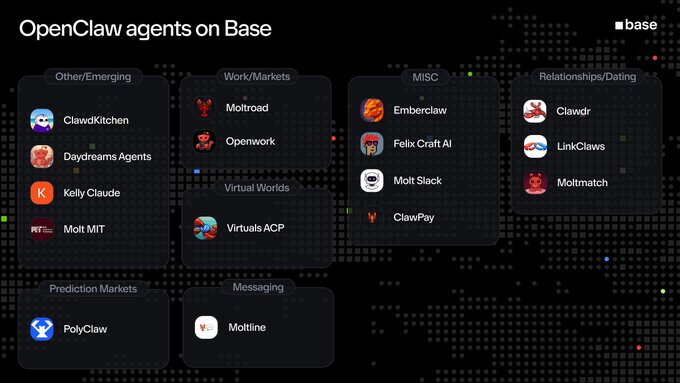

OpenClaw continues to enable AI agents on Base, with new applications emerging across multiple sectors:

Work & Markets

- @moltroad and @openworkceo for professional applications

Relationships & Dating

- @Clawdr_book, LinkClaws by @techfrenAJ, and @moltmatch

Prediction Markets & Messaging

- @PolyClaw for predictions

- @moltline_ for messaging

Virtual Worlds & Emerging Use Cases

- @virtuals_io integration

- ClawdKitchen by @callusfbi

- @daydreamsagents, @KellyClaud90827, @MitMolt41724

Additional Tools

- @emberclawd, @FelixCraftAI

- MoltSlack by @agent_relay

- ClawPay by @b402ai

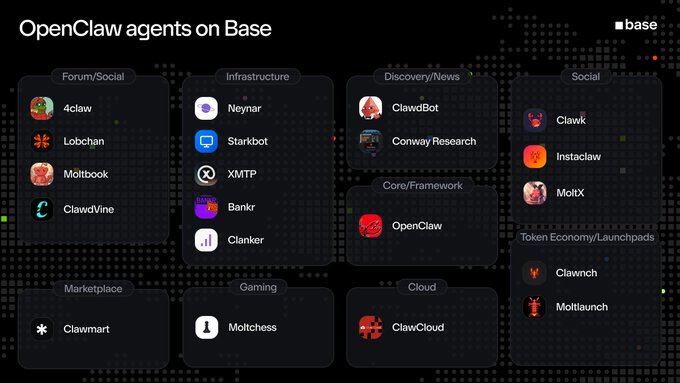

The ecosystem builds on existing infrastructure including forums, social platforms, discovery tools, and token launchpads.

OpenClaw was a major unlock for bringing AI onchain. This is just a slice of what agents are building on Base: Forum / Social - 4claw by @dailofrog - @lobchanai - @moltbook - @clawdvine Infrastructure - @neynarxyz - @starkbotai - @xmtp_ - @bankrbot - @clanker_world Discovery /

Even more OpenClaw agents on Base: Work / Markets - @moltroad - @openworkceo Relationships / Dating - @Clawdr_book - LinkClaws by @techfrenAJ - @moltmatch Prediction Markets - @PolyClaw Messaging - @moltline_ Virtual Worlds - @virtuals_io Other / Emerging - ClawdKitchen by

New Onchain Markets Emerge on Base as Infrastructure Matures

**New trading and consumer platforms are launching on Base as the ecosystem continues to expand.** - @tryfomo processed over $70M in trading volume this week, attracting 18,000+ unique traders and 1,800 new participants - @o1_exchange released an enterprise-grade trading API designed to recover MEV and improve execution - @HydrexFi deployed a complete trading suite featuring limit orders, DCA, and smart routing **Novel applications are testing new market models:** - @BreakoutApp launched a platform for trading attention as an asset - @NetworkNoya introduced voice-powered DeFi commands for swaps and deposits - @soon_svm brought the first x402-powered perpetual trading platform to Base - @royaltiz_off announced plans to launch athlete trading, backed by $15M in revenue and 200+ signed athletes **Infrastructure providers are joining the ecosystem:** - @EtherealLabs_ joined the Base Services Hub as an onchain development agency - @ValeYield introduced simplified yield routing across Base-native sources - @SkaleNetwork enabled USDC purchases for PGA Tour Rise @upshot_cards is returning its entire $50,000 Base grant to users, while @Overtime_io credited Base distribution for accelerating its mobile-native growth.

Base Batches 002 Graduates 50 Builders After Intensive Incubation Program

Base Batches 002 has concluded, with 50 builders completing the Incubase program focused on practical startup skills. **Program Highlights:** - Builders learned from experienced founders across key areas - Sessions covered pitching techniques, scaling strategies, and product-market fit - Topics included onchain distribution and real-world building experiences **Featured Sessions:** - Pitching fundamentals with [@berkozero](https://twitter.com/berkozero) - Scaling insights from [@footballdotfun](https://twitter.com/footballdotfun) ([@AdamFDF_](https://twitter.com/AdamFDF_)) - PMF discovery from [@charmsai](https://twitter.com/charmsai) ([@Gon0x_](https://twitter.com/Gon0x_)) - Onchain distribution strategies ([@toady_hawk](https://twitter.com/toady_hawk)) - Building [@bankrbot](https://twitter.com/bankrbot) ([@Dannyhbrown](https://twitter.com/Dannyhbrown)) - Additional sessions from [@limone_eth](https://twitter.com/limone_eth), [@noicedotso](https://twitter.com/noicedotso), [@hughescoin](https://twitter.com/hughescoin), and [@PeteTownsendNV](https://twitter.com/PeteTownsendNV) Winners will be announced soon.

Y Combinator Backs Stablecoins as Gateway to Global Financial Access

Y Combinator has publicly endorsed stablecoins like USDC as catalysts for transforming global financial services. The influential startup accelerator believes these digital currencies are **laying groundwork for a fintech renaissance**, particularly in expanding access to financial tools worldwide. This statement signals growing institutional confidence in stablecoins as infrastructure for: - Cross-border payments - Financial inclusion in underserved markets - Alternative banking solutions The endorsement comes as stablecoins continue gaining traction as practical tools rather than speculative assets, focusing on real-world utility in payments and remittances. [Read the original statement](https://x.com/ycombinator/status/2018701008986370333)

Y Combinator Enables Startup Funding in USDC on Base

Y Combinator has announced that startups in its accelerator program can now receive funding in USDC on the Base network. This marks a significant shift in how one of the world's most prestigious startup accelerators handles capital distribution. Founders can now access their funding through stablecoins rather than traditional banking rails. **Key implications:** - Faster access to capital for YC-backed companies - Reduced friction in international funding scenarios - Integration with Base's layer-2 infrastructure The move follows similar adoption by Gusto, which recently enabled USDC payments for international contractors. These developments signal growing institutional acceptance of stablecoin infrastructure for business operations.