Several significant developments showcase accelerating institutional adoption of tokenized finance:

GENIUS Act Passes Senate: Landmark stablecoin bill approved with 68-30 bipartisan vote, establishing US regulatory framework

JPMorgan Launches JPMD: World's largest bank piloting tokenized deposits on Coinbase's Base blockchain

Coinbase Pursues Tokenized Stocks: Exchange seeking SEC approval to offer blockchain-based equities

BlackRock Integration: Major exchanges now accept BlackRock's tokenized US Treasury fund as trading collateral

These developments signal growing mainstream acceptance of blockchain-based financial instruments, particularly in traditional banking and securities markets.

From tokenized stocks to stablecoins and treasuries, the past week has seen a flurry of headlines that reflect the rapid institutional embrace of crypto and tokenized finance. Here are the key recent developments you need to know. 👇

Yesterday, Circle—issuer of USDC—went public. It’s a milestone not just for one company, but for the stablecoin category writ large. It affirms what many in crypto already believe: that blockchain-based digital dollars are becoming core financial infrastructure. Stablecoins

The internet transformed media, commerce, and communication. Ondo Finance is doing the same for capital markets.

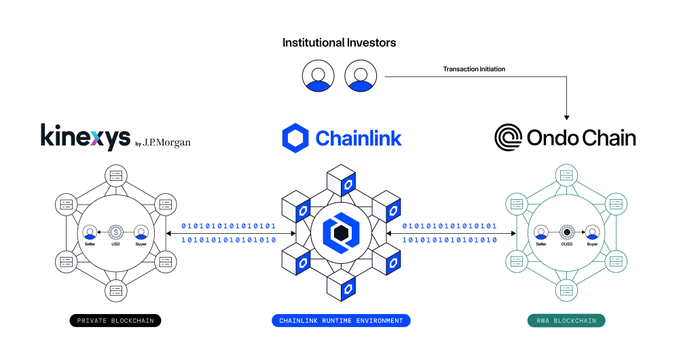

Hear from Nelli Zaltsman, Head of Platform Settlement Solutions at Kinexys by @JPMorgan, on our recent collaboration, and the future of tokenization. 👇 “The test transaction between Ondo Finance, J.P. Morgan and Chainlink was very exciting for our organization. I think it

"Providers like Chainlink play an important role because interoperability is not necessarily something a single institution can achieve by itself." @Nzaltsman of Kinexys by @jpmorgan joins Chainlink’s Future Is On series to discuss the institutional adoption of blockchain

Capital markets are coming onchain, and they’re not turning back.

Landmark Moment: U.S. Stablecoin Bill, the GENIUS Act, Passes the U.S. Senate. In a historic milestone for digital assets, the U.S. Senate has passed the GENIUS Act, the first comprehensive stablecoin legislation, with strong bipartisan support. Stablecoins are the first killer

Stablecoins made the US dollar globally accessible, instantly tradable and fully composable. Ondo Global Markets will unlock the same upgrades for US securities. US Treasuries and equities represent $28T and $62T in market value, respectively. Learn more about Ondo Global

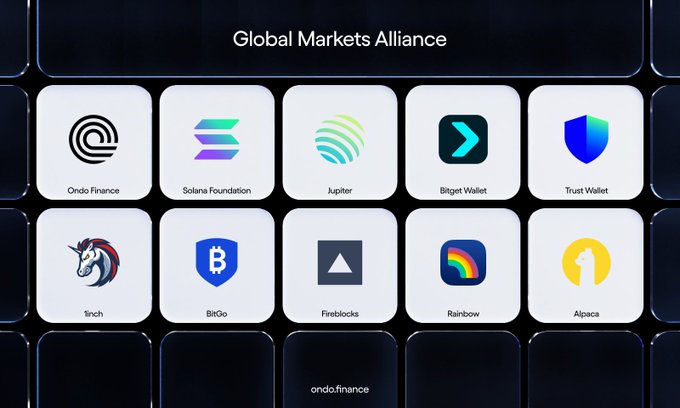

Here’s what leaders from Ondo Finance, Trust Wallet, Bitget Wallet, Jupiter, Fireblocks, and BitGo had to say about yesterday’s Global Markets Alliance announcement. 👇 “Access to US capital markets has historically been gated and inefficient and standardization is essential to

1/ Today we're announcing the Global Markets Alliance, a historic alliance of leading wallets, exchanges, and custodians to bring capital markets onchain and set standards for the interoperability of onchain stocks. This alliance includes: • @SolanaFndn • @BitgetWallet •

High-quality tokenized assets are a step toward upgrading the financial system—deeper transformation is enabled at the infrastructure level. Ondo Finance Vice Chairman @PatrickMcHenry joined @APompliano's latest podcast to discuss the latest in legislation and tokenization. “A

