Morgan Stanley Projects $34B AI Efficiency Gains in Real Estate by 2030

Morgan Stanley Projects $34B AI Efficiency Gains in Real Estate by 2030

🤖 AI Misses Real Estate's Blind Spot

Morgan Stanley forecasts $34B in efficiency gains for real estate by 2030, with AI automating 40% of CRE and REIT operations. The gains primarily focus on asset management, leasing, and facilities management.

While AI promises significant automation in administrative tasks, critical areas like title, escrow, and ownership transfer remain largely untouched by technological advancement.

Propy addresses this gap by:

- Applying AI to streamline document-heavy processes

- Using blockchain to secure ownership records

- Combining both technologies for end-to-end transaction efficiency

The integration aims to modernize real estate infrastructure beyond just automation, ensuring both speed and security in property transactions.

Thrilled to announce that the @PropyInc team will be at EthCC 8 in Cannes, France, June 30 - July 3, 2025! Join us at the Palais des Festivals as we showcase how $PRO is transforming real estate with Ethereum’s blockchain. Expect engaging discussions, valuable networking, and

Enjoy the view from our Riviera lounge in EthCC. ☀️ Roll call in the replies👇🏻 Drop your pics, we can’t wait to see them!📸

Inheritance, divorce, and estate settlements often stall when property is involved, not because the legal decision is unclear, but because the systems required to execute that decision are outdated. Even after a court ruling or trust directive, the transfer of ownership depends

Every major industry has adapted to the digital economy... except real estate. Consumers can buy cars, invest in stocks, and manage their finances online in seconds. Yet buying a property still involves stacks of paperwork, weeks of coordination, and outdated systems that

At the @Coinbase Summit, crypto’s future isn't being predicted, it's being built. @iampaulgrewal put it best: Clarity creates confidence. Confidence creates liquidity. That wasn’t just about stablecoins, it was a blueprint for the next financial system. One built on clear

One of the most powerful moments from @actionceo during our “Real Estate Onchain: Phase 1” Space: Real estate doesn’t sleep, and neither should the infrastructure behind it. What resonated wasn’t just that Propy brings real estate onchain. It’s that the platform is built for

As crypto enters mortgage conversations, we’re proud to already offer BTC-backed loans - real adoption is taking shape.

Real estate and Bitcoin will be swappable onchain — each usable as collateral for the other. Already proven at a small scale.

The AI market within real estate is expanding at a compound annual growth rate of 36%, projected to reach $303 billion by 2025. But AI alone cannot solve the industry’s most critical challenges, particularly around trust, traceability, and transaction finality. Generative models

RWAs just crossed $25B. Propy has already processed $4B in onchain real estate. Ownership, finance, and verification are being rebuilt from the ground up - with code, not paperwork.

🚨 BREAKING: The tokenized Real-World Asset (RWA) market just broke an all-time high, surpassing $25 BILLION for the first time ever! Securitize is leading the charge on the way to $1 TRILLION. From tokenized treasuries to private credit, and institutional funds to equities,

Personal wallets just became mortgage-ready. FHFA will now count crypto held in self-custody toward mortgage reserves. No conversion. No bank deposits. A historic shift in how U.S. housing finance views digital assets. @RobinhoodApp and @coinbase helped normalize self-custody.

Countries like Georgia, Colombia, Sweden, and the UAE have taken early steps toward blockchain-based land registries, recognizing the potential for distributed ledgers to improve transparency, reduce fraud, and modernize recordkeeping. These initiatives signal clear global

One of the most common questions we hear is: how can real estate possibly scale onchain when ownership records in the U.S. are spread across more than 3,000 counties, each with their own systems? That fragmentation is not a barrier to blockchain. It is the reason blockchain is

