Morpho Labs Launches rsETH Market on Unichain

Morpho Labs Launches rsETH Market on Unichain

🦄 Pink Rewards Just Dropped

Morpho Labs has launched a new rsETH <> WETH market on Unichain, curated by Nine Summits. The market offers multiple reward opportunities:

- 2x Kernel Points

- 1x Programmatic EIGEN rewards

- Additional rewards in OP, MORPHO, and USDC tokens

The 12-week campaign aims to enhance liquid restaking strategies on Unichain. This follows recent successful integrations, including a Uniswap pool with $16M TVL and 10.5% reward rate.

MEGA DeFi Incentives are now live across multiple protocols! 🌱 Looking for where to earn $KERNEL rewards? We've deployed incentives to key liquidity pools. Check out the complete breakdown. 🧵

Partner Spotlight: @Uniswap 🦄 A top decentralized exchange continues to be a cornerstone for rsETH liquidity. Let's explore the current opportunities! 🧵

Optimize your agETH rewards through @pendle_fi! 🧜♀️ The agETH pool on @pendle_fi now holds ~$7M TVL from users enhancing their positions. Deposit to earn: ⍛ 3.5x Kernel Points ⍛ 1x Programmatic EIGEN rewards ⍛ Leveraged Restaking rewards Bonus tip: You can use YT, LP and PT

Earn MOVE rewards with your rsETH! 🌱 2.8M MOVE tokens are now being distributed through @canopyxyz's DeFi Spring Wave Two. Here's how rsETH holders can participate. 🧵

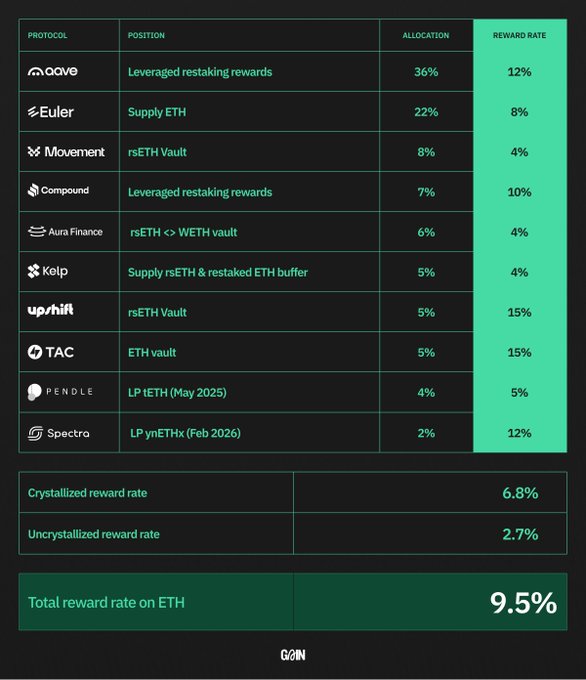

Your hgETH weekly strategy update is here! 🌱 Last week's highlights: ⍛ Portfolio reallocated for higher rewards ⍛ Total reward rate increased to 9.5% with strong performance across positions ⍛ @upshift_fi and @TacBuild vaults leading with impressive 15% reward rates Dive

Earn MOVE rewards with your rsETH! 🌱 We've secured significant MOVE incentives through @canopyxyz's DeFi Spring Wave Three to boost rsETH vault rewards. Here's where you can position your rsETH. 🧵

Summer's coming in hot with pink sunsets and pink rewards! 🦄 rsETH is now live on @unichain via @MorphoLabs. 🦋 Ready to stack rewards? Here's the alpha. 🧵

The pink chain keeps crushing it! 🦄 Let's look at two major opportunities for rsETH holders on @unichain. Dive in! 🧵

Kelp Captures 20% of $11B Liquid Restaking Market

Kelp has emerged as a major player in the liquid restaking market, now controlling ~$2B (20%) of the total $11B market cap. Key achievements in their 18-month journey include: - First liquid restaked token (rsETH) on Ethereum Mainnet - Integration with major protocols like Aave and Compound - Expansion to 10+ L2 networks - 550,000+ users across ecosystem - $200M TVL in Gain by Kelp product The protocol is transitioning to $KERNEL token, which will govern three protocols worth $2B+ combined: Kelp, Gain Vaults, and Kernel DAO. Season 3 staking rewards are now available for token holders.

Balancer V3 Pools Launch New Reward Streams

Two new liquidity pools on Balancer V3 have launched with multiple reward incentives: - hgETH/rsETH pool offering approximately 9% reward rate for liquidity providers and additional hgETH rewards - wrsETH/WETH pool on Optimism featuring: - 4,500 OP tokens in weekly incentives - Double Kernel Points - Programmatic EIGEN rewards Both pools are now accepting deposits at: - Ethereum: [hgETH/rsETH pool](https://balancer.fi/pools/ethereum/v3/0x6649a010cbcf5742e7a13a657df358556b3e55cf) - Optimism: [wrsETH/WETH pool](https://balancer.fi/pools/optimism/v3/0xe0d0b607539fdb647c4e87eff89588c6bb669c03)

Fluid Launches Smart Collateral Looping for rsETH

**Fluid (@0xfluid) has introduced two new looping strategies** for rsETH holders on Ethereum: - rsETH <> wstETH direct looping ($15.5M supply) - rsETH <> ETH/wstETH looping ($600k supply) Both strategies offer: - 2x Kernel Points - Programmatic EIGEN rewards - Enhanced position optimization while maintaining liquidity Users can access these opportunities through [Fluid's platform](https://fluid.instadapp.io/vaults/1/79). *This update represents a significant expansion of rsETH holder capabilities through smart collateral integration.*

Euler Finance Leads hgETH Portfolio with 21% Reward Rate

hgETH's growth vault reports improved total reward rate of 11.6%. Portfolio highlights: - Euler Finance maintains top position at 21% reward rate - Multiple protocols (Upshift, TacBuild, Growcompound) delivering 15% returns - Aave v3 holds largest allocation (45%) with 12% rewards - Portfolio actively managed across 8 protocols Total portfolio breakdown ranges from 3-45% allocations across various strategies including leveraged restaking, ETH vaults, and LP positions. [Mint hgETH](https://kelpdao.xyz/gain/growth-vault/?utm_source=highguide)