Ondo Finance Brings Tokenized Treasuries to XRPL via RLUSD

Ondo Finance Brings Tokenized Treasuries to XRPL via RLUSD

🔄 Treasury Tokens Meet XRPL

Ondo Finance has expanded its tokenized treasury offerings to the XRP Ledger (XRPL), enabling institutional investors to access OUSG (Short-Term US Government Treasuries Fund) through RLUSD. This marks the first seamless settlement between OUSG and RLUSD on XRPL.

Key points:

- OUSG is fully backed, yield-generating, and compliant

- Ondo Finance manages over $1.3B in TVL

- OUSG has $690M in TVL, invested in funds from BlackRock, Franklin Templeton, and others

This integration provides institutions with flexible treasury management tools and high-quality tokenized assets on XRPL.

Speaking with @CNBC about Ondo Chain testnet's debut transaction, @nathanlallman explained: “It’s really the first time that there’s been this interoperability between a bank’s permissioned blockchain environment and a public blockchain.” cnbc.com/2025/05/15/us-…

1/ Kinexys by J.P. Morgan (@jpmorgan), Ondo Finance, and @chainlink are teaming up to connect bank settlement infrastructure to Ondo Chain. Today, we are excited to announce the debut transaction on Ondo Chain testnet — a cross-chain, atomic DvP settlement of OUSG.

Ondo is building the capital markets layer for the onchain economy. From tokenized Treasuries to stocks and ETFs, we’re bringing traditional financial assets into the open economy.

1/ We’re excited to announce that @TruBit_Global, a leading crypto payment and trading platform in Latin America, has added support for Ondo’s market-leading yieldcoin, $USDY.

.@KomainuCustody has added Ondo’s flagship tokenized US Treasuries products—OUSG and USDY—to its custody platform. As a regulated digital asset custodian backed by Blockstream and Laser Digital, a Nomura company, Komainu offers an enterprise gateway for institutions to access

Wall Street still runs on 20th century rails. It's time to upgrade the system. Ondo Global Markets will make US securities as useful as stablecoins—liquid, interoperable, and available 24/7.

Tweet not found

The embedded tweet could not be found…

Ondo Global Markets enables always-on access to tokenized stocks and ETFs. Investors will soon be able to access US securities 24/7/365 without relying on legacy intermediaries. The future is always on, and it’s coming sooner than you think.

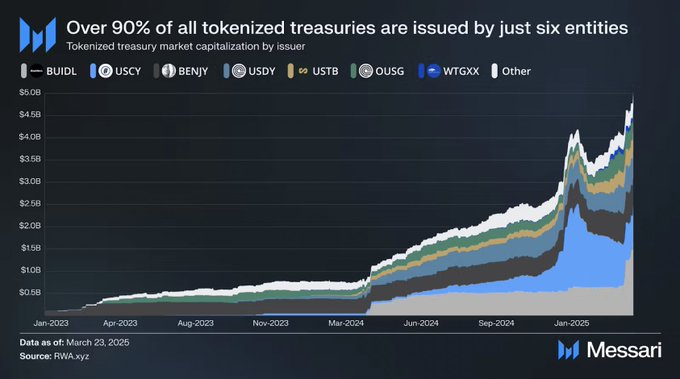

Tokenized US Treasuries have exceeded $7B in TVL for the first time, and are hitting milestones faster than ever. It took stablecoins five years to reach this scale. Tokenized Treasuries got there in less than three. Ondo is driving much of this growth with the most widely-held

The momentum behind tokenized assets is now impossible to ignore, prompting the US Treasury to weigh in. In its latest report, the department outlined how stablecoins could: → 8x to $2T by 2028 → Reshape global demand for short-term Treasuries → Replatform payments,

Here's what leaders from Kinexys by @jpmorgan, @chainlink, and @ondofinance had to say about the debut testnet transaction on Ondo Chain — a new L1 purpose-built to scale institutional-grade RWA tokenization: 👇 “The demonstrated cross-chain solution is a testament to what can

1/ Kinexys by J.P. Morgan (@jpmorgan), Ondo Finance, and @chainlink are teaming up to connect bank settlement infrastructure to Ondo Chain. Today, we are excited to announce the debut transaction on Ondo Chain testnet — a cross-chain, atomic DvP settlement of OUSG.

The future of capital markets won’t be built on old infrastructure. Over $90T in value exists in US stocks and Treasuries—yet only a fraction of that value is accessible onchain. Ondo is building the infrastructure to change that.

