Octav Launches Portfolio Management Platform for DAOs and DeFi Funds

Octav Launches Portfolio Management Platform for DAOs and DeFi Funds

🔍 Your DeFi Data Just Got Easier

Octav has introduced a comprehensive DeFi portfolio management solution targeting DAOs, funds, and on-chain treasuries. The platform offers:

- Real-time wallet position reporting

- Protocol-level tracking of staked assets and yields

- Percentage allocations across tokens, networks, and protocols

- Automated financial reporting for DeFi operations

The tool aims to streamline portfolio management for crypto-native teams, shifting focus from data collection to strategic capital deployment. Learn more at Octav.fi

🔍 DeFi is transparent, but managing it shouldn’t be a full-time job. For DAOs, funds, and on-chain treasuries, visibility isn’t the issue, it’s clarity. You need more than wallet balances. You need structured answers: 📊 What’s staked and where? 📈 What yield are you

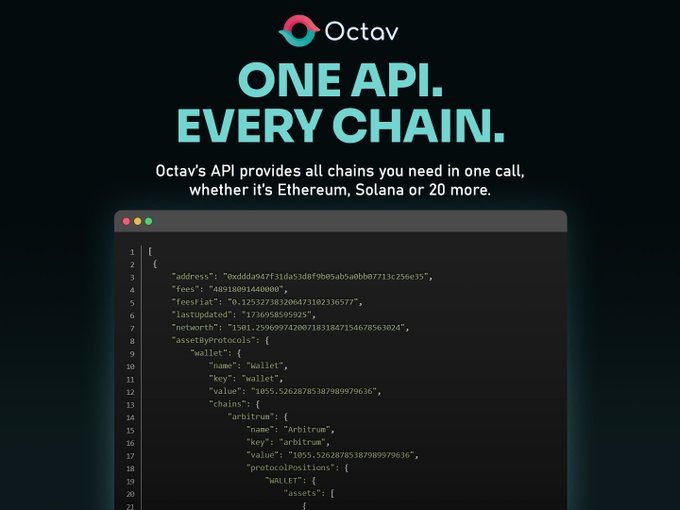

🧱 Still building your DeFi data stack from scratch? Why? 🚀 Octav’s new API platform gives you: 🔗 One call = full portfolio visibility 📊 Every chain. Every wallet. Labeled. Normalized. 🧠 No more stitching data or juggling formats. Now with credit-based access: ✅

Moody's Pilots Automated Credit Scoring on Solana

Moody's Ratings has launched a pilot program for real-time, automated credit scoring on the Solana blockchain, marking a significant shift from traditional quarterly manual assessments. Key changes: - Moving from manual to smart contract-based assessments - Real-time updates replace quarterly reviews - Transparent infrastructure instead of traditional middlemen This development follows growing momentum in tokenized private credit, which promises: - Shorter margin cycles - Lower collateral requirements - Reduced capital costs - Increased liquidity The transition awaits regulatory clarity on legal enforceability of smart contracts in relation to off-chain assets.

Sea Salt & Smart Contracts Kickstarts EthCC 8 in Cannes

A beachside gathering marked the beginning of EthCC 8 in Cannes, drawing over 300 Web3 builders and enthusiasts. The event, co-hosted by Octav alongside Mellow Protocol, RedStone DeFi, Symbiotic Finance, and Gearbox Protocol, featured: - Sunset networking on Cannes beach - Extended queues demonstrating high attendance - Casual cocktail discussions about blockchain innovation The momentum continued through EthCC 8 and into ETHGlobal Cannes, maintaining focus on DAO operations and on-chain portfolio management. Partners including Arkham, Portofino Tech, and Tron DAO contributed to subsequent networking events.

Lido's Gearbox Instance Hits $25M TVL After Launch

Gearbox Protocol has launched a dedicated instance for Lido, reaching $25M in TVL shortly after launch. The integration creates a new wstETH credit market powered by Mellow Protocol vaults. Key features: - Up to 20x leverage for borrowers using Mellow markets - Lenders can provide wstETH without impermanent loss or lockups - Annual rewards available on DVstETH (14x) and rstETH (20x) The partnership showcases Gearbox's institutional-grade features: - Customizable rates - Deep liquidity - Security-tested infrastructure - No liquidity fragmentation [Learn more about the Lido instance](https://blog.gearbox.fi/lido-instance-2/)

Overnight Finance Introduces Batch Transaction Editing

Overnight Finance has launched a new feature enabling users to edit multiple transactions simultaneously, marking a significant improvement in transaction management efficiency. - Users can now select multiple transactions at once - Single-click transformation of transaction attributes - Supports bulk changes to transaction types and protocols - Streamlines reconciliation process This update builds on previous improvements to their transaction handling system, including the Zapin feature that allows consolidating multiple transactions into one.