Ondo Finance participates in high-level tokenization discussion at Sibos

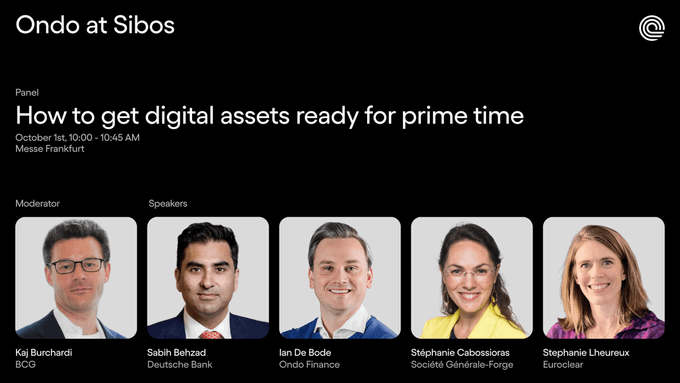

Ondo's Ian Debode joined executives from BCG, Deutsche Bank, Société Générale-Forge, and Euroclear for a digital assets panel at the premier banking conference.

Key details:

- Panel focused on tokenization entering mainstream finance

- Took place at Messe Frankfurt from 10:00-10:45 AM GMT+2

- Ondo positioned as dialogue leader in institutional tokenization

The discussion highlights growing institutional interest in digital asset infrastructure and tokenized financial products.

Today at @Sibos, Ondo’s @iandebode joins leaders from BCG, Deutsche Bank, Société Générale-Forge, and Euroclear to discuss digital assets. Tokenization is moving into the mainstream, and Ondo is helping lead the dialogue. Taking place 10:00–10:45 AM (GMT+2) at Messe Frankfurt.

Ondo Finance Completes Oasis Pro Acquisition, Gains Comprehensive SEC Licenses for Tokenized Securities

**Ondo Finance has completed its acquisition of Oasis Pro**, securing the most comprehensive set of SEC registrations for digital asset services in the United States. **Key acquisitions include:** - SEC-registered broker-dealer license - Alternative trading system (ATS) - Transfer agent (TA) licenses This acquisition provides Ondo with full-stack digital asset infrastructure, enabling: - **Tokenization engine** for real-world assets (RWAs) - Primary offering marketplace - Multi-asset secondary trading system - Capital markets activities including private placements and M&A advisory **Market opportunity:** The tokenized securities market is predicted to exceed $18 trillion by 2033. The deal positions Ondo to develop regulated markets for tokenized securities and blockchain-based financial products for U.S. investors. [Read full announcement](https://ondo.finance/blog/ondo-acquires-oasis-pro)

Tokenization Shifts from Proof of Concept to Implementation Reality

**Major industry shift observed** across key financial conferences this week. - Token2049, Sibos, and Ondo-Mastercard events all highlighted the same trend - **Tokenization has moved beyond experimental phase** - Industry conversations now focus on *implementation* rather than validation The dialogue has fundamentally shifted from **"why tokenize"** to **"how to tokenize."** This represents a significant milestone for blockchain adoption in traditional finance, suggesting institutional readiness for practical deployment.

Ondo Executive Discusses Path to $5 Trillion in Tokenized Assets at Sibos Conference

**Tokenization growth follows exponential patterns**, making ambitious targets more realistic than expected. - Ondo's Ian DeBode presented at Sibos on tokenization's rapid expansion trajectory - **Hockey stick growth curves** are typical for tokenized asset adoption - Previous McKinsey research projected **$2 trillion tokenized market cap by 2030** The discussion highlights how tokenized assets are **transitioning from pilot programs to large-scale deployment** across financial institutions. *Industry momentum suggests the $5 trillion milestone may be achievable sooner than anticipated.*

SEC Weighs Plan to Allow Blockchain-Based Stock Trading

The Securities and Exchange Commission is reportedly developing a plan to allow blockchain-registered versions of stocks to trade on cryptocurrency exchanges, marking a significant step toward integrating digital asset technology into traditional markets. **Key developments this week:** - **Robinhood CEO's bold prediction**: Vlad Tenev declared that "tokenization will eat the entire global financial system" following his Token2049 appearance - **European stablecoin integration**: Deutsche Börse Group and Circle signed an MOU to integrate USDC and EURC into Deutsche Börse's financial market infrastructure - **Swift's blockchain initiative**: The payments giant announced plans for its own blockchain to streamline transactions among global banks, with Bank of America, Citigroup, and NatWest as initial partners - **Stablecoin platform launch**: Bridge (acquired by Stripe) launched Open Issuance, enabling businesses to create and manage their own stablecoins These developments signal accelerating institutional adoption of blockchain technology across traditional finance, from stock trading to payment infrastructure.