Notional Finance Offers High Fixed Rates on USDC

Notional Finance Offers High Fixed Rates on USDC

🔒 10% Fixed Rates... But How?

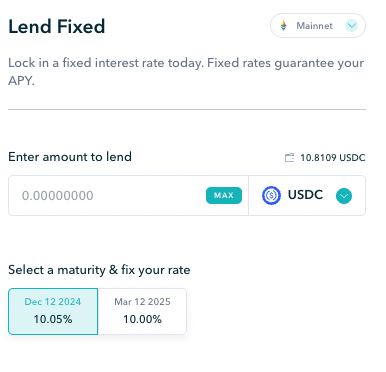

Notional Finance is currently offering fixed rates above 10% APY for USDC deposits. This comes alongside their new leveraged PT (Principal Token) strategies, though users can opt for the simpler fixed-rate option.

Key points:

- Fixed rates >10% APY for USDC

- Alternative to leveraged PT strategies

- Rates have remained consistently high since strategy introduction

Fixed rates provide a more conservative option for users seeking steady yields without leverage exposure.

Want to learn more? Visit Notional's platform to explore their fixed-rate lending options.

Don't want to take the risk of Notional's new leveraged PT strategies to earn yield? You don't have to. $USDC fixed rates on Notional now >10% APY

Notional Launches Exponent Beta with 4 Leveraged Yield Strategies

**Notional Exponent Beta** is launching with a **6-week program** featuring innovative leveraged yield strategies. **Key Features:** - 4 new leveraged yield strategies - 100,000 $NOTE token incentives for participants - Beta testing phase for the world's first leveraged yield protocol This represents the **next evolution** of Notional's fixed-rate lending protocol, expanding beyond traditional borrowing and lending into leveraged yield generation. The beta program offers early access to test these new strategies while earning substantial NOTE rewards for participation.

Notional Exponent Introduces Smart Liquidation for Illiquid DeFi Collateral

Notional Exponent addresses a critical DeFi challenge: managing illiquid collateral that requires days to redeem. The protocol introduces **Smart Liquidation**, a solution designed to handle slow-moving collateral in DeFi lending markets. Key features: - Automated handling of illiquid assets - Reduced risk for lenders - Streamlined liquidation process This development builds on Notional's existing fixed-rate lending infrastructure, which currently manages approximately $500M in TVL. The solution aims to expand DeFi lending markets beyond instantly liquid assets, potentially opening new opportunities for real-world assets on-chain.

Notional Finance Announces Notional Exponent - First Leveraged Yield Protocol

Notional Finance has unveiled Notional Exponent, marking a significant evolution in DeFi lending. This new protocol introduces leveraged yield capabilities, a first in the space. Key features of Notional's current offering: - Fixed-rate lending for USDC & DAI (up to 1 year) - ETH & WBTC lending (up to 6 months) - Automated debt rolling via nTokens - ~$500M Total Value Locked (TVL) The protocol, backed by Coinbase Ventures among others, continues to build on its successful V2 upgrade and $10M Series A funding. Learn more: [Notional Exponent Announcement](https://blog.notional.finance/notional-exponent-doubling-down-on-leveraged-yield/)

Notional Launches First Leveraged Yield Protocol - Notional Exponent

Notional Finance has announced Notional Exponent, positioning it as the first leveraged yield protocol in the space. This follows their successful implementation of leveraged yield farming vaults on Arbitrum, which include: - Smart contract risk protection via OpenCover - Integration with Balancer v2 and Aura Finance - Eligibility for Notional's ARB points program The protocol combines fixed-rate lending with leveraged yield strategies, offering users enhanced yield opportunities while maintaining risk management features. [View eligible vaults](https://notional.finance/points-dashboard/arbitrum) [Protocol coverage details](https://drive.google.com/file/d/16GDT3it0H5C-QVTRejdNUg6zs_zBsODV/view)

Security Incident at Bybit Leads to Temporary Pause of USDe-Related Vaults

**Key Updates:** - Notional has temporarily suspended operations for March USDe PT, May sUSDe PT, and Curve USDe/USDC vaults following a security incident at Bybit - Safe's security team is actively collaborating with Bybit officials on an ongoing investigation - No evidence of compromise found in the official Safe frontend - Safe{Wallet} has implemented temporary functionality restrictions as a precautionary measure **Current Status:** The situation is being actively monitored, with expectations of a benign resolution. User security remains the top priority, with further updates pending.