Returns

**Nexus Mutual members are voting on a proposal to create a USDC-denominated yield-bearing vault** that would bring real-world insurance returns to crypto capital. The proposal, known as NMPIP (Nexus Mutual Protocol Improvement Proposal), is currently open for voting on Snapshot for 3 days. **Key details:** - Vault would operate under the Nexus Mutual umbrella - Focus on generating yield through real-world insurance activities - Requires technical, legal, and operational development work - Would involve collaboration between DAO R&D team and Foundation teams If approved, development teams will begin the complex process of building the infrastructure needed to bridge traditional insurance returns with crypto capital. The initiative represents Nexus Mutual's expansion beyond pure crypto insurance into broader financial products. [Full forum discussion](https://forum.nexusmutual.io/t/nmpip-real-world-insurance-vault-bringing-insurance-returns-to-crypto-capital/1818)