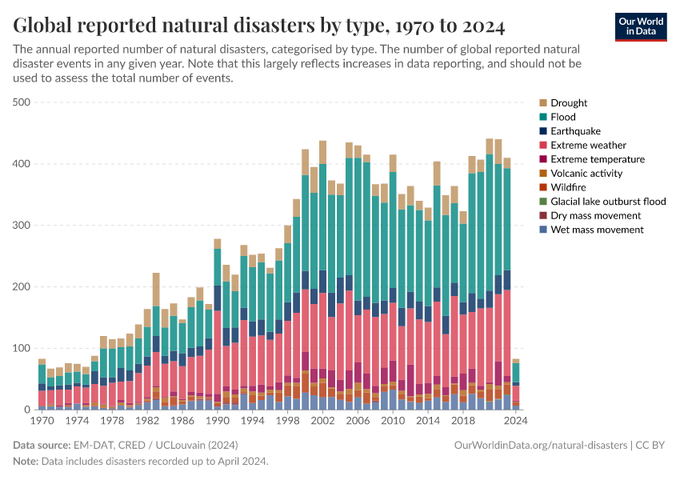

In recent years, major disasters have exposed a silent vulnerability in real estate: property records that exist only in local systems. In Maui, over 2,200 structures were destroyed in the 2023 Lahaina wildfires, including buildings housing county records. Earlier this month in

A woman’s Phoenix home was stolen and sold for $200K… while she was still the legal owner. In March 2025, squatters forged a deed, faked an ID, and closed the sale before anyone noticed. This isn’t a rare crime, it’s part of a growing trend. In Q1 2025, nearly 47% of real

The @kucoincom listing marked a major milestone for $PRO, but the deeper story is what it unlocks. We just published a detailed breakdown of what this means for Propy’s infrastructure, the role of liquidity in scaling real estate onchain, and how global access to PRO supports a

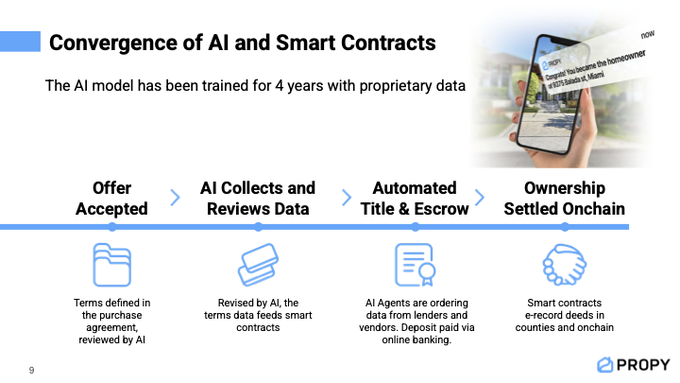

Last week at @EthCC 2025 in Cannes, Propy CEO @NataliePropy presented how Propy is leveraging Ethereum and AI to reshape the real estate transaction process from the ground up. One insight she shared: Propy’s AI, trained on four years of proprietary transaction data, now works

Tokenized real‑world assets have just hit the tipping point, and real estate is leading. As of mid‑2025, the onchain RWA market (excluding stablecoins) surpassed $15 billion, growing over 85% year‑over‑year. Meanwhile, total tokenized RWA value ticked up to $24 billion, driven

Buyers pay thousands per closing to “insure” title. But what are they actually buying? Not protection against future volatility, but coverage for potential mistakes in 30-year-old filings. Insurance priced for human error, not structural security. Blockchain eliminates that

As we wrap up a whirlwind week, we’re reflecting on one of the most quietly transformative gatherings in crypto: the @Coinbase Crypto Summit. What stood out was the sense that crypto had finally crossed an invisible line. It’s no longer fighting for legitimacy; it’s designing

.@MorganStanley projects $34B in efficiency gains for real estate by 2030, driven by AI automating nearly 40% of tasks across CRE and REIT operations. It’s a clear signal: real estate is investing in speed and scale. However, most of those gains are concentrated in asset

