Nexus Mutual Offers Bundled Protocol Cover for DeFi Platforms

Nexus Mutual Offers Bundled Protocol Cover for DeFi Platforms

🔒 Secure Your DeFi Yields

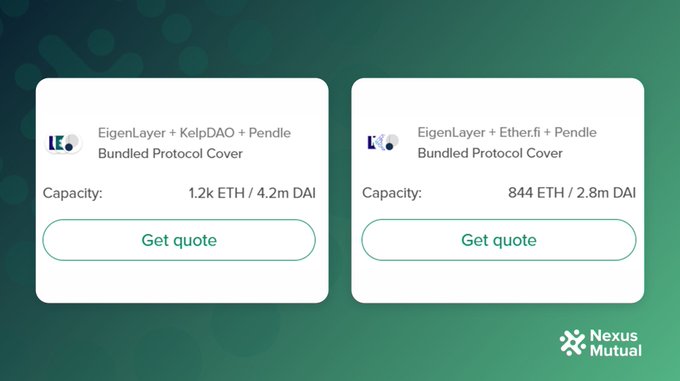

Nexus Mutual has listed several new Bundled Protocol Cover offerings in its user interface, providing protection against smart contract risks across multiple DeFi protocols. These bundled covers safeguard users from potential exploits, hacks, oracle failures, governance attacks, and severe liquidation failures. The covered protocols include Pendle, EigenLayer, Etherfi, Swell, Renzo, KelpDAO, Kwenta, and Synthetix. Users can purchase a single Cover NFT to protect against risks across three associated protocols. Nexus Mutual aims to make DeFi safer by mitigating smart contract risks for users engaging with these platforms.

If you're an LP or a PT holder for the $eETH maturity on @pendle_fi, we've got you covered across the full-stack of risk with Bundled Cover! This Bundle protects against smart contract risk across EigenLayer, Etherfi + Pendle 🛡️ 🔹 Etherfi Bundle: v2.nexusmutual.io/cover/product/…

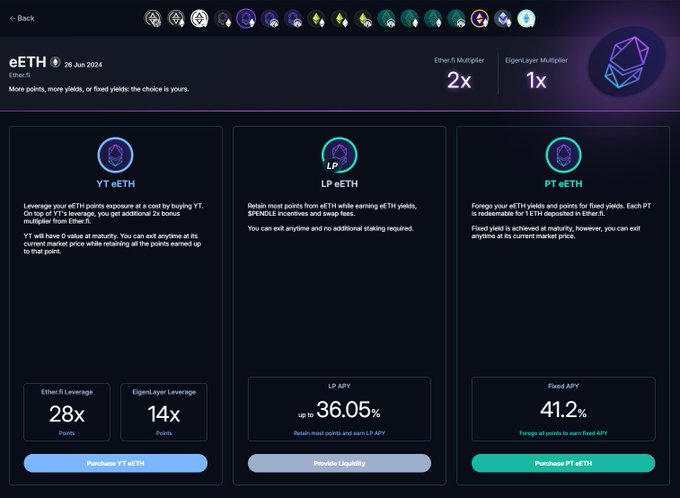

Higher points upside as $eETH LPs in this market, but LP yields are lower than $eETH (Zircuit) market which comes w/ added smart contract risk 🤔 Maturity 🔹 77 days PT Fixed Yield 🔹 36.05% LP APY (Fixed Yield, Trading Fees, Points) 🔹 41.2% Review 👀 app.pendle.finance/points/eETH

Whether you're an LP or a PT holder for the $rswETH maturity on @pendle_fi, we've got you covered across the full-stack of risk with Bundled Cover! This Bundle protects against smart contract risk across EigenLayer, Swell + Pendle 🛡️ 🔹 Swell Bundle: v2.nexusmutual.io/cover/product/…

