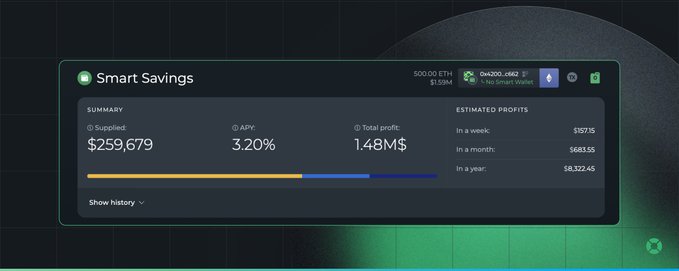

A new dashboard feature now provides users with a comprehensive view of their savings across all positions.

Key features include:

- Complete breakdown of all savings positions

- Projected return tracking with flexible timeframes

- Weekly, monthly, and yearly projection options

The dashboard builds on existing portfolio statistics features, offering users enhanced visibility into their financial positions. Users can now monitor their savings performance with greater precision and planning capabilities.

This update provides a centralized hub for tracking investment progress and making informed decisions about future savings strategies.

The new dashboard shows your complete savings breakdown across all positions, and lets you track projected returns weekly, monthly, or yearly.

Liquity V2 Offers Competitive Rates and Automated Tools for ETH Positions

**Liquity V2** provides competitive borrowing rates for ETH and liquid staking token (LST) positions. **Key features include:** - Instant leverage creation tools - Automated liquidation protection - Automated profit-taking options - Cost-effective borrowing against ETH and LSTs The platform positions itself as an affordable venue for users looking to leverage their Ethereum-based assets while managing risk through automation.

DeFi Saver Offers Liquidation Protection Across Major Lending Protocols

DeFi Saver has published a comprehensive guide detailing automation options for liquidation protection across eight major lending protocols. **Supported Protocols:** - Aave - Compound - Maker/Sky - Morpho - Fluid - Spark - CurveUSD - Liquity V2 Users can access detailed information about available automation features through the platform's [knowledge base](https://help.defisaver.com/features/automation). The service aims to reduce risks in DeFi lending by providing automated protection mechanisms for user positions.

🛡️ DFS Automation Protects 467 Positions During $5B Crypto Liquidation Event

**Market Volatility Response** During a turbulent weekend that saw over $5 billion in crypto liquidations across four days, DFS Automation demonstrated its protective capabilities: **48-Hour Performance Metrics:** - 🤖 1,227 automated adjustments executed - 🛡️ 467 unique positions automatically protected - 💱 $320 million in total leverage management swap volume **Platform Preferences:** - Arbitrum remains the most popular network for automation users - Aave continues as the top protocol choice for automated traders - Auto-repay (partial unwinding) is the most common automation option - Significant number of full stop-losses triggered due to market drop severity **Context:** DFS Automation recently expanded to support all Aave v3 positions across Ethereum mainnet, Arbitrum, Base, and Optimism - including EOA accounts without requiring smart wallet migration. Available automation options include automated leverage management, stop loss/take profit, and price-triggered boost/repay features. The platform has established itself as the leading automation solution for Ethereum DeFi lending protocols, helping users navigate market uncertainty with automated position management.

🚀 Yield Revolution: Yearn V3 Goes Live with Automated Multi-Protocol Strategies

**Yearn V3 launches** with automated yield strategies that rotate between protocols to find optimal risk-adjusted returns. **New yield options now available:** - **Steakhouse Morpho vaults** - institutional-grade risk management from Morpho's largest stablecoin curator - **Spark Savings** - powered by Sky's Liquidity Layer, anchored to Sky Savings Rate with RWA backing - **Sky Ecosystem Savings Rate** - earn yield on USDS with instant redemptions The platform automatically allocates between different strategies including SKY, SPK, Aave, and Compound to maximize returns without user intervention. **Enhanced USDS options** include a Liquid Locker Compounder Vault that stakes in the USDS-1 vault while earning additional YFI rewards. Users don't need to take any action - the vaults handle strategy optimization automatically in the background.