Global interest in U.S. real estate remains strong, especially from buyers in capital-restricted or high-volatility regions. But despite demand, the mechanics of buying cross-border remain nearly impossible: - Title is jurisdictional - Compliance is manual - Settlement depends

The SEC’s greenlight on RWA ETFs signals demand, but price exposure isn’t the same as property ownership. Most tokenized real estate ETFs track value. They don’t fix the core problem: title remains fragmented, escrow is manual, and closing takes 30-60 days. $2T in assets could

At @EthCC 2025 in Cannes, Propy CEO @NataliePropy is showcasing how Propy is advancing real estate through Ethereum’s blockchain. As crypto becomes more embedded in the housing market, with 10% of first-time buyers used crypto for down payments in 2022, and as of 2025, the FHFA

In 2018, @thinkingcrypto discovered Propy and saw what few did at the time: real estate, one of the world’s largest asset classes, was untouched by blockchain. While others focused on DeFi and payments, Propy was quietly building infrastructure for onchain ownership. He

Real estate is the largest asset class in the world, yet among the least liquid. A single transaction takes 30–60 days, depends on third parties, and excludes most participants unless they can manage full ownership, financing, and compliance. The system was never built for

Bergen County, New Jersey is migrating 370,000 deed records, representing approximately $240B in property, to blockchain infrastructure. It’s the largest known county-level onchain records initiative in the U.S. This shift signals a broader move: public institutions are

At Propy, we’ve spent years building blockchain solutions to redefine real estate, from tokenized property titles to secure payment systems. The @FHFA's directive to integrate cryptocurrency into mortgage assessments aligns with our mission to make homeownership accessible

Another step toward global adoption - $PRO is live on @RevolutApp! 30+ countries can now buy, hold, and sell Propy tokens directly from one of the world’s biggest finance apps. Announcement #2 is live, 3 more to come soon! Bigger ones ahead. Propy is becoming Global Liquid

AI is poised to reshape how real estate transactions are executed, but not by replacing professionals. The greatest value lies in removing the friction that slows them down. By 2030, it’s projected that 60-80% of administrative tasks in real estate will be handled by AI, from

.@AltcoinDaily just dropped a video on what makes Propy a true differentiator - the only infrastructure designed for the world’s most valuable asset: real estate. The video explores our tech, the utility behind $PRO token, and why @TimDraper backed it all before most saw it

The #1 Most Undervalued Real Estate Coin in Crypto -- What is Propy? @PropyInc -- Made in America Coin 🇺🇸 -- First-Ever Real Estate Asset Onchain 🌺 -- 100% #Crypto-Backed Real Estate Loans -- Growth Outlook -- & MORE! #partner $PRO 👉 WATCH: youtu.be/nPsxFRVI484

A huge step forward for crypto adoption in real estate. Regulators are moving. Markets are watching. We’re proud to be driving the infrastructure that brings property onchain and into the digital economy.

JUST IN: 🇺🇸 U.S. Director of Federal Housing Bill Pulte has ordered Fannie Mae and Freddie Mac to "count cryptocurrency as an asset for a mortgage." Pulte has stated this decision was inspired by "President Trump's vision to make the United States the crypto capital of the

In real estate, ownership isn't verified by a single trusted source. It’s reconstructed, deal by deal. using fragmented, often outdated public records spread across 3,000+ U.S. counties. Title companies are forced to search historical documents, resolve gaps manually, and

Traditional underwriting frameworks weren't built for digital wealth. Today’s crypto-native buyers often hold substantial onchain assets, but lack W-2 income or deep credit histories. That excludes them from homeownership, even when their net worth exceeds that of “qualified”

Real estate is finally getting its seat at the RWA table. Proud to be listed alongside other builders making assets programmable, verifiable, and borderless. The RWA narrative points to a deeper shift, one where entire markets begin operating onchain, not just the assets

