Monroe Capital Launches Income Plus Fund on Goldfinch Prime

Monroe Capital Launches Income Plus Fund on Goldfinch Prime

💼 Small Business Fund Gets Crypto

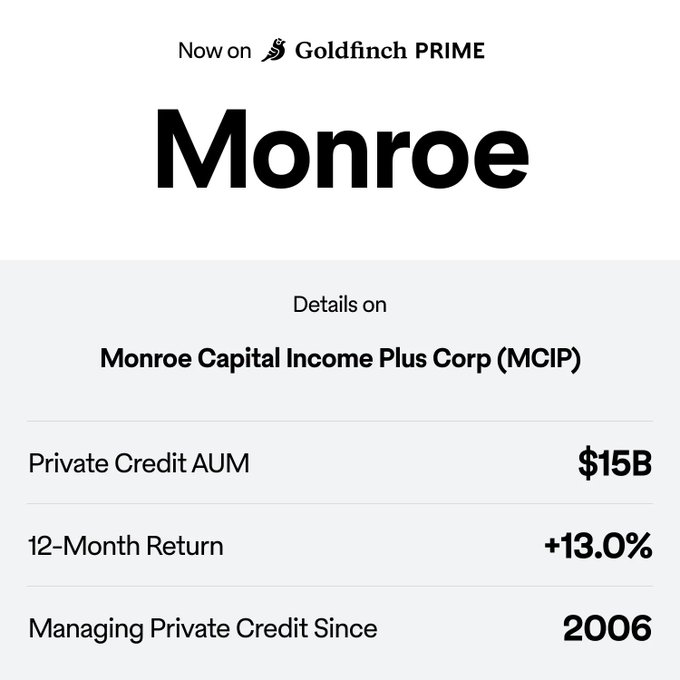

Monroe Capital has introduced a new onchain private credit fund targeting smaller U.S. and Canadian businesses. The Income Plus Fund joins TPG's Twin Brook Capital on the Goldfinch Prime platform.

Key features:

- Conservative, risk-aware lending approach

- Focus on lower middle market companies

- Available through Goldfinch Prime platform

The fund aims to provide resilient returns through selective lending to established businesses in North America. This launch expands Goldfinch's growing portfolio of institutional-grade private credit offerings.

New fund alert: Monroe Capital’s Income Plus Fund With a focus on smaller U.S. and Canadian businesses, Monroe brings a conservative and risk-aware approach to onchain private credit Lower middle market, higher resilience Now available on Goldfinch Prime

Goldfinch Prime Connects Major Asset Managers Apollo, Ares, and Golub to Blockchain

**Goldfinch Prime** has established connections with leading asset management firms including **Apollo**, **Ares**, and **Golub** through stablecoins and smart contracts. The platform enables blockchain access to private credit funds that collectively manage **over $1 trillion** in assets. This integration brings institutional-grade investment exposure to decentralized finance. - Major asset managers now accessible through single blockchain platform - Smart contract infrastructure facilitates stablecoin transactions - Represents significant step toward mainstream institutional DeFi adoption The development marks a notable bridge between traditional finance and blockchain technology, offering users exposure to established investment managers through decentralized protocols.

Goldfinch Prime Launches Institutional-Grade Private Credit Access

Goldfinch Prime introduces a new DeFi product offering exposure to elite private credit managers including Apollo, Ares, and Blackrock HPS. The platform democratizes access to institutional-grade private credit investments by: - Removing traditional barriers like high capital minimums - Eliminating lengthy lockup periods - Providing broad diversification across top-tier managers This development represents a significant step in making institutional-quality investments accessible through DeFi infrastructure. Learn more: [CoinDesk coverage](https://www.coindesk.com/sponsored-content/goldfinch-prime-a-new-leader-in-the-emerging-rwa-opportunity)

Private Credit Goes Public: Institutional Capital Flows Onchain

Institutional investors are increasingly moving private credit operations to blockchain networks, creating new opportunities for retail participants. - Traditional private credit markets are being transformed through decentralized protocols - Retail investors can now track and participate in institutional lending activities - All transactions and terms are publicly visible on blockchain - Complete transparency and permissionless access mark key improvements over traditional systems The shift represents a significant democratization of private credit markets that were previously exclusive to institutional players.

BMI Joins Goldfinch Prime, Opening Music Industry Investment Opportunities

Broadcast Music Inc. (BMI), which manages royalties for major artists like Lady Gaga and Eminem, has integrated with Goldfinch Prime's private credit platform. BMI now represents 0.13% of Goldfinch Prime's portfolio, creating a new avenue for investors to gain exposure to music industry revenues through blockchain technology. This development follows recent discussions about music streaming economics, where platforms like HIO Music are attempting to create more artist-friendly revenue models. - BMI manages royalties for top artists and publishers - Integration provides on-chain private credit exposure - Represents new intersection of traditional music business and DeFi