Nexus Mutual Expands Offerings with New Protocol Covers and USDC Support

Nexus Mutual Expands Offerings with New Protocol Covers and USDC Support

🔒 New Covers, USDC Support

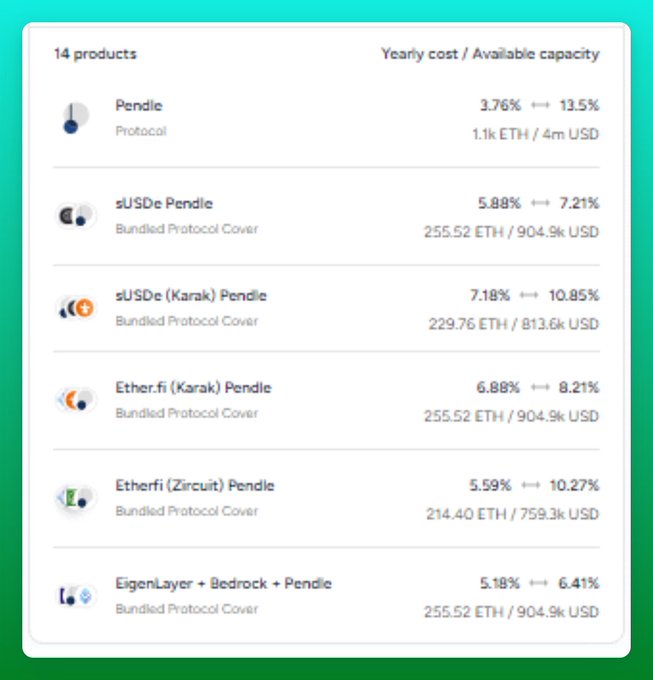

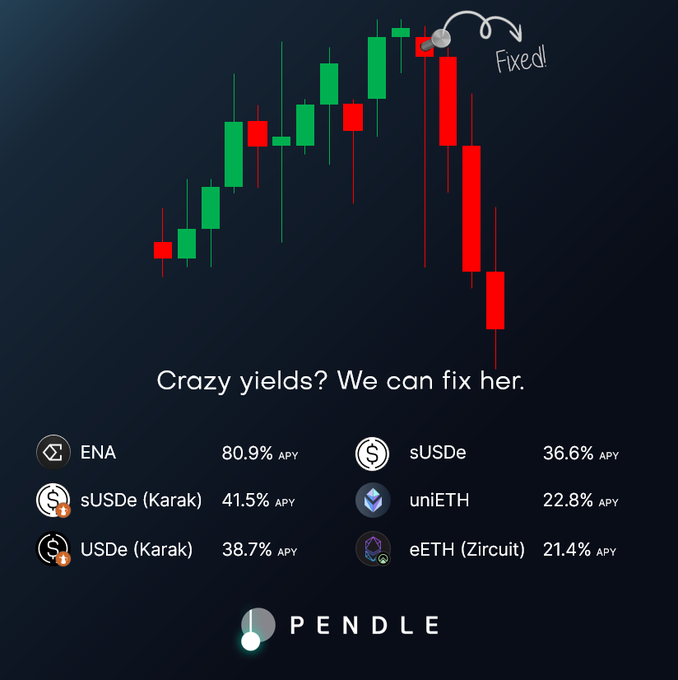

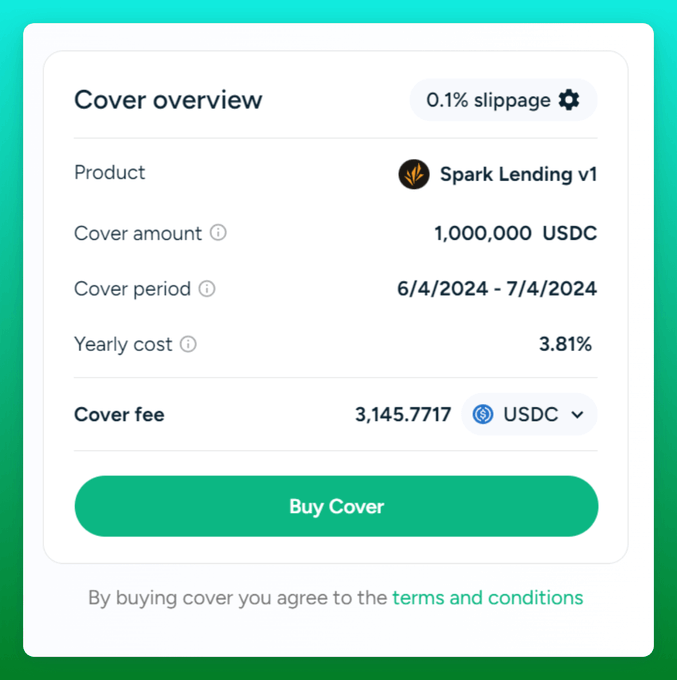

Nexus Mutual has announced several new developments in its decentralized insurance offerings. The Bedrock Fixed Yield Market on Pendle has been listed on the Nexus Mutual UI, allowing users to protect their uniETH positions against smart contract risks across the EigenLayer, Bedrock, and Pendle protocols. Additionally, the sUSDe Karak Network Fixed Yield Market on Pendle has been listed, providing coverage for sUSDe positions against smart contract risks in Karak, Pendle, and the USDe staking contract. Nexus Mutual has also introduced support for USDC-denominated cover, enabling users to purchase cover using USDC as the preferred payment asset in case of a loss. Furthermore, Nexus Mutual is working on developing new cover products, such as Depeg Cover, to protect users against events like a DAI or sUSDe depeg.

