MOR/wETH Pool Offers High Yields on Aerodrome

MOR/wETH Pool Offers High Yields on Aerodrome

🤑 Yield Farmers Gone Wild

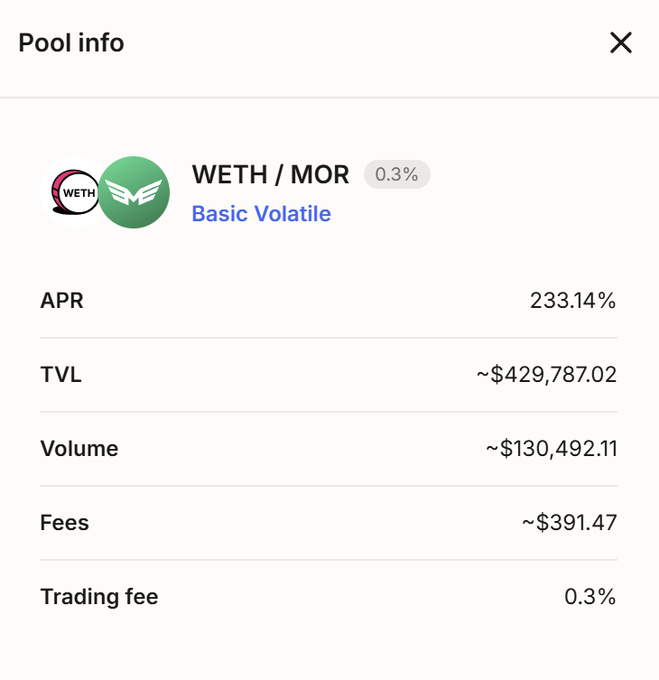

The MOR/wETH liquidity pool on Aerodrome Finance has become one of the platform's top incentivized pools. Users can currently earn:

- 233% APR through direct liquidity provision

- Up to 723% APY using Beefy Finance's auto-compounding strategies

This represents a significant yield opportunity, maintaining strong returns since March when APRs were around 250%. Liquidity providers can access the pool directly through Aerodrome Finance.

🚀 MOR/wETH pool is now among the top incentivized pools on @AerodromeFi! 🔥 Earn 233% APR directly, or up to 723% APY with @beefyfinance auto-compounding strategies Stack yield. Empower decentralized AI. 🧠⚡

🔒 Morpheus Ends Free API Access, Introduces Paid Tier to Combat Scrapers

**Morpheus is transitioning from free to paid API access** to protect legitimate builders from scrapers and spam. **Key changes:** - Free API tier ending next week - Current users must rotate API keys when "Pro" gate opens - Three-step migration: create new API key, set up payment, resume building **Why the change?** The move aims to filter out noise-makers and scrapers while maintaining service quality for serious developers building on the decentralized AI network. **Action required:** Existing free-tier users need to: 1. Sign in at [app.mor.org](https://app.mor.org/signin) 2. Generate new API credentials 3. Configure payment method Full API documentation available at [apidocs.mor.org](https://apidocs.mor.org/)

🔐 Everclaw: Decentralized Infrastructure for Security Agents

A new project called **Everclaw** is addressing infrastructure vulnerabilities for developers building security agents and audit tooling. **The Problem:** - Traditional platforms can access your sensitive code - Centralized services can revoke access at any time - Recent malware attacks have targeted AI agent configuration files **The Solution:** - Everclaw offers decentralized infrastructure for security-focused development - Aims to protect sensitive code from unauthorized access - Provides censorship-resistant hosting **Resources:** - GitHub: [github.com/profbernardoj/everclaw](http://github.com/profbernardoj/everclaw) - ClawHub: [clawhub.ai/DavidAJohnston/everclaw-inference](http://clawhub.ai/DavidAJohnston/everclaw-inference) - Full details: [Substack breakdown](https://substack.com/home/post/p-188524361) This follows recent reports of info-stealing malware targeting AI agent users, highlighting the need for more secure infrastructure in the space.

EverClaw Launches as Full Morpheus Node with Auto-Staking and Decentralized AI Routing

**EverClaw** has launched as a complete Morpheus Node implementation with several key features: - **Automatic MOR staking** built into the node - **Decentralized routing** across multiple AI providers - **20+ open-source models** available without content restrictions - **Failover protection** that automatically switches providers if one goes offline - **x402 protocol** enabling agents to autonomously pay for their own compute resources The release represents a step toward sovereign AI infrastructure, allowing users to run personal AI agents that can operate independently across decentralized networks.

Chinese AI Models Match Claude 3.5 Sonnet Quality, Challenging Centralized Inference Dominance

**The performance gap is closing rapidly.** Chinese AI models **Kimi 2.5**, **GLM-5**, and **MiniMax M2.5** are now matching the benchmark performance of Anthropic's Claude 3.5 Sonnet, previously considered a leading model. These alternatives are described as production-ready. **Key implications:** - Model quality is no longer a valid reason to rely exclusively on centralized inference providers - The competitive landscape suggests habit, rather than technical necessity, drives continued use of centralized services - This development opens opportunities for decentralized AI infrastructure The emergence of comparable alternatives challenges the assumption that top-tier AI performance requires centralized platforms. As quality parity becomes reality, users may reconsider their infrastructure choices based on other factors like cost, privacy, and decentralization.

Smart Contract Auditors May Be Exposing Pre-Deployment Code to AI Providers

A security concern has emerged regarding smart contract auditing practices. When auditors use AI tools like Anthropic's Claude, pre-deployment contract code may be: - **Logged by the inference provider** - **Potentially used for training data** - **Subject to legal subpoenas** - **Accessible to attackers with provider access** This creates a **front-running risk** where malicious actors could exploit vulnerabilities before audits are complete. **The Risk:** Sending unaudited code to third-party AI services exposes it before deployment, potentially allowing attackers to identify and exploit weaknesses. **What This Means:** Developers and auditors need to reconsider their workflows when using AI assistance for security reviews. The convenience of AI tools may come at the cost of code confidentiality. This highlights broader questions about data privacy in AI-assisted development and the need for secure, private inference solutions in sensitive applications.