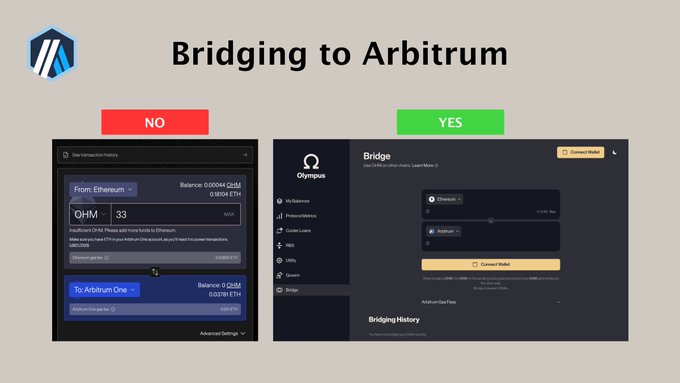

The Olympus DAO community advises using the Olympus native bridge when moving $OHM to Arbitrum. The official Arbitrum bridge mints an illiquid version of OHM and can take 7 days to retrieve back to the mainnet. The address for Arbitrum $OHM is 0xf0cb2dc0db5e6c66B9a70Ac27B06b878da017028.

Backing Floor Absorbs 98% of 15% Price Drop, Demonstrating Asset-Backed Stability

A decentralized reserve currency's backing floor mechanism proved effective during a recent market downturn. **Key Performance Metrics:** - Price declined 15% - Backing value moved only 0.3% - Backing premium absorbed 98% of the drawdown The backing floor differs from traditional pegs by relying on real, liquid assets that remain available regardless of market conditions. Unlike pegs that can break under pressure, this asset-backed approach provides a tangible foundation for price stability. This event demonstrates how treasury-backed mechanisms can cushion volatility while maintaining protocol integrity through actual reserves rather than algorithmic promises.

Olympus Protocol Demonstrates Resilience During Market Crash

When markets crashed again, Olympus demonstrated the stability it was designed to provide. The protocol's mechanisms functioned as intended during the downturn, maintaining its core operations. **Key Points:** - Olympus protocol operated according to design during market volatility - System maintained stability through built-in mechanisms - Demonstrates practical application of decentralized reserve currency model The event showcases how DeFi protocols can respond to market stress through automated systems rather than centralized intervention. [Read the full analysis](https://olympusdao.medium.com/when-markets-crashed-again-olympus-did-what-it-was-built-to-do-5fa4040b3bb2)

CD Strike Prices Drop 14% as Smart Money Locks in Entry Points

**Market participants responded to recent price movements by increasing their positions.** - CD strike prices adjusted programmatically from $22.99 to $19.71, representing a 14% decrease - Deposit volume increased 5.7x as users secured entry points at the lower strike prices - The price adjustment mechanism responded to market conditions automatically The automated repricing created conditions that attracted increased capital deployment from market participants seeking favorable entry positions.

🛡️ OHM's Yield Repurchase Facility Absorbs Market Shock

The Yield Repurchase Facility (YRF) demonstrated its autonomous stabilization capabilities during recent market volatility. **Key Performance Metrics:** - Protocol automatically increased OHM buybacks as prices declined - Buyback activity peaked at 980 OHM on February 1st - Capital efficiency improved as premium compressed **How It Works:** The YRF evaluates weekly yield from protocol reserves and Cooler Loans interest, then creates bond markets through Axis Finance to bid OHM for USDS. Acquired OHM is redeemed at 11.33 USDS to maintain proper collateralization. This mechanism acts as a countercyclical force—buying more when prices fall and less when they rise—without manual intervention.

🛡️ Olympus Cooler Loans Survive Market Pressure

**Zero Liquidations During Market Stress** While external DeFi protocols faced significant pressure, Olympus's Cooler Loans infrastructure recorded **zero liquidations**. **Key Features:** - Backing-based LTV (loan-to-value) system - Fixed 0.5% interest rate - Designed to prevent reflexive selling during market downturns The protocol's unique approach to lending demonstrates resilience during volatile market conditions, contrasting sharply with traditional DeFi lending platforms that experienced liquidation cascades.