Lazy Summer Protocol Market Update and ETH Vault Recovery

Lazy Summer Protocol Market Update and ETH Vault Recovery

🏦 When Vaults Get Lazy

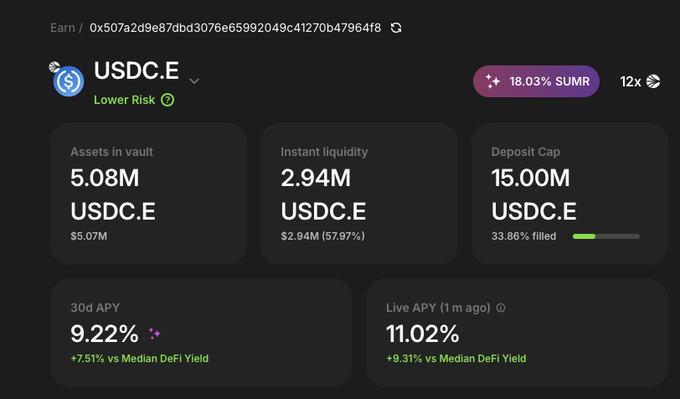

The USDC.e Vault on Sonic Labs maintains strong performance with 18.03% SUMR rewards and 5.08M USDC.e in assets. This follows recent challenges with ETH vaults, where limited liquidity affected withdrawals due to increased validator unstaking times and large withdrawals. Summer.fi has acknowledged communication shortcomings during this period.

The protocol continues expanding, with recent integrations including:

- Morpho Seamless WETH on Base

- Hyperithm USDC on Mainnet

- Origin Ether (OETH) integration

- Cross-Chain Vaults development

All vaults are managed by BlockAnalitica for risk assessment and vetted for security.

An update on the limited liquidity on ETH Vaults on the Lazy Summer Protocol First and foremost, to reduce any uncertainty, user funds remain 100% safe, are all still earning yield, and all technical mechanisms within the protocol are operating (and have been throughout) as

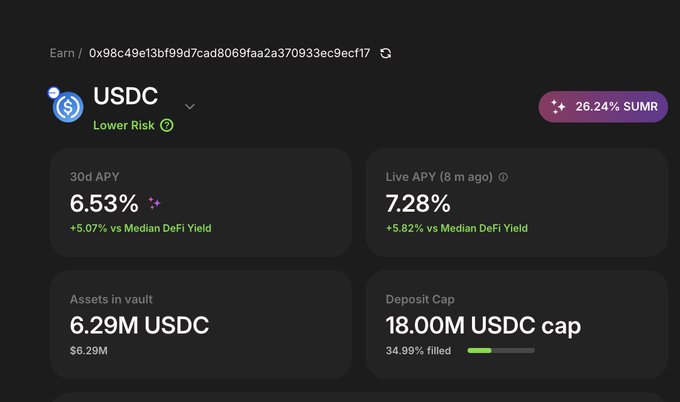

📊 Market Watch Monday: Lazy Summer Vault Spotlight This week’s standout: the USDC Vault on @base, a go-to for stable yield seekers - Live APY: 7.28% (+5.82% vs median DeFi yield) - 30d APY: 6.53% (+5.07% vs median) - SUMR reward: 26.24% - Assets in Vault: 6.29M USDC - Cap:

📊 Market Watch Monday: Lazy Summer Vault Spotlight New week. Same mission: smarter yield. The USDC.e Vault on @SonicLabs is keeping it stable and rewarding $SUMR Rewards: 18.03% SUMR Assets in Vault: 5.08M USDC.e Best for: Optimized lending yield 🔗 Try it:

🧵 Morpho x Lazy Summer: How Seamless WETH Delivers Safer ETH Yield on @base Lazy Summer's ETH Lower Risk Vault isn't just a passive ETH yield tool - it's an automated, smart vault composed of multiple curated strategies across DeFi. Let's dig into the details 👇

Lazy summer latest dev update covered Cross-Chain Vaults - Summer.fi just got... lazier 😴 The problem: Yield opportunities appear and disappear in HOURS across chains. Large allocators move 8-figure sums daily to capture better rates. Cross-chain yield farming

Say 👋 to Seamless @MorphoLabs Seamless WETH now live in Lazy Summer ETH Lower Risk on @base! Get more info blog.summer.fi/say-to-seamles…

Say 👋 to @OriginProtocol Ether (OETH) in Lazy Summer ETH Lower Risk Vault The Lazy Summer Protocol has officially integrated OETH on Ethereum Mainnet unlocking another source of sustainable, automated ETH yield. 👉 Dive in: blog.summer.fi/say-to-origin-…