🛡️ New Bundled Protocol Cover Listing The @Bedrock_DeFi Fixed Yield Market on @pendle_fi is now listed in the Nexus Mutual UI! If you're earning high APYs on your uniETH in the Pendle Fixed Yield Market, you can protect your position against smart contract risk 💪

Deposit and earn rewards with $uniETH's newest @pendle_fi pool! 💎💰🏊♀️💰💎 With a current max APY of 47.69% and 5x Diamonds, don't sleep on this deal if you're a uniETH hodler! Check it out here: app.pendle.finance/trade/pools/0x…

Cover your PT tokens with Bundled Protocol Cover and sleep easy, while you earn high APYs on @pendle_fi 🛡️ Protect your Pendle positions today 👇 v2.nexusmutual.io/cover/buy-cover

Jumping into the @NotionalFinance markets on Arbitrum to earn high yields? Purchase Notional V3 Protocol Cover and lend with peace of mind knowing your assets are protected against smart contract risk, oracle failure/manipulation and more 🛡️ Where to buy Protocol Cover 👇

Big demand to borrow $ETH on Arbitrum has pushed $ETH variable lend rates way up! Do what you will with this information anon👀

🛡️ New Bundled Protocol Cover Listing The $sUSDe @Karak_Network Fixed Yield Market on Pendle has been listed in the Nexus Mutual UI! If you're earning high APYs on your sUSDe in the Karak Pendle Fixed Yield Market, you can protect your position against smart contract risk 🛡️

🛡️ Now Supporting $USDC Denominated Cover! Now that USDC has been added to the Capital Pool, you can now buy USDC-denominated Protocol Cover in the Nexus Mutual UI We're happy to offer this new cover asset as an option for our members 👇

🗺️ Onchain Risk Map Launches: Six-Dimension Framework for DeFi Risk Assessment

A new institutional framework for understanding blockchain risk is launching February 11th. The **Onchain Risk Map** categorizes onchain risk across six core dimensions: - Custody - Transactions - Protocols - Digital Assets - Staking - Systemic Risk Built in collaboration with OpenCover, this comprehensive taxonomy aims to help risk professionals, protocols, and institutional DeFi users navigate the complex landscape of decentralized finance. **Launch Event Details:** - Date: February 11, 2026 - Time: 17:00 CET - Format: Live webinar with expert Q&A - Platforms: X (Twitter) and LinkedIn - Featuring experts from the project team The framework represents the first comprehensive approach to categorizing DeFi risk for institutional use. Attendees will receive priority access to the full report and recording. [Join the launch event](https://nexusmutual.io) for a detailed walkthrough of the framework and the opportunity to ask questions directly to the development team.

🛡️ Digital Asset Risk Management Panel at DAF Global

A panel discussion on risk management for digital assets is taking place at DAF Global, featuring industry experts from leading organizations. **Panel participants include:** - Hugh Karp from [Nexus Mutual](https://nexusmutual.io) - Simon Peters from Xerberus - Laeeq Shabbir from EY - Darren Jordan from Komainu Custody - José Ángel Fernández Freire from Prosegur Global The session focuses on strategies and practices essential for long-term survival in the digital asset space, covering critical aspects of protecting and managing crypto holdings.

Nexus Mutual Reports Strong January with Product Milestones and Risk Expertise Focus

Nexus Mutual released its January 2026 monthly update, highlighting key developments across product integrations and DeFi risk management. **Key Updates:** - Product milestones and new integrations completed - DeFi risk insights and legal analysis published - Ecosystem updates and events coverage The protocol also published analysis on building risk expertise in DeFi, arguing that trust in code alone is insufficient. Their approach combines: - Transparent onchain data - Expert networks for risk assessment - Collaborative rather than competitive risk sharing Full details available in their [monthly recap](https://nexusmutual.io/blog/nexus-mutual-monthly-january-2026) and [risk expertise analysis](https://nexusmutual.io/blog/why-defi-needs-real-risk-expertise).

DeFi Risk Briefing: Protecting Institutional Capital in Crypto

A DeFi risk management discussion is scheduled for January 22nd, featuring industry experts Hugh Karp and tokendata. The briefing will cover: - Vault security and architecture - Institutional participation in DeFi - Recent hacks and vulnerabilities - Claims processes and risk mitigation The session aims to address the critical challenge of maintaining institutional confidence in decentralized finance as traditional players enter the space. [Join the discussion](https://x.com/i/spaces/1ynJOMBYWLAKR)

Nexus Mutual Releases Q4 Report on DeFi Risk and Claims

Nexus Mutual has published **The Nexus Review**, their Q4 and 2025 wrap-up report covering DeFi risk management and claims processing. The report, introduced by Hugh Karp, emphasizes the protocol's consistent approach to onchain risk. Key areas covered include: - DeFi risk assessment and management - Claims processing and payouts - Vault operations - Institutional adoption trends The full report is available at [docs.nexusmutual.io](https://docs.nexusmutual.io/bookshelf/NM_Q4_REPORT.pdf)