Milestone Reached: $1B+ TVL Officially Confirmed

Milestone Reached: $1B+ TVL Officially Confirmed

🎯 Billion Dollar Club

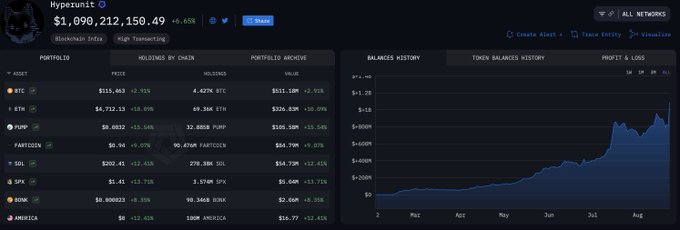

A major DeFi protocol has officially crossed the $1 billion Total Value Locked (TVL) threshold, marking a significant milestone in the platform's growth.

This achievement represents substantial user confidence and capital deployment in the protocol's services. The $1B+ TVL figure demonstrates the platform's ability to attract and retain significant liquidity.

Key highlights:

- Official confirmation of $1B+ TVL milestone

- Represents major growth benchmark for the protocol

- Indicates strong user adoption and trust

This milestone follows recent trends of increasing TVL across various DeFi platforms, suggesting continued institutional and retail interest in decentralized finance solutions.

Officially 1B+ TVL

🚀 Unit Expands Team

**Unit is actively recruiting top-tier talent** across multiple technical roles as the company scales its on-chain asset interaction platform. **Open positions include:** - DevOps Engineer - Senior Backend/Protocol Developer - Fullstack Engineer - Designer The company emphasizes seeking **high-agency individuals** who thrive on ownership and want ground-floor opportunities in reshaping digital asset interactions. **$10,000 USDC referral bonus** available for successful candidate referrals. [Apply here](https://jobs.polymer.co/unit)

Mystery Whale Drives Unit to Record $3.2B Daily Volume

An unknown trader executed massive swaps on Hyperliquid's Unit platform over 4 days, selling **19,663 BTC** ($2.22B) and buying **455,672 ETH** ($2.19B). **Record-Breaking Performance:** - Unit hit **$3.2B+ in 24-hour spot volume** - Surpassed Coinbase and Bybit BTC volumes combined - Nearly matched Binance's BTC/USDT trading **Infrastructure Resilience:** - Zero downtime despite billions in transactions - Guardian network processed massive load seamlessly **Financial Impact:** - Hyperliquid generated **$4.7M in fees** (24 hours) - **$1.88M in HYPE buybacks** from Unit trading fees - Unit contributed $941K to additional buybacks The whale's identity remains unknown, but their choice of Unit as a decentralized trading venue demonstrates the platform's growing institutional appeal and liquidity depth.