Ondo Global Markets will bring stocks and ETFs from NYSE and NASDAQ onchain. They will be: → Accessible 24/7 → Eligible for margin → Composable with DeFi Whether you're an individual user or a platform developer, Ondo Global Markets brings tokenized equities directly to your

The US capital markets are worth over $60T—but only a fraction of that value is accessible onchain today. Ondo is laying the groundwork for tokenized finance, paving the way for trillions of dollars in value to transition onchain. Welcome to Wall Street 2.0.

Tweet not found

The embedded tweet could not be found…

Ondo's OUSG is one of the only tokenized US Treasuries funds to support 24/7, instant mints & redemptions with USDC — with no mint or redemption fee. OUSG enables efficient portfolio management & liquid access to tokenized US Treasuries-backed assets. Always on. Always ready.

USDY is now supported via @ZodiaCustody, with OUSG support coming soon, bringing yield-bearing tokenized US Treasuries to institutional balance sheets. With institutional-grade custody, earn network, and settlement solutions, Zodia Custody offers institutional clients seamless

Where is onchain finance headed over the next 12 months? “We’re going to continue to see rapid growth in tokenized treasuries,” explained @nathanlallman on @jacqmelinek's @_TalkingTokens podcast. “Tokenized treasuries have still barely scratched the surface of eating into the

Is 2025 the year of tokenization?🪙 @OndoFinance's Founder & CEO @nathanlallman says yes. Ondo is home to $USDY and $OUSG, which have market caps of ~$600M and $420M, respectively His team is banking big (pun intended) that onchain finance will change everything for crypto

This week we saw Citi entering the tokenized private markets with late-stage pre-IPO equities, and the US Treasury Secretary classing digital assets as strategically important to America. Here are all the key developments you don’t want to miss. 👇

“There's 64 trillion dollars in global equities that can be brought onchain.” —Ondo Finance Vice Chair Patrick McHenry, live on Nasdaq @TradeTalks with Rep Zach Nunn. Today, only a fraction of that value is accessible onchain. Ondo is building the infrastructure to change that.

.@OndoFinance @PatrickMcHenry & @ZachNunn join @JillMalandrino on @Nasdaq #TradeTalks to discuss the future of digital assets, crypto regulation and policy, and the importance of national security in financial innovation. x.com/i/broadcasts/1…

"...this is the first time JPMorgan has built out a structure to interface with a public blockchain" @FortuneMagazine writes how Kinexys by @jpmorgan, Ondo Finance, and @chainlink completed a novel cross-chain, atomic settlement of tokenized treasuries. fortune.com/crypto/2025/05…

The world is connected. Financial markets should be, too. Ondo Global Markets will give global investors seamless access to US securities—enhanced by the composability of onchain finance. Financial markets built for a borderless, connected future.

Markets shouldn’t sleep, and they shouldn’t stop at borders. Ondo Global Markets brings tokenized US securities to the world—onchain, composable, and always accessible. Welcome to the open economy.

There are no closing bells onchain. Ondo has arrived at the forefront of financial innovation, and now, at Wall Street station. As Digital Assets Week kicks off in NYC, the world is watching as the US embraces digital assets, with Ondo helping define the industry's future.

From JPMorgan's strategic entry into the MENA region to the launch of BlackRock’s second tokenized money market fund, global institutions are increasingly focused on digital assets. Here are the key recent developments you don’t want to miss. 👇

First came stablecoins. Now, @capa_fi brings yieldcoins to Latin America. Through an integration with Ondo's USDY on @solana, users in Mexico and the Dominican Republic can now onramp to tokenized US Treasuries from their local bank accounts. Read more: blog.ondo.finance/how-capa-is-un…

“This is the first time ever that you can go 24/7, 365 from a tokenized bank deposit to a tokenized treasury.” —@nathanlallman, speaking with @coindesk at @consensus2025 after Ondo Chain testnet's debut transaction in collaboration with @chainlink and Kinexys by @jpmorgan.

The Ondo Finance team is in DC today meeting with the SEC Crypto Task Force to discuss tokenization and the future of digital asset regulation. We look forward to collaborating with regulators on shaping a thoughtful framework for digital assets.

Yieldcoins represent a new class of tokenized assets designed to deliver steady, onchain yield. Ondo’s market-leading yieldcoins, USDY and OUSG, give global investors access to institutional-grade yield without the friction of traditional finance.

The tokenized treasuries market continues to expand—and Ondo is at the forefront with two products. USDY is the most widely held yieldcoin, and OUSG offers market-leading instant liquidity—together unlocking global, 24/7 access to US treasuries yield. The future of capital

This week we saw Kinexys by J.P. Morgan executing the first cross-chain Delivery vs Payment transaction with Ondo Chain as well as Moonpay partnering with Mastercard to bring stablecoin acceptance mainstream. Here are the key recent developments you don’t want to miss. 👇

Stablecoins took the dollar global. Ondo Global Markets will do the same for US capital markets. We’re building Wall Street 2.0—Made in America, built for the world.