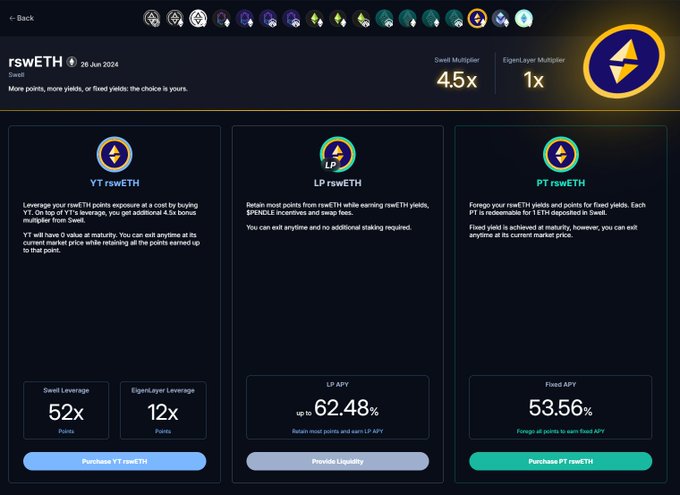

For Swell's $rswETH market, the highest available yields are for LPs with great PT yields, as well. Great choices in this market 👀 Maturity 🔹 77 days PT Fixed Yield 🔹 53.56% LP APY (Fixed Yield, Trading Fees, Points) 🔹 62.48% Review 👀 app.pendle.finance/points/rswETH

🛡️ New Bundled Protocol Cover Listing We've got a special treat for onchain leverage traders and perps lovers ❤️ We've listed Kwenta + Synthetix Bundled Protocol Cover in the Nexus Mutual UI! 🔹 Kwenta + Synthetix Bundle: app.nexusmutual.io/cover/buy/get-…

🛡️ New Bundled Protocol Cover Listing Another Pendle bundle is here 🐢 We've listed EigenLayer + Renzo + Pendle Bundled Protocol Cover in the Nexus Mutual UI! 🔹 Renzo Bundle: app.nexusmutual.io/cover/buy/get-…

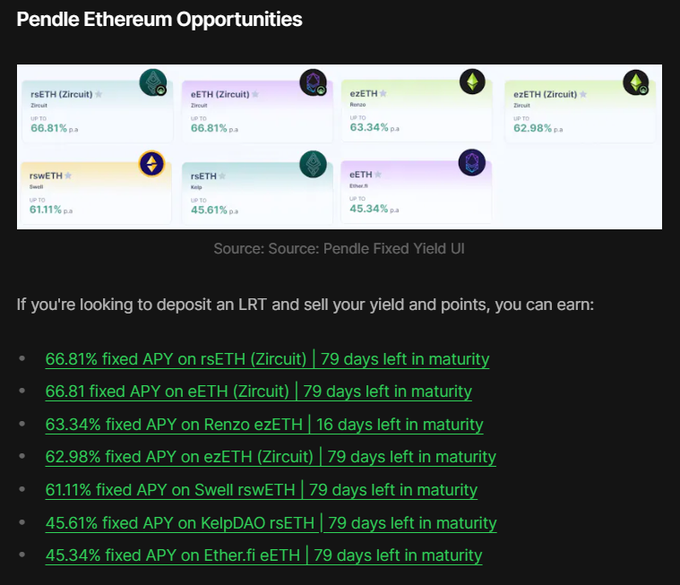

In @BraveDeFi's latest issue of State of DeFi Yields, he provided an update on the Fixed Yield markets on Pendle, where LRT holders can earn 45–67% fixed APY 👀 PT-LRT holders can protect their PTs w/ Bundled Protocol Cover 🛡️ What do the Pendle Bundled Covers protect against?

Jumping into a new Fixed Yield maturity or liquidity pool on Pendle? We've got you covered with bundled cover that protects against smart contract risks across multiple protocols 🛡️ 🔹 KelpDAO Bundle: app.nexusmutual.io/cover/buy/get-… 🔹 Etherfi Bundle: app.nexusmutual.io/cover/buy/get-…

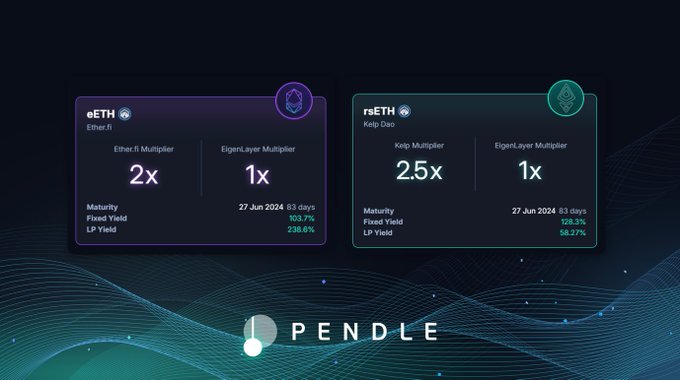

Wen more LRT on @Arbitrum? Now more LRT on Arbitrum! Welcoming 2 new additions to our Arbitrum lineup: 🔹 @ether_fi eETH (June 2024 maturity) 🔹 @KelpDAO rsETH (June 2024 maturity)