📊 A new asset class in crypto is emerging: RWA Start with our visual guide, covering the trending RWAs: 🏦 Equities @OndoFinance, @BackedFi 🪙 Stablecoins $USDT, $USDC, $USDe, $USD1 🏠 Real Estate @PropyInc, @Parcl 🥇 Gold assets @Paxos, @tethergold 📈 Credit @MapleFinance,

Propy Launches 14-City AI Roadshow Following $100M Raise

Propy has launched its AI Roadshow, visiting 14 U.S. cities over two months to demonstrate its digital infrastructure for real estate closings. **Recent Milestones:** - Raised $100M to modernize title operations - Closed $14M commercial deal in USDT - Launched California Escrow (Texas coming next) - Introduced Finders Fee Program offering $10k in $PRO tokens **Roadshow Focus:** The tour targets title company owners and real estate agents interested in: - AI automation and operational efficiency - Succession planning and modernization - Scaling volume without increasing overhead Propy's AI agent Avery aims to reduce manual work by 70% while maintaining service quality. The company is actively acquiring and partnering with top-tier title and escrow companies nationwide. [Register for roadshow](https://luma.com/propyroadshow2026) | [January recap](https://propy.com/browse/jan-with-propy-2026/)

Propy Targets $25B Title Industry with AI-Powered Acquisition Strategy

The title and escrow industry remains stuck in outdated processes—fragmented systems, slow timelines, and paper-based workflows dominate the $25B sector. **Propy's modernization approach:** - Acquiring independent title operators - Integrating AI automation through agent_avery - Reducing closing times while improving margins - First acquisition already integrated, expansion underway The company is actively seeking partnerships with title operators interested in modernizing their operations. The goal: transform weeks-long closing processes into days through automation and smart contract technology. Propy invites title operators to discuss partnership opportunities.

AI-Powered Title Company Consolidation Targets 10 Acquisitions in Six Months

A real estate technology company is actively acquiring title companies, aiming to partner with 10 firms over the next six months. The acquisition strategy focuses on: - **Preserving existing operations**: Acquired companies retain their brand identity and staff - **AI integration**: Promising 70% reduction in manual work through automation - **Fast closings**: 30-45 day transaction timelines - **Quick valuations**: Confidential assessments provided within 24 hours The company positions this as an opportunity for title company owners to modernize operations while maintaining their market presence. They claim valuation multiples are currently at peak levels. This follows their earlier announcement of an AI-powered national consolidation strategy aimed at reducing traditional title and escrow processing times from weeks to days. The company has already completed its first acquisition and is expanding across multiple markets with a goal of nationwide coverage.

Propy Expands AI-Powered Title Acquisition Strategy Nationwide

Propy is accelerating its $100M national expansion of AI-powered title and escrow services. The company has successfully integrated its first acquisition and is actively pursuing additional regional title firms to join its modernization effort. **Key developments:** - First acquisition in Alabama now integrated - AI automation reduces manual work by 40% - Platform enables closings in as fast as 3 days - Supports both crypto and fiat escrow transactions - 24/7 closing capabilities **2025 performance metrics:** - 41.8% of escrows opened after hours - 48% of online deposits submitted outside business hours - Average close time: 29 days - 10.4% of escrow volume settled with crypto - Over $5B in total transactions processed The company combines licensed US title and escrow services with blockchain-based deed recording. Propy is seeking profitable, independent title firms interested in scaling with AI technology and blockchain security. Goal: Expand AI-powered closing services to all 50 states.

🏠 Propy Co-founder Speaks at Abu Dhabi Blockchain Summit on Real Estate Tokenization

**Propy Co-founder Denitza is presenting at the Global Blockchain Summit in Abu Dhabi today**, discussing the future of blockchain-based home ownership. **Real estate tokenization has moved from concept to reality**, with the company positioning itself at the forefront of this transformation. Key developments: - Live presentation on blockchain home buying and ownership - Focus on tokenized property solutions - Part of ongoing global speaking tour including recent Binance Blockchain Week Dubai The timing reflects growing institutional interest in real world asset tokenization, particularly in real estate markets.