Ondo’s $1B in TVL reflects growing conviction in tokenized treasuries. But capital markets are orders of magnitude larger, and they demand infrastructure built to match. Ondo Global Markets is bridging that gap.

Ondo Finance's CEO Nathan Allman (@nathanlallman) is at @consensus2025 today discussing the future of tokenization: > 10:20am Mainstage Panel > 12:20pm Panel with Kinexys by @jpmorgan & @SergeyNazarov > 11:15pm on @CoinDesk > 1:00pm on @Nasdaq > 2:45pm on @CNBC Crypto World

Tokenization is “faster, better, cheaper,” explained Ondo Finance Vice Chairman @PatrickMcHenry on @CryptoAmerica_, and when it comes to tokenization, “Ondo is best-in-class.”

“And so when you look at anything Ondo does, they do it at an extremely high standard, like at the Goldman Sachs, McKinsey, or higher standard.” — @SergeyNazarov, Co-Founder of @Chainlink Ondo is setting the bar for tokenized finance by building truly institutional-grade

“We're very optimistic about our ability and the industry's ability to bring more tokenized products to the US.” — @nathanlallman from the NYSE floor, following the US administration's engagement with the industry, including the SEC's Crypto Task Force meeting with Ondo Finance.

Tokenization is about unlocking access - for investors, products, and capital. At Ondo, we’ve built market-leading solutions that are globally accessible with industry-leading cost efficiency, seamless interoperability, and instant redemption capabilities. Today, Ondo is

The institutions are here. Solana Stories featured Ondo’s Ian De Bode alongside leaders from Visa, VanEck, and Galaxy Digital to discuss the accelerating shift toward digital assets. “Everyone sees the writing on the wall that the regulation and legislation is changing.”

1000-year-old financial systems don't change overnight — except when they do. The institutions are here, and they're building on Solana.

Ondo Global Markets will do for US securities what stablecoins did for the US dollar. What will Ondo Global Markets provide? • A gateway to US equities trading • Instant minting and redemption of tokenized securities • Composability for tokenized US stocks This is how

Ondo Global Markets provides more than tokenized access — it enables programmable liquidity for the world’s most important assets.

On May 14, Ondo Finance Founder & CEO @nathanlallman takes the @consensus2025 mainstage for “Tokenize Everything: Why RWAs Are Finally Here.” He’ll be joined by @carlosdomingo (@securitize), @rleshner (@superstatefunds), @0x_tracy (@hiframework), to discuss the future of RWAs.

At @Solana Accelerate (@SolanaConf), Ondo's Founder & CEO @nathanlallman took the stage to deliver a clear message: tokenization is about unlocking access. Access is the foundation of a more inclusive financial system, yet high-quality assets and services have long remained out

Institutional adoption of real-world assets is on the rise, and the custody rails are here to support it. OUSG & USDY are now supported via @CopperHQ Custody, giving Copper clients a secure entry point, with MPC custody, to tap into yield-bearing onchain RWAs. Read more:

Ondo Global Markets provides more than tokenized access — it enables programmable liquidity for the world’s most important assets.

The tokenized treasuries market continues to expand—and Ondo is at the forefront with two products. USDY is the most widely held yieldcoin, and OUSG offers market-leading instant liquidity—together unlocking global, 24/7 access to US treasuries yield. The future of capital

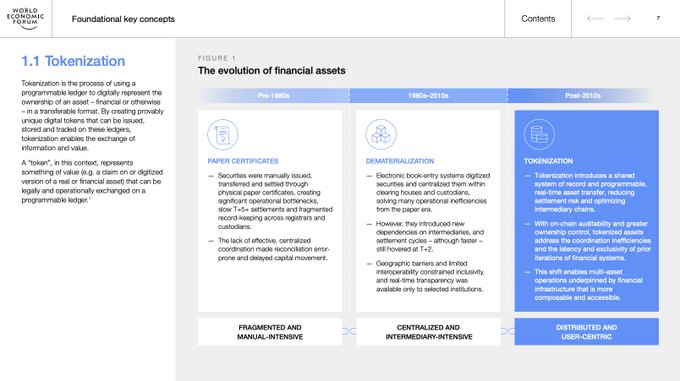

Ondo Finance was just featured in the World Economic Forum’s (@wef) tokenization report. “Franklin Templeton’s Benji and Ondo Finance’s USDY have succeeded in bringing off-chain treasuries and other high-quality liquid assets on-chain.” The report, titled “The Next Generation

