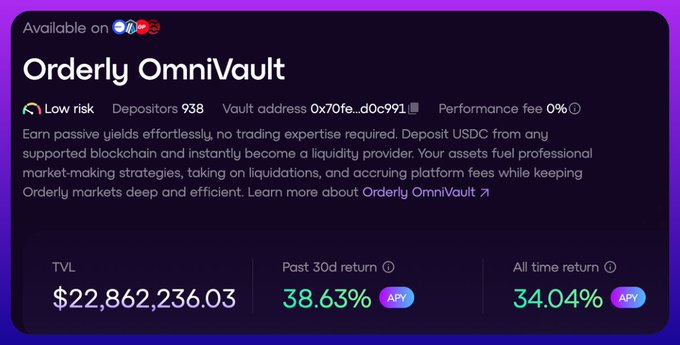

OmniVault Delivers 34% Returns Without Performance Fees

OmniVault Delivers 34% Returns Without Performance Fees

📈 Beating hedge funds

OmniVault achieves 34.04% annualized returns since inception, outperforming elite hedge funds while charging zero performance fees.

The vault generates yield through:

- Market-making strategies

- Liquidations

- Trading fees

- Up to 40% of Orderly's protocol revenue

Recent performance highlights:

- 40% APY on USDC over 30 days

- Maximum drawdown of only 0.12%

- Nearly $7M in active capital deployed

OmniVault is now live on Sei Network, allowing users to add liquidity while keeping funds on their preferred chain. The vault combines institutional-grade trading strategies from Kronos Research with DeFi transparency.

Annualised return since inception: 34.04% That's better than elite hedge fund returns but with zero performance fees. OmniVault: app.orderly.network/vaults

OmniVault is now live on @SeiNetwork. Users on SEI can now add liquidity to our vault while keeping their funds on SEI. OmniVault has delivered a 40% APY on $USDC over the past 30 days, with a maximum drawdown of only 0.12%. Yield is generated through market-making strategies,

Aegis DEX Generates $65K+ in Fees Within 10 Days of Launch

**Aegis DEX** has achieved significant early success, generating over **$65,000 in fees** within just 10 days of launching. The new decentralized exchange was built using **Orderly One**, a platform that enables rapid DEX deployment. Aegis previously joined Orderly's exchange layer to power perpetual trading features. Key highlights: - Launch occurred approximately 10 days ago - Revenue generation of $65K+ demonstrates strong early adoption - Built on Orderly One infrastructure - Part of growing ecosystem of DEXs created through the platform This success story showcases the potential for new DEXs to quickly establish revenue streams when leveraging proven infrastructure. Orderly One continues to see regular DEX creation, with 37 new exchanges built in a recent 24-hour period. [Explore DEX opportunities](https://dex.orderly.network/)

RVV Futures Trading Goes Live with 5x Leverage Across Multiple DEXs

**RVV futures trading is now available** across EVM and Solana networks with up to **5x leverage**. Traders can access RVV futures on multiple decentralized exchanges including: - WOOFi - Saros - Raydium Protocol - What Exchange - Kyrrio Official - Coin98 Wallet - BBX Official - Mode Network - Bugscoin - PerpsDAO - KodiakFi The listing is also **available on any Orderly One DEX**, expanding access across the omnichain trading infrastructure. This follows recent futures listings for SNX and DASH tokens with 10x leverage, and ZEC with similar leverage options.

🎧 Order Podcast Episode 4: Mode Network Co-founder Discusses L2 Infrastructure Innovation

**The Order Podcast** releases its fourth episode featuring an interview with Mode Network co-founder @JRossTreacher. The discussion covers: - How Mode is **transforming the Layer 2 landscape** - Core infrastructure developments and innovations - Strategic approaches to L2 scaling solutions This follows Episode 3's conversation with Pyth Network's ecosystem marketing lead about real-world data integration. *Listen to learn about the latest developments in L2 infrastructure and scaling solutions.*

Orderly Network's NAS100 Launch Generates $11M Volume on First Day

Orderly Network's new **$NAS100 listing** achieved impressive first-day metrics: - **$11M trading volume** in 24 hours - Instantly became the **4th most traded pair** on the platform - Built on previous day's $650K volume momentum The launch demonstrates strong demand for **on-chain index trading**. Orderly positions itself as offering the deepest liquidity for traditional market indices in the decentralized finance space. This performance suggests growing interest in bringing traditional financial instruments to blockchain-based trading platforms.