Nexus Mutual is in the Ether.fi UI 👀 $eETH holders can deposit into 💧 Liquid, earn DeFi APYs, $ETHFI rewards & EigenLayer + Ether.fi points 👇 app.ether.fi/liquid And now, you can buy Liquid Bundled Cover for peace of mind 🛡️ What's covered?

🛡️ Digital Asset Risk Management Panel at DAF Global

A panel discussion on risk management for digital assets is taking place at DAF Global. **Featured Speakers:** - Hugh Karp (Nexus Mutual) - Simon Peters (Xerberus) - Laeeq Shabbir (EY) - Darren Jordan (Komainu Custody) - José Ángel Fernández Freire (Prosegur Global) The panel focuses on strategies and practices needed for long-term survival in the digital asset space, covering institutional-grade risk management approaches.

Nexus Mutual Reports Strong January with Product Milestones and Risk Management Focus

Nexus Mutual released its January 2026 monthly update, highlighting key developments across product integrations and risk management. **Key Updates:** - Product milestones and new integrations completed - DeFi risk insights and legal analysis published - Ecosystem updates and community events The platform also published analysis on building risk expertise in DeFi, arguing that trust in code alone is insufficient. Their approach combines transparent onchain data with expert networks to make risk more manageable. Nexus Mutual emphasizes that **risk sharing should be collaborative rather than competitive** in the DeFi ecosystem. Full details available in their [monthly recap](https://nexusmutual.io/blog/nexus-mutual-monthly-january-2026) and [risk expertise analysis](https://nexusmutual.io/blog/why-defi-needs-real-risk-expertise).

🏦 Vaults Emerge as Core DeFi Infrastructure

**Vaults have become essential DeFi infrastructure**, according to TokenData's primer from Nexus Mutual's DeFi Risk Briefing. **Key context:** - Nexus Mutual provided over $1B in cover during 2025 - $5.5M+ in premiums earned by underwriters - $370K distributed in claims to covered members in 2025 - Total claims paid since 2019: $18.6M+ **Recent developments:** - Launch of Nexus Mutual v3 with expert-led claims and reworked governance - Introduction of Real World Insurance Vault (RWIV) - Focus on institutional DeFi adoption and vault risk management The briefing covered vault mechanics, recent hacks, claims processing, and institutional adoption trends. Vaults now handle complex backend operations including tokenization, multi-protocol strategy execution, and continuous risk management—far beyond simple deposit-reward-withdraw models. [Watch the vault primer](https://www.youtube.com/live/dD2S-CXlXCw?si=THW2wUsGU7OetJvL&t=1260)

Nexus Mutual Highlights Recent Vault-Related Claim Payouts in New Analysis

Nexus Mutual has released a breakdown of recent claim payouts connected to vault-related loss events. The analysis, presented by TokenData, demonstrates the protocol's track record of processing and paying claims. **Key Points:** - Focus on vault-related incidents and associated payouts - Part of Nexus Mutual's ongoing transparency efforts - Adds to the protocol's $18m+ in total claims paid since 2020 The update reinforces Nexus Mutual's position as an active claims payer in the crypto insurance space, with documented payouts across multiple incidents including bZx, Yearn, Cream Finance, and FTX-related events. For detailed claims data, visit their [documentation](https://docs.nexusmutual.io/overview/claims-history/) or [Dune dashboard](https://dune.com/nexus_mutual/claims).

OpenCover Launches Onchain Risk Map: New Framework for DeFi Risk Assessment

OpenCover has released the **Onchain Risk Map**, a comprehensive framework designed to help institutions understand and categorize blockchain risks. **Key Details:** - Built in collaboration with Nexus Mutual - First complete taxonomy of DeFi risks - Targets risk professionals, protocols, and institutional users - Launch webinar scheduled for February 11 at 17 CET The tool aims to standardize how blockchain risk is understood and managed across the industry. A full report and expert Q&A session will accompany the launch. [Join the launch webinar](https://opencover.com) for priority access and recording.