Traditional stocks trade 9:30 to 4:00. Tokenized stocks are available 24/7. Traditional markets settle in days. Tokenized stocks can settle instantly. Traditional finance excludes billions. Tokenized stocks are globally accessible. Stocks aren't just coming onchain—they're

The institutions are coming. Major banks and asset managers “are now finally seeing an environment where they can lean forward because regulatory clarity is coming,” explained Ondo’s Ian De Bode, live on Nasdaq @TradeTalks. “A lot of big institutions are coming to us looking

.@OndoFinance Chief Strategy Officer Ian De Bode joined @JillMalandrino to discuss why major banks and other financial institutions are ready to move their financial services on chain. Watch the full video: spr.ly/6016F2IIQ

Yieldcoins = Upgraded Stablecoins with Returns While DeFi primarily focuses on crypto speculation, tokenization allows the benefits of blockchain to be applied to traditional finance. Stablecoins were the first successful example of tokenization, offering global access to a

🏦 Institutions Prep for Onchain Future

At Binance Blockchain Week in Dubai, Ondo President Ian De Bode emphasized how **tokenization is reshaping finance**. The key message was clear: **major institutions are preparing for an onchain future**. This follows recent regulatory support, with: - **Paul Atkins (SEC Chairman)** calling tokenization inevitable for keeping the US competitive - **BlackRock's leadership** highlighting tokenization's potential for enormous growth - **Major financial institutions** converging at the upcoming Ondo Summit in February 2026 The institutional momentum is building as traditional finance recognizes blockchain's role in modernizing capital markets. From tokenized Treasuries to stocks and ETFs, the infrastructure for bringing trillions onchain is taking shape. **The shift from experimentation to implementation is accelerating across the financial sector.**

Silver Outperforms Google Stock in 2025 as Precious Metals Shine

**Silver has outperformed Google stock ($GOOGL) in 2025**, highlighting the continued strength of precious metals in investment portfolios. This performance reinforces why **precious metals deserve a place in traditional investment strategies**. Investors can now access these assets alongside stocks through blockchain technology. **Key highlights:** - Silver beats major tech stock performance - Precious metals proving portfolio value - Traditional assets now available onchain [Ondo Global Markets](https://summit.ondo.finance/2026) offers access to over 100 tokenized stocks and ETFs, including gold and silver ETFs, bringing traditional assets to the blockchain. **Learn more at the upcoming summit** - view speakers and RSVP at the link above.

Onchain Stocks Set for Mainstream Adoption in 2026

**2025 marked the emergence of onchain stocks** as a significant trend in the tokenization space. **The next phase begins in 2026**, when these blockchain-based equity instruments are expected to gain widespread mainstream adoption. Key developments: - Onchain stocks gained traction throughout 2025 - Infrastructure and regulatory frameworks matured - **2026 positioned as the breakthrough year** for mass market acceptance This progression follows the broader tokenization trend that has seen various traditional assets move onto blockchain platforms, offering improved accessibility and programmability.

Nasdaq Embraces Tokenization as Next Evolution in Securities Trading

**Nasdaq is positioning itself at the forefront of securities tokenization**, with Head of Digital Assets Matt Savarese describing it as the natural next step after the transition from paper to electronic trading. The exchange is actively working to **support tokenized stocks and ETFs**, building on their earlier SEC filing to allow trading of tokenized securities on their platform. **Key developments:** - Nasdaq views tokenization as an evolutionary step in market infrastructure - The exchange is developing capabilities for tokenized traditional securities - This follows their September regulatory filing with the SEC **Market implications:** - Could increase trading efficiency and market accessibility - Represents institutional validation of blockchain-based securities - May face regulatory hurdles as the framework develops Nasdaq's embrace of tokenization signals **growing institutional confidence** in blockchain technology for traditional financial markets, potentially paving the way for broader adoption across major exchanges.

Major Onchain Stock Purchases Hit $1.2M This Week Led by Google

**Large institutional money is flowing into tokenized stocks this week**, with over $1.2 million in major purchases recorded onchain. **Top purchases include:** - $500,000 in Google (GOOGLon) - $273,506 in QQQ ETF - $200,705 in Meta - $150,000 each in Alibaba and NVIDIA The **Google purchase executed as a single transaction** on BNB Chain, demonstrating how tokenized stocks can handle large orders efficiently. **Ondo's tokenized stocks inherit traditional exchange liquidity**, allowing these substantial onchain orders to execute with the same efficiency as conventional stock trades. This activity signals **growing institutional adoption** of tokenized traditional assets in DeFi.