Ondo Finance CEO @nathanlallman discusses the GENIUS Act's impact on institutional participation with @TheStreet: “This legislation provides long-awaited clarity around the treatment of digital assets, laying the foundation for increased institutional participation.” Sustained

From tokenized stocks to stablecoins and US Treasuries, the past week has delivered a number of headlines that show how fast the institutional embrace of tokenized finance is racing ahead. Here are the key recent developments you need to know. 👇

Tokenization is already scaling. “You’re starting to see that inflection point and hockey stick moment. First in cash. Now in treasuries. And the big question is: what’s next? We believe that the assets that make most sense to tokenize is stuff that people really want and is

Gradually, then suddenly. Have we already reached the inflection point for tokenization? 📶 @OndoFinance’s Ian De Bode says yes and joined @MonicaLongSF on the XRPL mainstage at Apex 2025 to unpack what's next as markets move onchain.

What stablecoins did for the dollar, Ondo is doing for capital markets. Speaking with @thestreet, @nathanlallman explained, “the financial system wasn’t designed for the world we live in—it was stitched together over centuries.” Just as stablecoins brought accessibility and

NEW: What stablecoins did for the dollar, @OndoFinance is doing to capital markets. thestreet.com/crypto/innovat…

ICYMI: Ondo Finance, @Chainlink, and Kinexys by @JPMorgan teamed up to connect bank settlement infrastructure to Ondo Chain.

Chainlink is excited to be working with Kinexys by J.P. Morgan and Ondo on a groundbreaking way to utilize Kinexys Digital Payments to allow institutional clients to purchase Ondo’s tokenized treasuries. With $23B+ in tokenized RWAs on public chains, the need for secure

“This surge should be expected to continue.” Today, @coingecko released a report on the real-world asset tokenization market. It notes that the “tokenized treasuries market cap climbed by $4.7B (+544.8%) since the start of 2024,” with Ondo Finance as one of the top contributors

Who said tokenized US Treasuries are only for DeFi-native users? Ondo Finance CEO @nathanlallman joined @NYSE Live to discuss our collaboration with @jpmorgan and @chainlink to integrate bank payment rails into Ondo Chain. Ondo's latest transaction with J.P. Morgan demonstrates

Stablecoins unlocked programmable dollars. Ondo Global Markets is unlocking programmable equities. To learn more about Ondo Global Markets, visit ondo.finance/global-markets

From closed systems to open protocols. Ondo Finance is accelerating one of the biggest upgrades in capital markets history.

Institutional Adoption and Regulatory Clarity Signal New Era for Web3

Key figures in the blockchain space point to a convergence of favorable conditions for institutional adoption: - Infrastructure and technology readiness confirmed by industry leaders - Major banks and asset managers showing increased interest in blockchain solutions - Regulatory clarity emerging as final catalyst for widespread US adoption Ondo Finance's infrastructure network, including Ondo Chain, Global Markets, Nexus, and Bridge, is positioning to support traditional financial institutions in their transition to blockchain-based services. *Notable quote*: Now is the time - Sergey Nazarov, Chainlink

Artemis Report Highlights Growth in Onchain Stablecoin Yields

A new Artemis report examines the evolution of onchain stablecoin yields and increasing institutional adoption, with Ondo Finance playing a key role. The analysis points to a clear trend of global markets transitioning to blockchain infrastructure. Key developments: - Growing adoption of tokenized treasuries - Expanding institutional participation - Launch of Ondo Global Markets and Ondo Chain upcoming Traditional finance players are expected to take greater notice as demand increases for tokenized securities.

Ondo Finance OUSG Reaches $700M+ TVL Milestone

Ondo Finance's OUSG has achieved a significant milestone with over $700M in Total Value Locked (TVL), highlighting growing institutional adoption of tokenized US Treasuries. This follows their earlier $1B TVL achievement across all products in March 2025. OUSG offers: - Institutional-grade tokenized US Treasury exposure - Integration with BlackRock ETFs - 24/7 instant minting and redemption - Cross-chain compatibility - Partnerships with major financial institutions OUSG has become the primary liquidity layer for onchain asset managers through Ondo Nexus, with the most diverse tokenized US Treasury exposure in the market.

U.S. Senate Passes GENIUS Act: First Comprehensive Stablecoin Legislation

The U.S. Senate has approved the GENIUS Act with bipartisan support, marking a watershed moment for digital asset regulation. This first comprehensive stablecoin legislation aims to establish clear regulatory frameworks for blockchain-based dollar alternatives. Key points: - First major stablecoin regulation in U.S. history - Strong bipartisan backing in Senate - Positions U.S. as innovation-friendly jurisdiction - Supports 24/7 permissionless access to USD The bill's passage signals U.S. commitment to fostering domestic digital innovation rather than pushing development offshore.