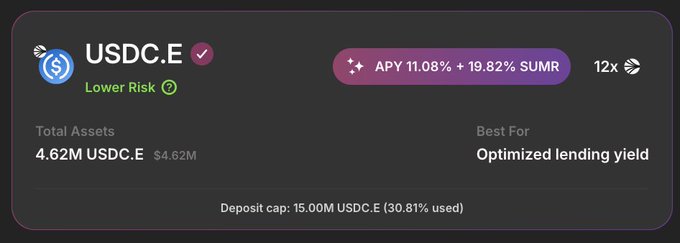

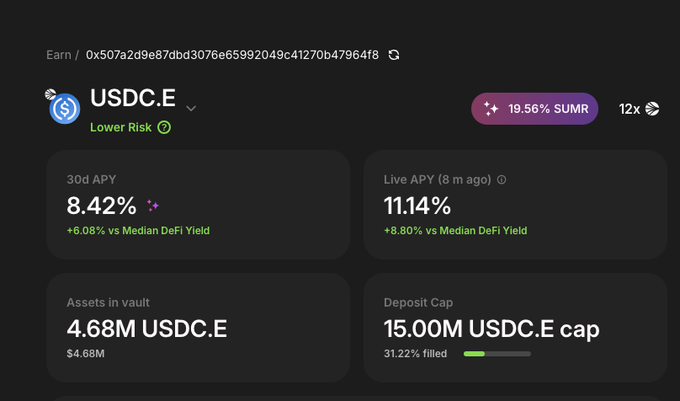

📊 Market Watch Monday: Lazy Summer Vault Spotlight USDC.e Lower-Risk Vault on the @SonicLabs Live APY: 11.08% 30d APY: 8.58% Assets in Vault: 4.62M USDC.e Best for: Optimized lending yield Explore: summer.fi/earn/sonic/pos… #LazySummer #DeFi #SonicNetwork #MarketWatchMonday

Lazy Summer Protocol - July Dev Update What we've been building Introducing Cross-Chain Vaults: Summer.fi just got… lazier 🤭 Read to get full info blog.summer.fi/lazy-summer-pr…

📊 Market Watch Monday: Lazy Summer Vault Spotlight USDC.E Lower risk on @SonicLabs Live APY: 11.14% (+8.80% vs median DeFi yield) 30d APY: 8.42% (+6.08% vs median) 19.56% $SUMR Rewards Eligible for 12x Sonic points Assets in Vault: 4.68M Cap: 15M (31.22% filled) 👉 Try it

Say 👋 to @SiloFinance Apostro USDC higher risk Read more blog.summer.fi/say-to-apostro… #DeFi #USDC #LazySummer

Vaults FYI: Silo Apostro USDC Higher-Risk @apostroxyz was added to the USDC Higher-Risk Vault last week and it’s already expanding the yield frontier. Read thread🧵

Say 👋 to Hyperithm USDC, now live in Lazy Summer USDC lower risk on Mainnet Now you can earn higher USDC yields with @hyperithm USDC automatically integrated and rebalanced in Lazy Summer’s USDC lower risk vault on Arbitrum.

Lazy Summer DAO Governance Update - August 2025

Four key proposals are up for voting until August 3rd, 2025: - **SIP2.19**: Integration of Silo Finance's Greenhouse USDC vault into SonicLabs Lower Risk fleet - **SIP5.9**: AdmiralsQuarters contracts upgrade across all chains to support Merkl reward claiming - **SIP5.10**: Whitelisting addresses for SUMR token to enable Merkl rewards transition - **SIP5.8**: Launch of SUMR Transfer Readiness Working Group Charter Vote on-chain via [Tally](https://www.tally.xyz/gov/lazysummer) or visit the [governance portal](https://gov.summer.fi/dao) to participate.

State of DeFi Yield 2025 Survey - Last Chance for Rewards

The annual State of DeFi Yield survey is closing soon. Your participation helps shape the future of DeFi yields while giving you a chance to win valuable rewards: - **Grand Prize**: $1,000 USDC for one lucky respondent - **Exclusive Merch**: Limited edition Lazy Summer gear - **Token Rewards**: 100 $SUMR tokens for selected participants [Complete the survey here](https://form.typeform.com/to/E9MigPmO) *Your insights will help improve DeFi yield strategies for the community.*

DeFi Yield Optimization Challenges: Users Caught Between Idle Capital and Yield Chasing

DeFi users face a significant dilemma in yield optimization: - **Idle Capital**: Over $2B sits in Sky Ecosystem's savings rate, earning suboptimal yields - **Yield Chasing**: Users struggle to time market shifts across numerous options (40+ markets for USDC on Ethereum via Morpho) The challenge stems from rapidly changing market conditions affected by: - Utilization rates - Token farming events - Liquidity dynamics Most users either remain in low-yield positions for simplicity or inefficiently chase higher yields, often missing opportunities due to timing.

Summer.fi Beach Club Merchandise Claim Now Available

Summer.fi has launched its exclusive Beach Club merchandise drop for qualifying users. Members who have accumulated sufficient points through user referrals and TVL contributions are now eligible to claim limited edition branded apparel. - Available items include T-shirts and Hoodies - Claims can be made at [Summer.fi's merchandise page](https://summer.fi/earn/merchandise/t-shirt/0xddc68f9de415ba2fe2fd84bc62be2d2cff1098da) - Eligibility is based on Beach Club participation and referral success The Beach Club rewards program continues to offer incentives for bringing new users to the platform, with SUMR tokens and fees automatically accruing to participants' wallets based on referred TVL.